Consumers and Mobile Payments 2012: Make It Useful

- Date:October 02, 2012

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Consumers and Mobile Payments 2012: Make It Useful

Second report from Mercator Advisory Group's 2012 CustomerMonitor Survey Series probes consumer attitudes toward payment usage and privacy

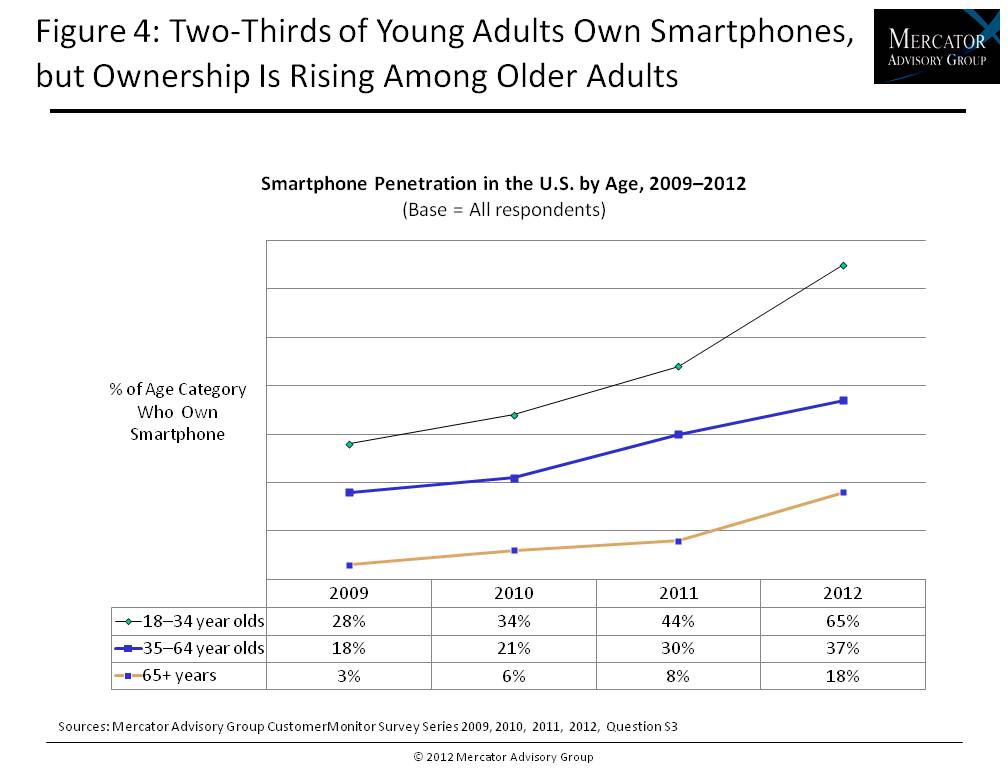

Boston, MA - October 1, 2012 - This year, as smartphone penetration spikes to nearly 50 percent of the market, the profile of smartphone ownership is changing from early adopters (who were among the technical or powerful elite) to more widespread acceptance. These new users are reflective of a more maturing market with needs that are more pragmatic than those of the early adopters. While two-thirds of smartphone owners are young adults, now 1 in 5 seniors also own smartphones.

Consumers and Mobile Payments 2012: Make It Useful, the latest report from Mercator Advisory Group, is the second in a series of eight consumer survey reports. This study examines dynamics including mobile payments, couponing and receipting strategies, financial alerts, retail applications, privacy issues and evolving usage trends. This year, consumer excitement for mobile payments has been tempered with a fear they will be bombarded with data or processes that are cumbersome to use.

The report findings are based Mercator's CustomerMonitor Survey Series. The foundation of the series is data obtained during a national sample of 1,003 online consumer survey responses completed between June 8 and June 19, 2012.

Highlights of the report include:

Review of the evolving mobile user landscape and the shifting demographics of mobile and tablet usage.

Breakdown of the various mobile payment scenarios and identification of the ones that garner strongest interest from consumers.

Usage trends and corresponding consumer interest in retail applications, couponing, receipting, financial alerts, and different methods of mobile payments.

The impact of growing consumer privacy concern on service providers and services managing the privacy of online and mobile payment purchase data.

"As smartphone penetration spikes and the mobile market matures, mobile payments must provide more value than just "tap and go," states Karen Augustine, manager, CustomerMonitor Survey Series at Mercator Advisory Group and the author of the report. "Consumers are looking for ways to organize their finances and get discounts on items they are about to purchase without crowding their mobile phones with too many apps or data that is unorganized or unnecessary."

One of 27 exhibits in this report:

The report is 49 pages long and contains 27 exhibits

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send e-mail to info@mercatoradvisorygroup.com.

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor. About Mercator Advisory GroupMercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Learn More About This Report & Javelin

Related content

2024 North American PaymentInsights: Canada: Digital Transactions and Emerging Technologies – Digital Wallet Use

This survey is focused on understanding what factors influence consumer adoption of various payments options, as well as what concerns they have about these emerging channels. Addi...

2024 North American PaymentInsights: U.S.:Digital Transactions and Emerging Technologies – Digital Wallet Use

This survey is focused on understanding what factors influence consumer adoption of various payments options, as well as what concerns they have about these emerging channels. Addi...

2024 North American PaymentInsights: Canada: Financial Services and Emerging Technologies Exhibit

This survey is focused on understanding what factors influence consumer adoption of various payments options, as well as what concerns they have about these emerging channels. Addi...

Make informed decisions in a digital financial world