Does your Financial Institution’s Digital Strategy Pass the ROI Test?

Javelin Strategy & Research Assesses Emerging Bank Services of Bank of America, Citi, Wells Fargo, PNC, Chase, USAA, SunTrust, and 13 other Banks

San Francisco, CA, August 21, 2013: Large investments in emerging services like mobile and online do not always translate into higher customer satisfaction or even high financial performance. Javelin Strategy & Research, a leading financial services analyst firm, is releasing the company’s new competitive benchmark service, Retail Experience Benchmarking, which is a result of analyzing over 20 leading financial institutions and provides insights to improve each banks’ return on investment on emerging bank services---mobile and online banking services.

Online banking adoption has been growing rapidly at many large financial institutions and rippling through to the smaller tiers. Over 70% of Wells Fargo customers frequently log in online, compared to Bank of America (65%). While online banking has been viewed as an advanced service, you would expect these banks to capture large numbers of early adopters. Yet, Wells Fargo has fewer customers who consider themselves early adopters of technology or new services, at similar levels to community banks customer technology profile. Bank of America and J.P. Morgan Chase have the highest proportion of customers rating themselves as early adopters (27% and 24% respectively). Understanding customers’ current stance toward new technology is vital when choosing particular capabilities that will be result in greater loyalty toward high-value financial services and higher return on investment.

“The banking industry is increasingly a ‘have-and-have-nots’ realm in which institutions who invest wisely in particular emerging capabilities are increasingly solidifying their dominating position,” said Jim Van Dyke, CEO and Founder, Javelin Strategy & Research. “Banks need to continually assess their investments to ensure they are carefully choosing the best technologies that create real customer value and higher financial performance beyond the latest fads.”

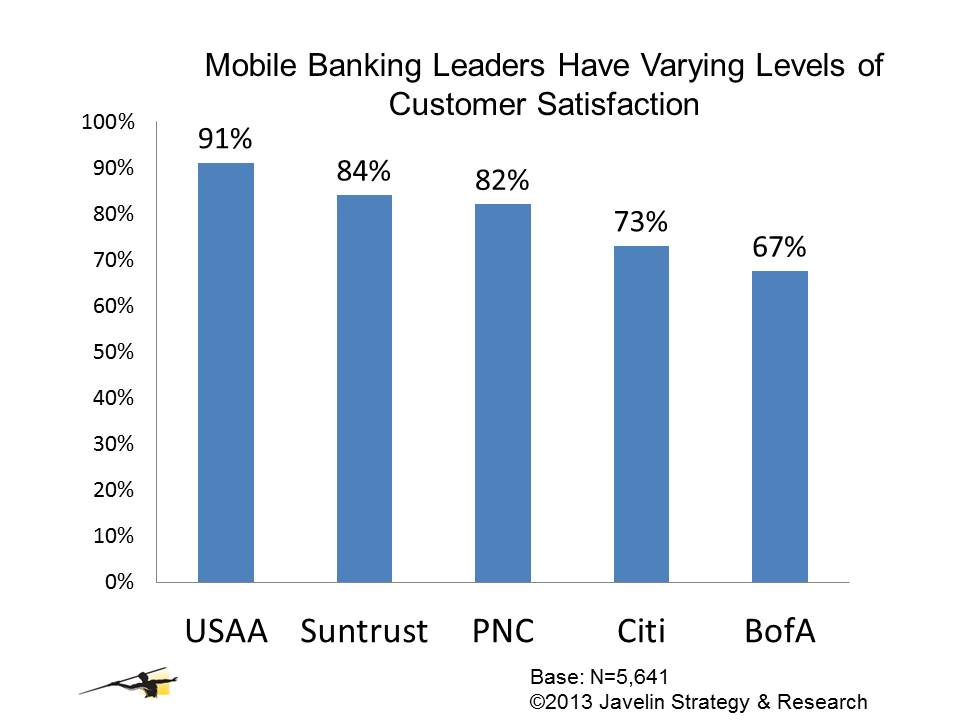

Javelin’s research found little overall correlation between customer satisfaction and technology adoption on a bank-by-bank comparison. For example, two large banks who are both mobile leaders investing in mobile technologies have varying levels of satisfaction. USAA, with all its mobile services, achieved high customer satisfaction scores with 90% of its customers citing “satisfied” or “very satisfied”, while Bank of America achieved only a 67% satisfaction score. Javelin’s newest benchmark service—Outperform—reveals insights into how wise investments in emerging services can result in higher satisfaction and a stronger, competitive position.

Javelin Strategy & Research’s new benchmark service, Retail Experience Benchmarking helps U.S. retail banks assess their competitive position of emerging bank services such as mobile banking, online banking, mobile deposit, smartphones, and tablets. Outperform benchmarks over 20 leading financial institutions by surveying over 10,000 bank customers and providing insights and strategic direction to improve the banks’ return on investment.

Selected Statistics from Outperform Benchmark Study

• 37% of USAA customers conduct mobile banking on a highly frequent basis.

• 4 Large Banks—SunTrust, USBank, Wells Fargo, and Citi¬ have achieved a smaller proportion of highly frequent mobile bankers with 22% to 24%.

• Two out of 3 credit unions members are highly frequent online users, higher than most regional and community banks.

About Outperform

Outperform is a new competitive benchmark service to help U.S. retail banks assess emerging bank services and identify ways to improve their competitive market position. Outperform provides market intelligence to ultimately increase acquisition rate, increase revenue, minimize costs, and improve loyalty.

About Javelin Strategy & Research

Javelin Strategy & Research, a division of Greenwich Associates provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other service providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses providers, customers and the transactions ecosystem.

Media Contact

Nancy Ozawa

(925) 219-0116

[email protected]

www.javelinstrategy.com/retail-experience-benchmarking