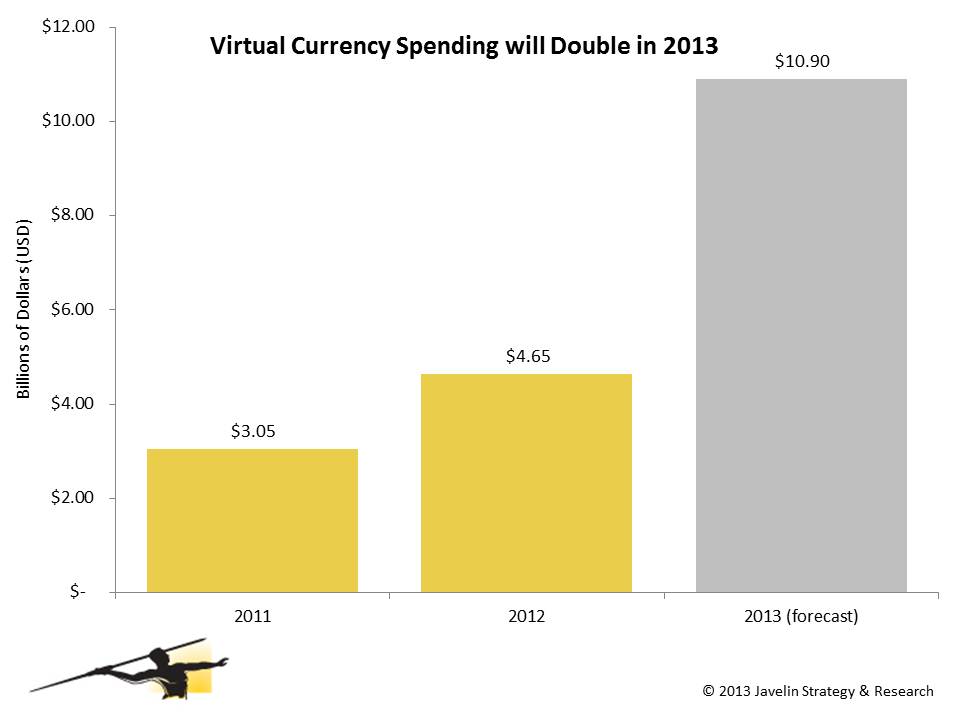

Global Virtual Currency Forecasted to Reach Over $10 Billion in 2013

Javelin Strategy & Research Identifies Virtual Currency moving from Digital Swords to Physical Goods

San Francisco, CA, August 7, 2013: Virtual currency has evolved far past its humble beginnings as an in-game currency. More than 47 million U.S. adults purchased $4.65 billion worth of virtual currency in 2012, and spend on virtual currencies is expected to more than double in 2013. Today, Javelin Strategy & Research released the firm’s Virtual Currencies 2013– Crossing the Chasm report, which assesses the transition of virtual currencies from the digital world to the physical, specifically focusing on the shift from simple, closed-loop virtual currencies to bidirectional virtual currencies used for real-world fiat exchange.

Without users, virtual currencies are nothing but an academic experiment. Two types of “real-life” purchases increased among virtual currency users: digital entertainment downloads and vouchers redeemable for physical goods. In 2011, 16% of virtual currency spend was on digital entertainment, rising to 19% in 2012. Similarly, there was a growth in virtual currencies being redeemed for vouchers that can be redeemed for physical items or services, from 13% in 2011 to 17% in 2012.

“Traditional players that capture the loyalty of virtual currency users will have a firm advantage over competitors, as they will be well positioned to successfully rollout emerging products to the customers that would be most likely to adopt them,” said Nick Holland, Senior Analyst – Payments at Javelin Strategy & Research. “Today’s virtual currency users are significantly more likely to choose Bank of America and American Express for their traditional credit card needs, providing these two issuers with keen advantage in the emerging payment space.

Javelin Strategy & Research’s Virtual Currency and Bitcoin: Crossing the Physical Chasm report discusses the dramatic market changes that have altered global virtual currency initiatives and provides in-depth analysis of the unique characteristics of virtual currency users. The report also provides a market sizing and forecast for the 2013 U.S. virtual currency market. It is based on one online survey of more than 3,000 consumers.

Learn More: Virtual Currency and Bitcoin: Crossing the Physical Chasm

About Javelin Strategy & Research

Javelin Strategy & Research, a division of Greenwich Associates provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

(925) 219-0116

[email protected]

www.javelinstrategy.com/research