Overview

In new research, 2012 ATM Market Benchmark Report, Mercator Advisory Group reviews how retail financial institutions are leveraging the power of today's ATMs to be the foundation of a multichannel experience. The report provides many market sizing statistics and projections for the next several years.

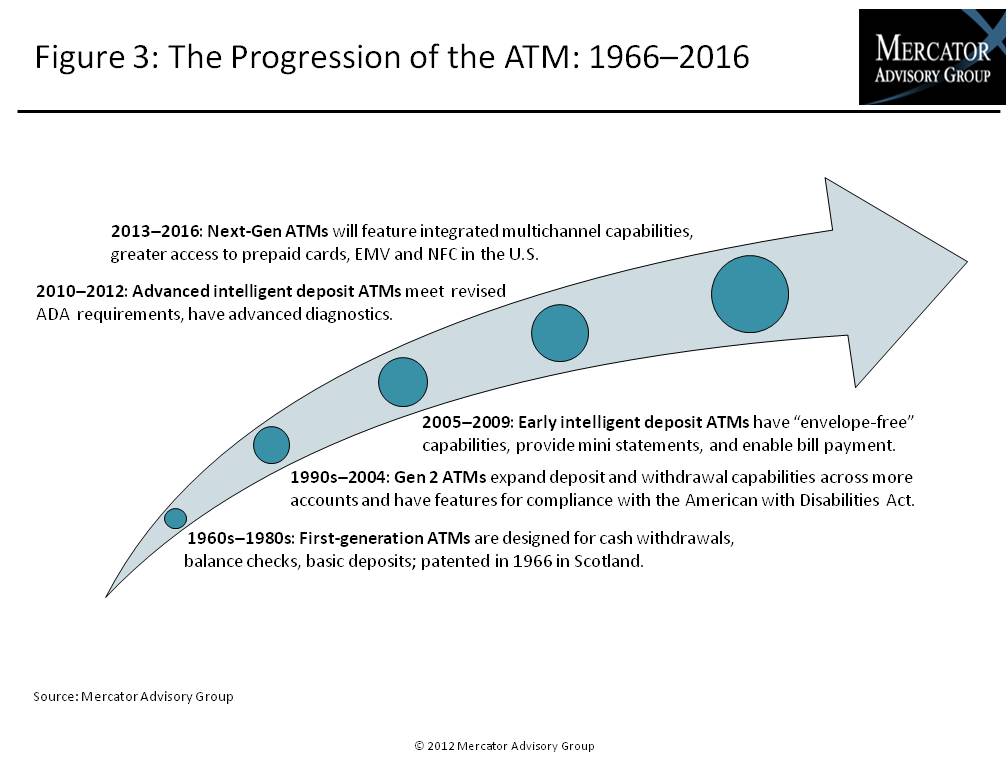

The report begins with a review of the ATM landscape including global usage and growth, the renewed interest in this channel, and how the channel has evolved in the last half century. Next, detailed perspectives from both the user and the owner-operator side are presented. The perspectives include information on customer trends, fees, and the competitive landscape. In addition, strategic implications for the future are outlined.

One of the exhibits included in this report:

Highlights of this report include:

- Data illustrating growth trending and proliferation for the ATM channel for delivery of banking services

- Survey findings from Mercator Advisory Services' CustomerMonitor Survey Series regarding the size of the U.S. ATM market, consumers' frequency of ATM usage, reasons for branch visits, attitudes toward surcharges for use of out-of-network ATMs, and more

- Statistics on the leading ATM owner-operators, both financial institutions and independent deployers

- Data on the leading global ATM manufacturers and discussion of their jockeying for position in a tightly competitive market

- Examples of increasingly popular advanced-feature ATMs

"Financial institutions of all sizes throughout the world are embracing today's ATM channel and leveraging its power as the foundation for a coordinated multichannel strategy. Modern ATMs enable cash and check deposits, transfers, and bill pay as well as dispensing various types of payment cards, tickets, tokens, and other items. So-called intelligent deposit machines are performing tasks formerly handled by tellers in branches or via online banking. Many of these ATMs now have touch screens, virtual keyboards, and integration to banking and loan products beyond simple DDA accounts" Ed O'Brien, director of Mercator Advisory Group's Banking Channels Advisory Service, comments.

This report is 22 pages long and has 16 exhibits.

Organizations mentioned in this report include: ACCEL/Exchange, Allpoint, Alliance One, Bank of America, BB&T Bank, BMO Harris, Capital One, Citibank, Cardtronics, Co-Op Financial Services, Citizens Bank, Credit Union 24, Diebold, Elan MoneyPass, Fifth Third Bancorp, Global Access Corporation, Huntington Financial, JPMorgan Chase, M&T Bank, NCR, NO SUR!, NYCE Payments Alliance International, PNC Bank, PULSE Select, RBC Bancorp (USA), RD Bank, Regions Financial, Sovereign Bank, STARsf/FirstData, SUM/FIS SunTrust Bank, University Federal Credit Union, U.S. Bancorp, Wells Fargo, Wincor Nixdorf, 7-Eleven.

Learn More About This Report & Javelin

Make informed decisions in a digital financial world