Overview

In new research, 2012 Mobile Banking Market Assessment, Mercator Advisory Group explores how retail financial institutions can increase interaction with customers and members to include 24x7, anytime anywhere service, and also expand their reach beyond simple demand deposit account transactions.

"In this report, we review the burgeoning mobile banking market and evaluate key trends and market drivers that are contributing to its impressive and staggering growth. Mobile banking adoption has accelerated at unprecedented rates, rivaling the speed-to-adoption of such consumer "must have" products as telephones, dishwashers, automobiles, and color TVs," comments Ed O'Brien, director of Mercator Advisory Group's Banking Channels Advisory Service and author of the report.

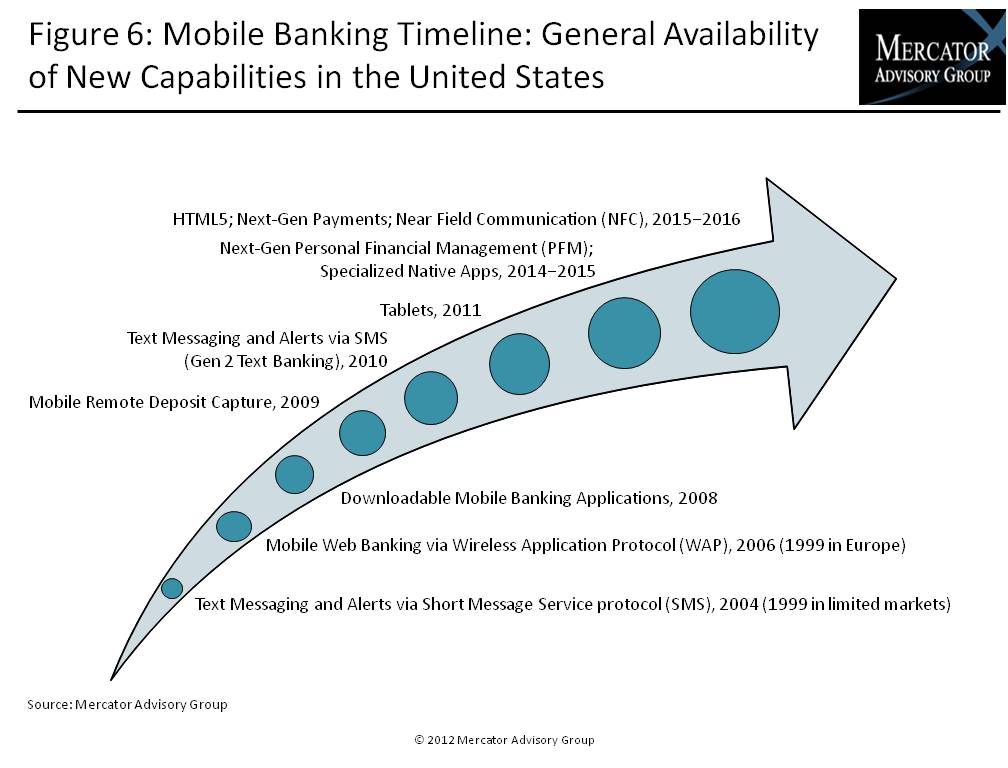

One of the exhibits included in this report:

Highlights of this report include:

- The factors contributing to the phenomenal growth of mobile banking

- The impact of increasing mobile consumer usage to the market, new opportunities for customer engagement, and new benefits for financial institutions

- Three key areas of change in customer behavior that are being driven by mobile banking

- The three modes of mobile banking and the circumstances when each is most appropriate for use

- The reasons not all consumers are comfortable with using mobile devices for banking

- The new advances opening the door to additional features and capabilities to further grow the mobile banking channel

This report is 25 pages long and has 15 exhibits.

Organizations mentioned in this report include: Apple, ACI Worldwide, Euronet, FFIEC, FIS, Fiserv, Google, Harland Financial Services, and mFoundry.

Learn More About This Report & Javelin

Make informed decisions in a digital financial world