2021 U.S. North American PaymentsInsights: Subscriptions, Bill Pay, and Consumer Fraud Experience

- Date:August 13, 2021

- Author(s):

- Nicholas Bisconti

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group has released a new primary research report titled 2021 U.S. North American PaymentsInsights: Subscriptions, Bill Pay, and Consumer Fraud Experience, summarizing findings from the North American PaymentsInsights survey of 3,001 U.S-based adults. The report aims to highlight the key findings from the survey as they relate to consumer experience with subscriptions, bill pay, and fraud. The report brings together various aspects of how U.S. consumers interact with the payments ecosystem to pay for subscriptions and recurring bills, as well as their experiences with fraud in the past year. The report highlights consumers’ experience and attitudes towards various fraud events, which have seen increased relevance with the radical expansion of card-not-present transactions during the pandemic. Readers are presented with summary findings regarding consumer behaviors and inclinations, as they vary across different demographic cohorts of consumers.

“The accelerated expansion of online shopping and the associated rise in card-not-present transactions during the pandemic has led to an increased incidence of fraud events. This makes it vital for card networks, issuers, financial institutions, merchants, and other players in the payments space to update their fraud prevention solutions to maintain consumer confidence in the safety of their products.” - Amy Dunckelmann, Vice President, Research Operations, Mercator Advisory Group.

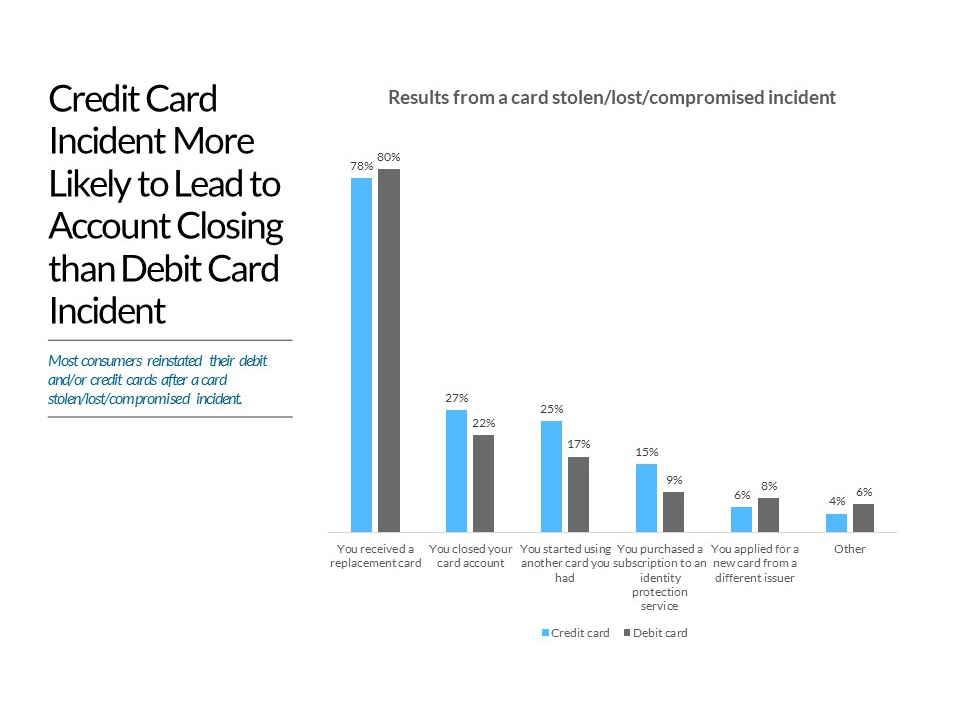

One of the exhibits included in this report:

Highlights of this document include:

• Subscriptions to news and magazines as well as software services had the highest share of consumers paying with credit cards, compared to all other subscription types, 55% and 48% respectively.

• High-income respondents were more likely to pay their bills via automatic deductions from credit or debit card.

• 90% of consumers who pay bills believe that their bills should reach the biller within a single business day.

• Young consumers are more likely to experience fraud of all types, with 46% of 18-34 year-olds reporting to have experienced fraud in the past 12 months.

• Most respondents contacted their bank following a fraud incident involving a P2P money transfer service, with less than half contacting the service in question.

Learn More About This Report & Javelin

Related content

2024 North American PaymentsInsights: Canada: Exhibit

This year, we identified consistent patterns of payment behavior that align with the findings from last year's study of Canadian consumers. Younger generations predominantly drove ...

2024 North American PaymentsInsights: U.S.: Exhibit

The economic environment of 2024 was particularly challenging. Consumers grappled with inflationary pressures and high interest rates among an economically uncertain market with a ...

2024 North American PaymentsInsights: Canada: Generational Consumer Payment Trends

This year, we identified consistent patterns of payment behavior that align with the findings from last year's study of Canadian consumers. Younger generations predominantly drove ...

Make informed decisions in a digital financial world