University-Issued Prepaid Cards Face the Regulatory Firing Squad

Javelin Strategy & Research Finds Almost a Quarter of College Students Own a Prepaid Card

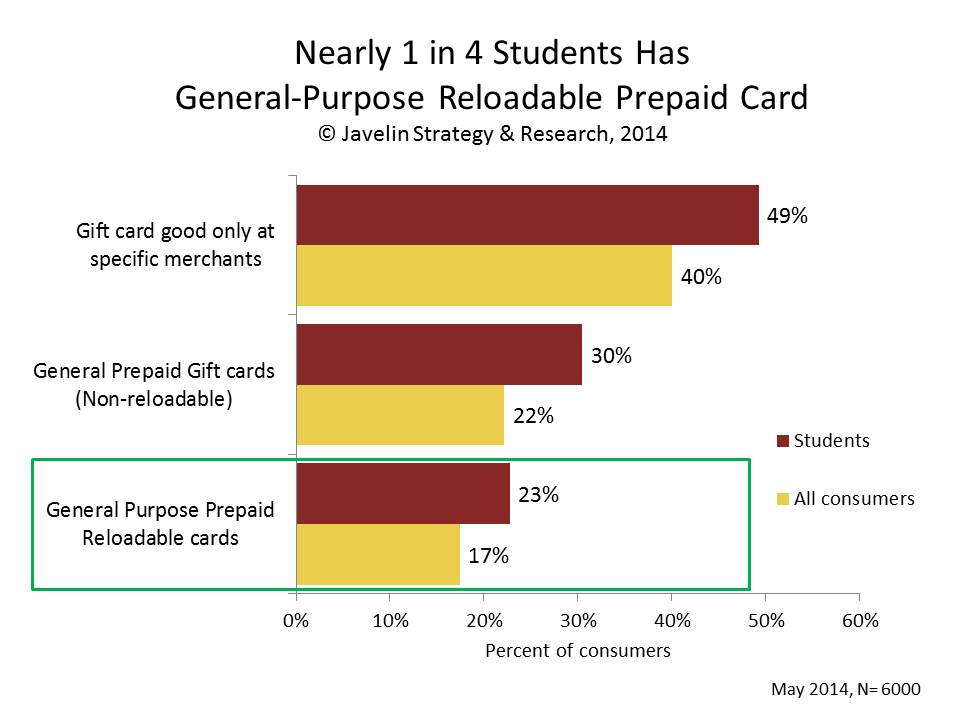

San Francisco, CA, July 23, 2014: The CARD Act of 2009 severely limited the once-pervasive trend of issuing credit cards to college students. Fast forward to 2014, where issuers are partnering with colleges to provide prepaid cards to students and regulators are once again proposing regulations for college cards that could dramatically alter payments for students. Today, Javelin Strategy & Research released Prepaid Card Regulation for College Students: Addressing the Needs of Future Banking Customers report, which examines the controversial regulatory environment for campus prepaid cards and recommends how issuers and universities can best manage potential regulation.

“Regulation is inevitable if FIs don't tread carefully on college campuses, but there's still time to avoid further legislation; however, nearly all providers need to improve their fee transparency and overall card disclosure,” said Nick Holland, Senior Research Analyst, Payments at Javelin. “FIs cannot afford to rely on partnering universities to properly convey the fees and features of campus prepaid cards. FIs risk the wrath of regulators if they don't address this problem soon.”

Javelin Strategy & Research released Prepaid Card Regulation for College Students: Addressing the Needs of Future Banking Customers report, which examines the controversial regulatory environment for campus prepaid cards and recommends how issuers and universities can best manage potential regulation. It also examines the unique financial needs of today’s college students and offers insights into how providers can best help young customers and build long-term financial relationships. It is based on multiple surveys of over 12,000 consumers and includes profiles of several campus prepaid cards including BlackboardPay, Fifth Third Mastercard Prepaid Campus Card, Heartland ECSI Acceluraid Prepaid Discover Card and U.S. Bank Contour Card.

Learn More: Prepaid Card Regulation for College Students: Addressing the Needs of Future Banking Customers

Related Javelin Research

- Empowering Underbanked Consumers in the Mobile Era: Identifying Bank Needs and Ranking Top Prepaid Providers

- Banking with Women Customers: Strategies to Increase digital Banking Engagement

- Checking vs. Prepaid: Threat or Opportunity?

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.