JAVELIN Examines Features to Cement Gen Y's Lead in Bill Pay

JAVELIN Finds Banks and Credit Unions are First Stop in Bill Pay Journey Over Billers

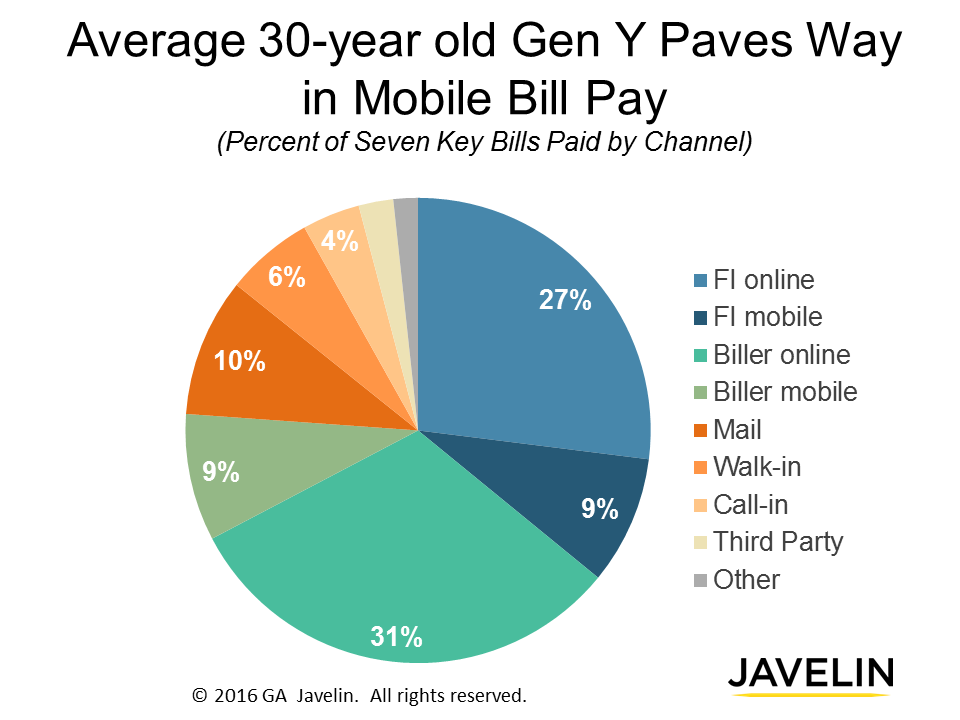

San Francisco, CA, February 10, 2016: Banks and credit unions are the first place that most consumers turn to handle their bill-paying chores, instead of going directly to the biller. Bill paying totals over $3.5 trillion for seven key bills, including $442 billion made on smartphones and tablets. Today, JAVELIN released Rethinking the Role of Bill Payment in Digital Banking report, which identifies why consumers typically choose FIs over paying billers directly and examines how to upgrade digital banking with bill pay features to attract high-value customer segments.

People in their late 20s and early 30s are in a critical transitional stage of life when they spread their financial roots. Gen Y.2 consumers, aged 25 to 34, initiate relationships with secondary FIs, open more accounts and loans, and establish long-term credit. By age 35, the average consumer owns nearly twice as many financial products as when they were in their 20s, but what might be counterintuitive is that Gen Y has yet to show an obvious preference when deciding whether to pay through FIs or directly at billers.

“It is critical for banks and credit unions to provide digital banking services that compel customers of all ages to consolidate their financial activity and purchases," said Mark Schwanhausser, Director of Omnichannel Financial Services, JAVELIN. "FIs that fail might be identified as the primary FI by virtue of providing the foundational checking account — but that is a hollow victory if FIs lose subsequent profitable loans and services to secondary institutions that win on fees and rates,”

The report, Rethinking the Role of Bill Payment in Digital Banking, explores how to leverage bill pay functionality to drive successful engagement in digital banking, as well answer the question why consumers typically choose FIs over paying billers directly. The results are based primarily on information gathered from multiple JAVELIN surveys conducted in 2013 and 2015 from a cumulative of 12,000 U.S. consumers.

Related JAVELIN Research

- Bank Switching: Combating ‘Silent Churn’ to Maximize Primary FI Status

- Turning Digital Banking Into a Financial Journey Starts With the First Paycheck

- Online Banking and Bill Payment Forecast 2014–2019: Tech-Savvy Moneyhawks Foreshadow New Bill Pay Habits

About JAVELIN

JAVELIN, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research

Twitter: @JavelinStrategy