Overview

“Data regarding debit cards and transaction is not as publicly available as it once was. Given the market shifts occurring, this information is as important as ever to issuers, networks, and processors, who need to react to the ways that debit card transactions are being routed. The purpose of this report is to create the foundation to track the trends of all debit card transactions through the various networks,” commented Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group and author of the report.

This report also analyzes the events and market conditions that created the trends we are seeing in debit volume and discusses what trends are likely to be most influential in the future.

This report has 24 pages and 10 exhibits.

Companies mentioned in this report include: Accel, AFFN, Bank of America, Discover, EMVCo, Jeanie, JP Morgan Chase, MasterCard, Merchant Advisory Group, NYCE, Pulse, Shazam, STAR, and Visa.

One of the exhibits included in this report:

- Changes in debit card ownership and usage in the U.S.

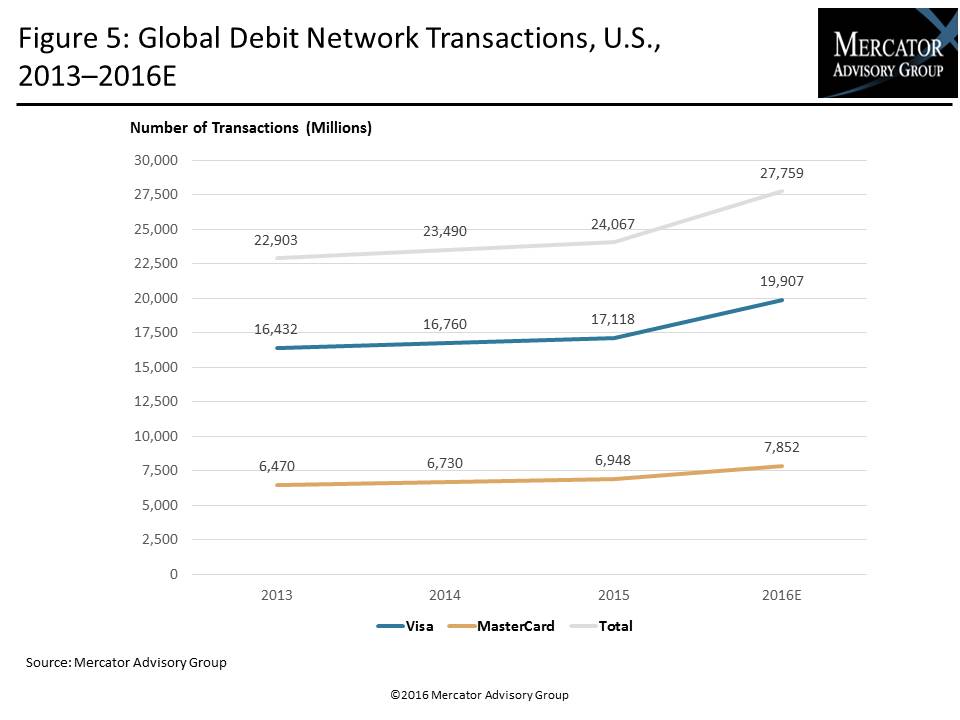

- rends in global network transactions and dollar volumes

- Trends in EFT debit network transactions and dollar volumes

- Analysis of how mobile, EMV, PIN-less debit and other forces have impacted these trends

- Discussion of how future products, services, and regulation may impact debit transactions in the future

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world