Post-Breach Complimentary Identity Protection Services: Do they Really Benefit Consumers?

JAVELIN Examines Identity Protection Services B2B Market and Provides Recommendations to Enhance Services

San Francisco, CA, July 16, 2015: Pressure from consumers, media, and governments has contributed to make the offer of complimentary identity protection services all but inevitable following any major breach. While this may be hailed as a positive step, with companies offering a more robust response than simple notification, it does bring many challenges. Today, JAVELIN released 2015 Identify Protection Services: Business-to-Business Market, which provides an understanding of the current business-to-business identity protection subscription market.

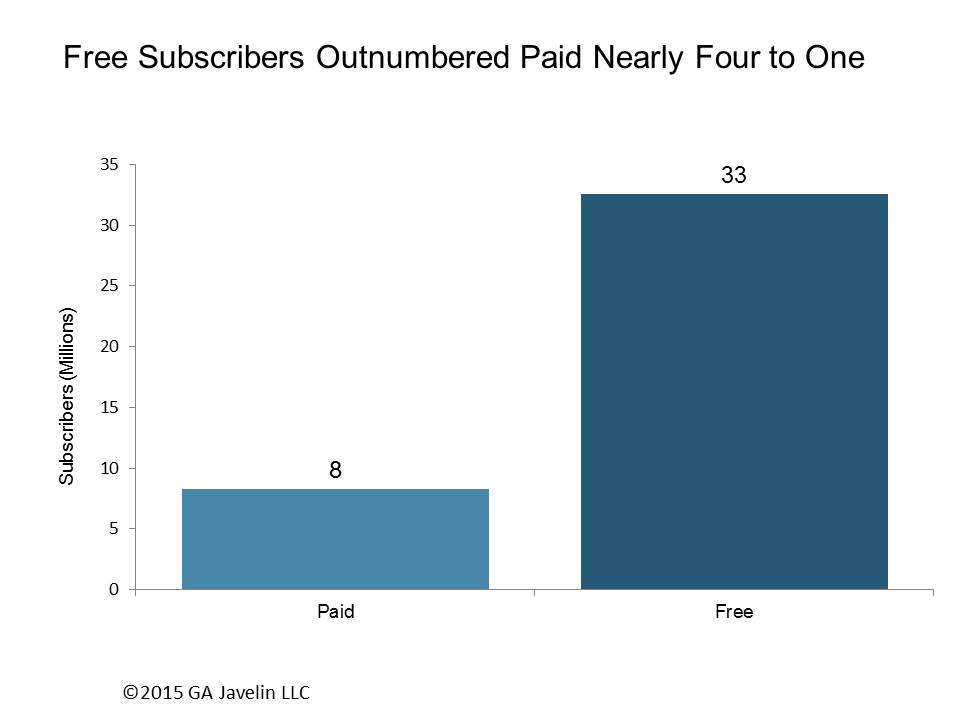

Between April 2013 and March 2014, 40 million consumers held at least one identity protection subscription through business-to-business channels, with the bulk being “free” services provided after a data breach. And while these solutions can be an effective hedge against consumer identity fraud, not all identity protection services are created equal.

“The biggest problem with the mass issuance of identity protection services is the mismatch of risk and coverage,” said Al Pascual, Director of Fraud & Security, JAVELIN. ”For example, we have seen countless breach victims being offered solutions that rely heavily on credit monitoring, even though it may not have been appropriate or effective based on the type of data compromised”.

The report, 2015 Identify Protection Services: Business-to-Business Market, includes two consumer surveys of a total of 8,000 consumers and market sizing of the business-business identity protection services market. In addition, this report includes 9 profiles of vendors serving including: CSID, D+H, Europ Assistance, Experian, EZShield, IdentityForce, IDT911, LifeLock, and TransUnion.

Related JAVELIN Research

- 2015 Identity Protection Services Scorecard: Direct-to-Consumer Market

- 2015 Identity Fraud: Protecting Vulnerable Populations

- New Moneyhawks: Highly Profitable and Engaged Customers Defining the Future of Banking

About JAVELIN

JAVELIN, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research

Twitter: @JavelinStrategy