2009 - CPS - Issue #3 - Mobile

- Date:October 05, 2009

- Author(s):

- Mercator Research

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

The Mobile Consumer: Well-Equipped But Cautious

Third of Four Reports from Mercator Advisory Group's

Primary Data Series

Boston, MA - October 7, 2009 -- Interest in mobile payments and financial applications is high and growing in the payments and banking industries. With 88% of the population carrying mobile handsets, it is a channel that cannot be ignored or neglected by financial service providers. It is not a uniformly equipped or utilized channel, however it is on a unique maturity curve independent of other financial applications and channels. Understanding the trajectory of that maturity curve is critical for financial service stakeholders needing to establish a presence in the mobile channel.

Based on primary consumer surveys The Mobile Consumer: Well-Equipped But Cautious report examines payment card and banking topics, highlighting consumers' growing use of mobile devices,wireless and smart phones, and the implications for growth in mobile payment and payment security applications. This is the third Primary Consumer Payments report being offered as part of Mercator Advisory Group's newly launched Primary Data Series (PDS). This new offering by Mercator Advisory Group provides access to a library of valuable resources that combine both relevant payments and banking data with experiential analysis focused on today's most critical and strategic issues.

"Just as online banking's growth took almost a decade to accelerate, certainly the golden age of the mobile channel in financial and payment services is still ahead of us. And given its tremendous consumer footprint, we might concur that the sky is the limit for new applications," Ken Paterson, VP for Research Operations at Mercator Advisory Group and the primary author of the report comments. "On the other hand, without a firm foundation in consumer understanding and education, little progress will be made toward increased adoption of mobile payment and security applications."

Based on a national sample of 1,012 online consumer survey panel survey responses completed between May 28 and June 4, 2009, the report outlines device usage patterns, experience with text messaging and alerts, experience with security issues on payment cards, and acceptance of select mobile payment and security applications.

Highlights of the report include the following:

- The vast base of mobile phone users, some 88% of adults, creates distinct opportunities for payment applications across the various segments of handset users.

- Consumer experiences with reissued payment cards make them conscious of payment security issues, but they ascribe no particular security benefits to the mobile channel.

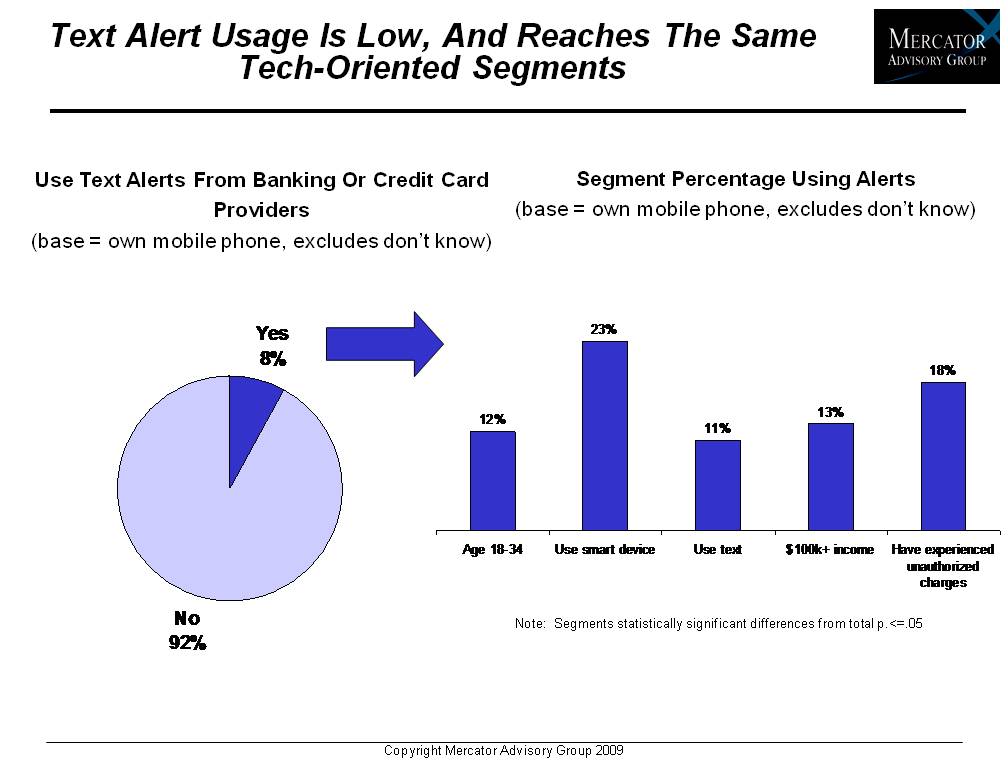

- Text alert users, though a small segment today, show some positive experiences with the service.

- When considering a range of payment and security services that might be deployed in the mobile channel, smart handset users often distinguish themselves as early adopters, and the most likely early prospects for mobile payments services.

- On the other hand, mobile's broad and diverse adult user base is very cautious in signaling interest in online payment and security services. Providers will need to incorporate consumer education needs and variable tech sophistication into account when planning product launches.

One of the 13 Exhibits included in this report

The report is 34 pages long and contains 13 exhibits

Access to the PDS library is offered as a subscription-based membership, separate of Mercator's Advisory Services (Debit, Credit, Prepaid, International, Banking, Emerging Tech.) because it is composed of large national sample surveys, a compilation of primary data (Cross Tabs), analysis (summaries of the data set) and companion power points. This collection of cost-effective primary data and analysis can be leveraged to validate research initiatives and business strategies, refine operations and fulfill objectives.

For more information about this report and Mercator's Primary Data Series, call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Mercator Advisory Group is the leading independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

2024 North American PaymentsInsights: Canada: Generational Consumer Payment Trends

This year, we identified consistent patterns of payment behavior that align with the findings from last year's study of Canadian consumers. Younger generations predominantly drove ...

2024 North American PaymentsInsights: U.S.: Generational Consumer Payment Trends

The economic environment of 2024 was particularly challenging. Consumers grappled with inflationary pressures and high interest rates among an economically uncertain market with a ...

2024 North American PaymentsInsights: Canada: Exhibit

This year, we identified consistent patterns of payment behavior that align with the findings from last year's study of Canadian consumers. Younger generations predominantly drove ...

Make informed decisions in a digital financial world