The 2020 Credit Card Data Book: Good Times Roll a Bit Longer

- Date:February 19, 2020

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

2019 was a banner year for many credit card issuers, as the stars aligned. Unemployment and inflation were low, interest margins were at a peak, collection results were favorable, and total open accounts grew slightly. And according to Mercator Advisory Group’s new report, The 2020 Credit Card Data Book: Good Times Roll a Bit Longer, 2020 will likely be slightly better, and more profitable, assuming the economic tides do not turn.

“Credit card risk is fragile right now. Times have been good, but that “sooner or later” economic shift draws closer every month. Use Mercator’s 2020 Credit Card Data Book to see where sensitivities exist,” comments Brian Riley, Director, Credit Advisory Service, at Mercator Advisory Group, the author of this research report. “As an example, if there is a sudden shift, warning bells will ring at credit card issuers and they will quickly tighten credit to protect their balance sheets. As that happens, delinquency will start to climb. This ends up as high credit losses and increased non-interest expense.” Riley continues: “Right now, infrastructure and credit management are as important as portfolio growth. Risks are higher than ever, and issuers must ensure that their credit management policies and systems are ready to react. Overflow and diversion strategies, champion/challenger testing, and a battle-ready credit management team are the order of the day.”

This document contains 29 pages and 20 exhibits.

Companies and other organizations mentioned in this research report include: ACI Worldwide, Bank of America, Chase, Citi, Federal Reserve System, and FICO.

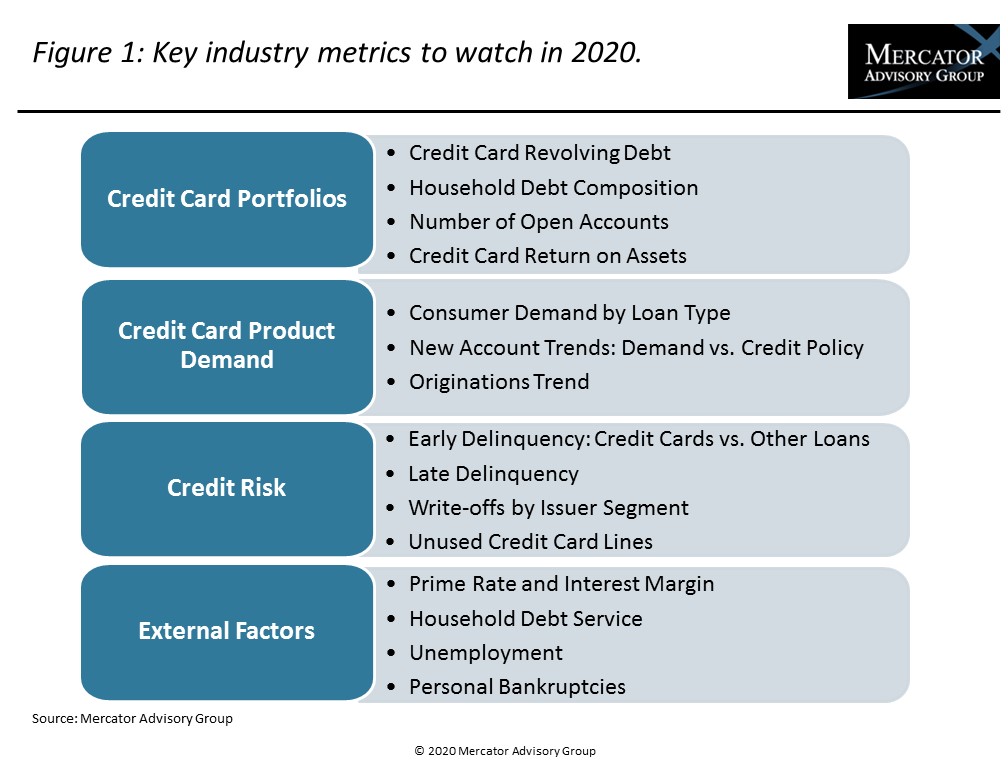

One of the exhibits included in this report:

- Key industry metrics to watch in 2020

- Growth in revolving debt

- Average credit card debt

- Credit card return on assets

- Originations and total active accounts

- Trillions of dollars in contingent credit card liability

- Interest rate margins

- Household debt burdens

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world