Consumers Vote with their Wallets: Hold Breached Organizations Accountable

Javelin Strategy & Research Finds Consumers Avoid Breached Small Online Merchants and Alternative Payment Providers Most Out of All Organizations

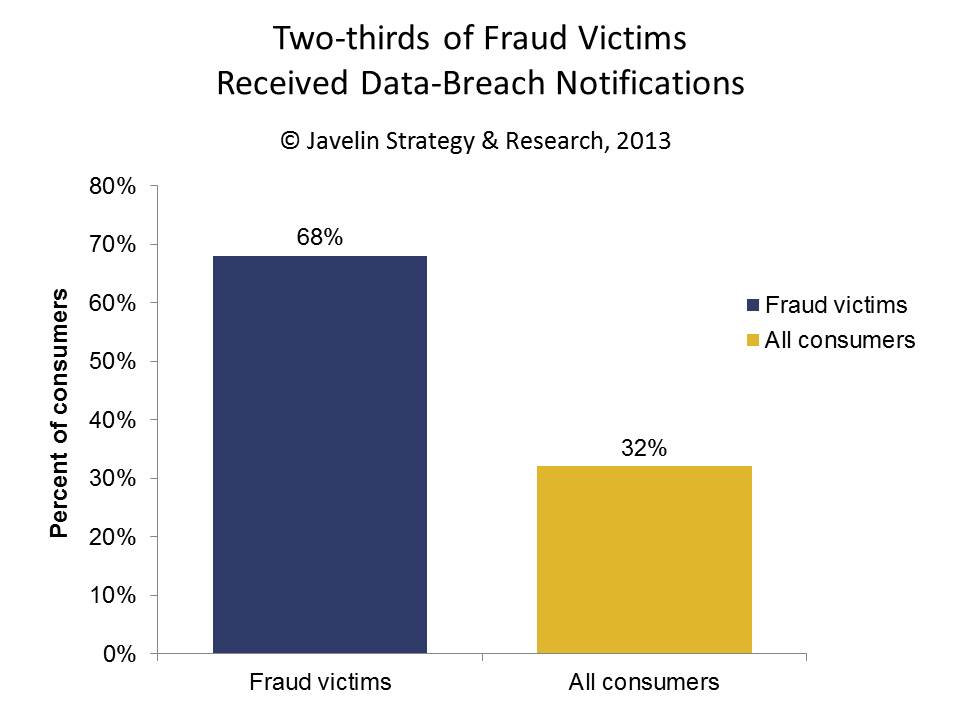

San Francisco, CA, June 12, 2014: Years of complacency among businesses and indifference among consumers regarding data breaches were effectively shattered in 2013. In the same year as one of the largest data breaches in history, the misuse of breached consumer data hit a record high, raising the issue of data breaches into the public consciousness. Today, Javelin Strategy & Research released 2014 Data Breach Fraud Impact Report: Consumers Shoot the Messenger and Financial Institutions Take the Bullet, which examines consumers' attitudes and behaviors towards companies that have exposed their customers to a data breach. Javelin found that consumers tend to avoid retailers the most, especially small online merchants and alternative payment providers, compared to other industries. The report also contrasts two of the most prolific data breaches in U.S. history- TJX and Target, to uncover important lessons and strategies for stakeholders in responding to data breaches as they try to maintain their reputations and retain the loyalty of consumers.

Retailers are most likely to be targeted by criminals for their card data resulting in a higher fraud rates. Coupled with insufficient detailed notifications about the data breaches, Javelin found that consumers tend to avoid retailers the most, compared to other industries such as banking and credit card issuers.

"The changing nature of data breaches is not lost on affected consumers as they are punishing organizations that they perceive to have failed to protect their PII. Unfortunately, their perception may not always match reality as they lay blame at the feet of the notifying organization even if it was not the one that was breached," said Al Pascual, Senior Analyst, Fraud & Security at Javelin Strategy & Research. "Notifications that describe in detail how a breach occurred can bolster an organizations claims that they have corrected the security vulnerability that enabled the breach to occur, restoring some degree of confidence among consumers."

Javelin Strategy & Research’s 2014 Data Breach Fraud Impact Report: Consumers Shoot the Messenger and Financial Institutions Take the Bullet report includes important lessons and strategies for stakeholders in responding to data breaches as they try to maintain their reputations and retain the loyalty of consumers. It is based on an address-based survey of over 5,000 consumers, including 936 identity fraud victims.

Related Javelin Research:

- 2014 Identity Fraud Report: Card Data Breaches and Inadequate Consumer Password Habits Fuel Disturbing Fraud Trends

- 2013 Banking Identity Safety Scorecard: Changing Tactics in the Face of Growing Account Takeover and New Account Fraud

- 2013 Data Breach Fraud Impact Report: Mitigating a Rapidly Emerging Driver of Fraud

About Javelin Strategy & Research:

Media Contact: