Tech-Savvy Consumers put Pressure on Banks to Reimagine the Banking Experience

Javelin Strategy & Research Examines Four Neobanks that Could Disrupt the Financial Industry: GoBank, Moven, Serve, and Simple

San Francisco, CA, September 30, 2014: Financial institutions today are under tremendous pressure to reinvent themselves for the digitally-driven future. Rapidly changing consumer needs, combined with ever-faster technology adoption curves and evolving regulatory pressures, have created an urgent demand to reimagine the digital banking experience. Javelin Strategy & Research released Reimagining the Banking Experience: GoBank, Moven, Serve, and Simple, which outlines new business models to align to future priorities. In addition, this report builds on an analysis of four neobank models: GoBank, Moven, Serve, and Simple, with takeaways that can improve any institution’s competitive position in the shifting digital landscape.

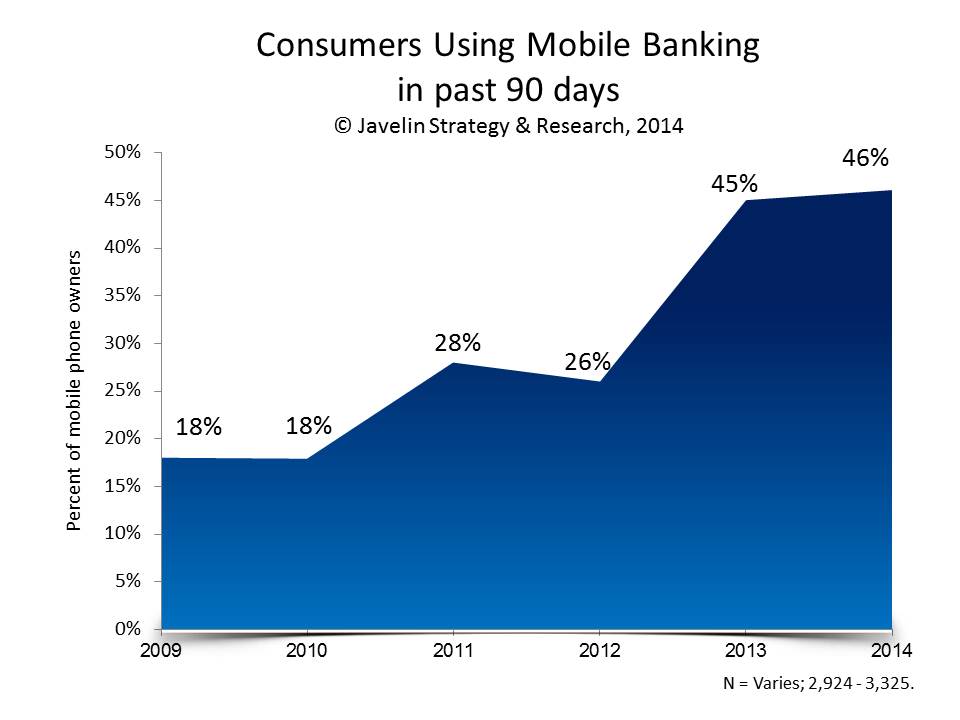

Neobanks are niche institutions that target neglected segments that might have been considered unprofitable or unreachable before the rise of digital banking. The ever more rapid and prolific adoption of new digital tools has helped to open up the financial services model to disruption from neobanks. Most often, these targets are enticed by mobile-first and prepaid banking products. A surgical approach to segmentation is formative to a neobank’s product offering, design, and marketing. Each neobank has a distinct spin on the new-banking recipe, mixing in new features to set themselves apart and entice consumers.

Neobanks are niche institutions that target neglected segments that might have been considered unprofitable or unreachable before the rise of digital banking. The ever more rapid and prolific adoption of new digital tools has helped to open up the financial services model to disruption from neobanks. Most often, these targets are enticed by mobile-first and prepaid banking products. A surgical approach to segmentation is formative to a neobank’s product offering, design, and marketing. Each neobank has a distinct spin on the new-banking recipe, mixing in new features to set themselves apart and entice consumers.

Two large segments are driving digital adoption: Gen Y, with the greatest earning potential and underbanked consumers—those without a primary checking account—accounting for a total of 73 million and 64 million consumers, respectively. These consumers are ripe for disruption; 25% of the underbanked have switched primary FIs in the past 2 years. Furthermore, 8 times as many 18- to 24-year-old customers cite digital capabilities as a reason for switching primary FIs.

"FIs should reconsider their existing market footprint with an eye to digital expansion. Flagship branches will increasingly be self‐service and advice‐driven," said Mary Monahan, EVP and Director of Research at Javelin Strategy & Research. "Regional FIs with superior digital offerings can now extend them statewide and beyond, while national FIs could expand across international borders. The opportunity is vast, and rapid changes in market position should be expected."

Javelin Strategy & Research released Reimagining the Banking Experience: GoBank, Moven, Serve, and Simple, which builds on an analysis of four neobank models: GoBank, Moven, Serve, and Simple, with takeaways that can improve any institution’s competitive position in the shifting digital landscape. It is based on longitudinal online surveys with over 20,000 respondents over the past five years, as well as executive interviews with the four neobanks.

Related Javelin Research

- Tablet Banking Forecast 2014–2018: Design and Deployment Strategies for Mass Adoption

- A Tale of Two Gen Y’s: On the Road to Long‐Term Banking Profitability

- Empowering Underbanked Consumers in the Mobile Era: Identifying Bank Needs and Ranking Top Prepaid Providers

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.