Overview

Boston, MA

June 2005

2005 Legal and Regulatory Review

Association Battles, Bankruptcy Reform and Potential Data Security Regulations

Regulations and legal issues are changing the credit card industry from a number of different angles. Congress and the President gave the industry a victory when they passed a bankruptcy reform bill heavily lobbied-for by the card industry, but now seems on the verge of writing some data security laws that could hinder the industry's ability to operate. There are also several legal issues that threaten to shake up the industry as well, including big fights with the associations pitted against both each other and their merchants.

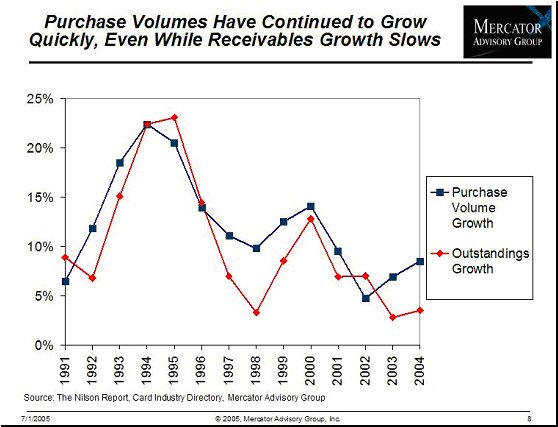

Visa and MasterCard face new challenges from two directions. First, both associations and eight of their members are being sued by American Express and Discover for damages relating to the antitrust ruling that went against the two bankcard associations in 2001. And second, a class action suit from five merchants seeks damages based on collusive behavior in setting interchange rates. Interchange has become an increasingly important earnings driver for issuers as purchase volume growth has outstripped receivables growth (see Figure 1 below) and any actions to decrease interchange revenues could dramatically harm issuers, and possibly drive them to use their newly won right to issue AmEx and Discover cards.

Figure 1: Purchase Volume Growth has been Stronger than Outstandings Growth Since 1996

Using examples from some international incidences of legal challenges to interchange, Mercator Advisory Group discusses the possible outcomes, and the impact that this suit could have on the competitive balance of the industry.

Bankruptcy reform has been heralded as a major victory for the card industry, with most estimates of the industry's benefit ranging from $1 billion to $1.5 billion, and some as high as $4 billion annually. However, Mercator Advisory Group's analysis of the available data has concluded that the benefits have been drastically overestimated, and are likely to be only a fraction these estimates.

"A series of data security breaches in 2004 and early 2005 have raised the likelihood of government regulations of the data collection and brokerage industry. Given the card industry's heavy reliance on collecting, buying, and selling data, any restrictions will directly impact the operations of the industry. In addition, the Card Systems Inc. incident threatens to bring added scrutiny to the data storage practices of the entire card industry. This could well result in new regulations, and eventually new costs to everyone in the value chain," says Brian O'Keeffe, Director of Mercator Advisory Group's Credit Advisory Service.

All three of these subjects, as well as the business impact to the various parties involved, are discussed at length.

The report is 26 pages and contains 6 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world