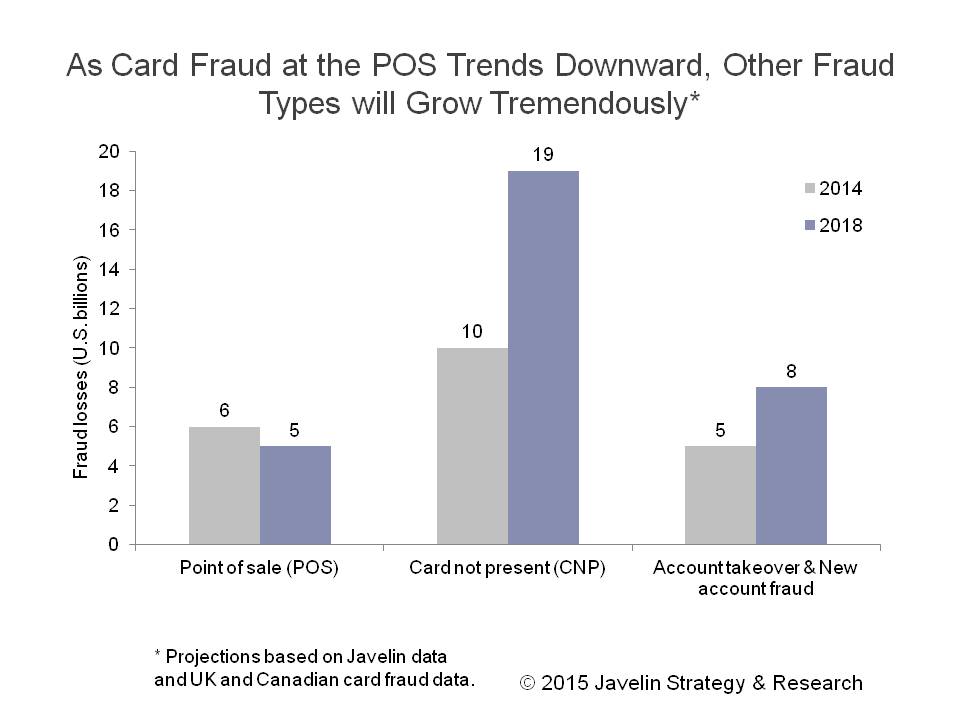

Point-of-Sale Card Fraud Predicted to Decrease as Card Not Present and New Account Fraud Increases

Javelin Strategy & Research Predicts Consumers Who Experience Both a Card Breach and Identity Fraud in the Same Year to Reach 8 Million by 2018

San Francisco, CA, June 11, 2015: Data breaches stole the spotlight in 2014 with a barrage of high profile retail breaches. Many of those breaches led to more identity fraud victims. Javelin announced its first forecast of the relationship between data breaches and fraud and made predictions of what is to come by 2018. Javelin Strategy & Research released 2015 Data Breach Fraud Impact Report, which explores the type of credentials that fraudsters will want to steal, the type of businesses that are most at risk for a data breach, and the magnitude of identity fraud by 2018.

As the United States transitions to EMV, POS fraud will grow less lucrative. Higher-security cards will make counterfeiting substantially more difficult, if not impossible. Additionally, any encrypted or tokenized payment information will make data gained from compromised terminals useless for future POS transactions. Criminals will focus on other areas including card-not-present (CNP) fraud, vulnerable merchants that have been slow to transition to EMV terminals and businesses that store Social Security Numbers that will be of significant value in committing new account and account takeover fraud.

“The relationship between data breaches and identity fraud is intuitive — quick access to millions of credentials makes life easy for a fraudster. For criminals looking to make a quick buck, buying breached credentials eliminates the need to directly harvest financial information through malware or social engineering before cashing in at a merchant or by withdrawing funds,” said Al Pascual, Director of Fraud & Security, Javelin Strategy & Research.

2015 Data Breach Fraud Impact Report

Javelin forecasted four years of new account fraud, account takeover, and data breach-linked fraud given the expected EMV implementation. This report drew from a survey of 5,000 respondents’ fraud behaviors and the types of fraud experienced.

Related Javelin Research

- 2015 Identity Fraud: Protecting Vulnerable Populations

- Fixing CNP Fraud : Solutions for a Pre- and Post-EMV U.S. Market

- 2014 Identity Safety in Banking Scorecard: Finding a Balanced Approach as Fraud Diversifies

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.