Middle-Market Businesses on Losing End of Payment Fraud

Javelin Strategy & Research Examines the Impact of Payment Fraud on Small-to-Mid-Market Businesses

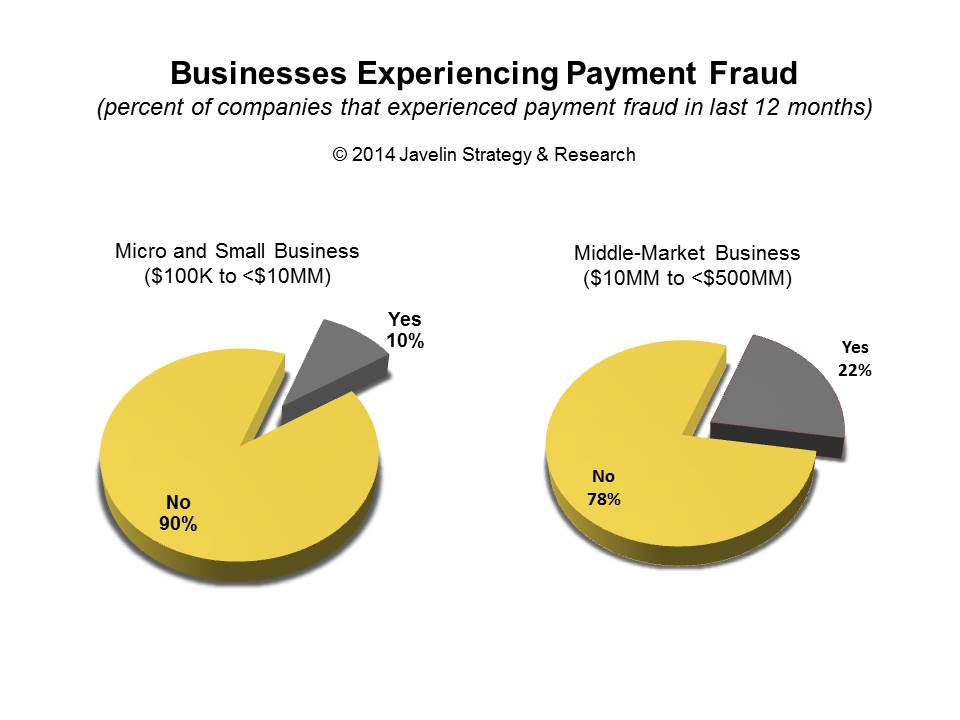

San Francisco, CA, September 16, 2014: Mid-market businesses depend on a variety of financial accounts and instruments to make payments to employees, suppliers, and vendors. None of these payment methods escape fraudsters’ crosshairs. Every business is at risk, as criminals do not discriminate, targeting companies both large and small. While larger businesses are more likely to suffer greater losses, smaller face the more serious threat from these crimes, as they are inherently less able than their larger peers to absorb their resulting financial costs. Today, Javelin Strategy & Research released the firm's first SMB Payments Fraud Report: Preserving Relationships by Securing Accounts and Managing Mobile, which builds on the firm's Commercial Payment practice and additional years of research into fraud and security issues affecting businesses in a variety of industries.

Over 58% of defrauded micro and small businesses ($100K-$10M in annual revenue) experienced misused credit card accounts last year. Liability protections for this segment provide relief comparable to that enjoyed by consumers. Micro and small businesses face a more serious threat from fraud on those types of payments where they do not enjoy the same protections, such wire transfers, as they are inherently less able than middle-market businesses to absorb the resulting financial costs.

On the other hand, 52% of middle-market businesses ($10M-$500M in annual revenue) experienced credit card fraud in 2013. They do not enjoy similar protections as micro and small businesses. Criminals have undertaken a campaign to breach the services and systems provided to card-accepting businesses by third-party providers and it would seem that almost anywhere a card payment is accepted is fair game for hackers, including suppliers and other businesses patronized by these small and mid-market businesses.

“Any business can be a target. Tools such as alerts, positive pay and dual authorization, along with alternative mobile-centric solutions allow a small to mid-market business to exert considerable control over the security of their financial accounts – facilitating prevention or early detection of fraud, which could directly affect their bottom line Al Pascual, Director – Fraud & Security at Javelin Strategy & Research.

The Report, SMB Payments Fraud Report: Preserving Relationships by Securing Accounts and Managing Mobile examines fraud and security affecting two segments of businesses: micro and small-businesses ($100K-$10M) and middle-market businesses ($10M-$500M). It is based on a survey of over 1,000 business payment decision-makers and influencers.

Related Javelin Research

- 2014 Identity Fraud Report: Card Data Breaches and Inadequate Consumer Password Habits Fuel Disturbing Fraud Trends

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research