Overview

Boston, MA

August 2008

5th Annual Network Branded Prepaid Market Assessment

Measuring the Phenomenal Growth of the Open Prepaid Industry

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report is the first in our annual series of three reports that provides a thorough analysis of the growth and development of the Prepaid Industry. It benchmarks the spending, growth, and market dynamics for all Network Branded Prepaid Solutions. This includes a review of the dollars loaded on Network Branded Prepaid products in 22 different market segments, up one segment from last year's 21 segments. As before, we have measure load for Travel, Events & Meetings, Employee & Partner Incentives, Consumer Incentives, Relocation Card, Campus, In-Store Gift Cards, Distributed In-Store Gift Cards, TANF, Court Ordered Payments, Transit (Tolls & Light Rail), State Unemployment, Insurance, Payroll Benefits, FSA/HSA Tax Deferred Programs, and Purchasing, and this year we have added the Social Security segment.

This report is unique because it clearly defines what is being counted (the 33 market segments) and because these measurements have been conducted since 2003, it delivers to Mercator Advisory Group members the only consistent data set that measures the growth and dynamics of the prepaid industry for several subsequent years.

Highlights of the report include:

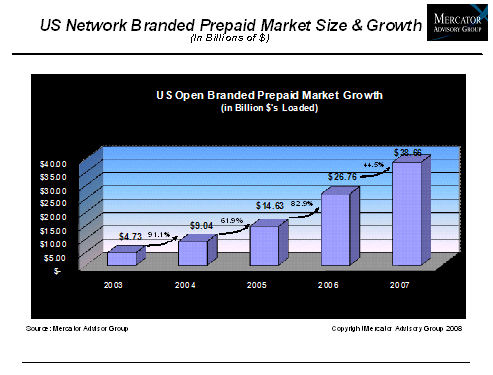

- There was a total load of $38.66 Billion in 2007 on all Network Branded prepaid solutions. This is an increase of 44.5% from 2006. The total load for all 33 Prepaid Segments in 2007 (Open & Closed) was $218.3 Billion, which is $20.4 Billion more than in 2006, an increase of 10.3%

- Network Branded Gift Cards grew by 70%, becoming a $5.03 Billion market at the conclusion of 2007.

- The biggest news is the rapid adoption and roll out of Network Branded cards for government disbursements. State Unemployment grew 150% while court ordered payments grew 82%. These will pale in comparison to Social Security, which deployed its first open loop pilot in 2007 and with an estimated load of $10.6 Million. Social Security has been added as a new segment in the Government Category.

- Consumer Incentives loads on Network Branded cards grew 87% while Employees and Partner Incentives grew at 83.4%. These numbers include the estimated load for the AEIS Direct Spend program and similar RAN-Based solutions such as Mall Cards.

- Businesses also increased loads for Payroll by 21%, Benefits by 7%, and FSA/HSA by 8%.

- An analysis of the "The Electronic Payments Study" conducted by the Federal Reserve Board with Dove Research. This study concluded that the Prepaid Market is significantly smaller than Mercator Advisory Group estimates. Our analysis identifies key differences in research methodologies that account for a significant portion of the variance. This analysis also identifies how the FRB methodology prevents a direct comparison and how the adoption of a standard taxonomy by prepaid market research firms could enable the direct comparison of different research efforts.

- Increasingly both merchants and Consumer Packaged Goods manufacturers are investigating Merchant Funded Discount Networks, Restricted Authorization Networks and even Decoupled Debit-like solutions to lower payment costs while improving customer satisfaction and more precise target marketing.

Tim Sloane, Director of the Prepaid Advisory Service at Mercator Advisory Group and on the report's authors comments, "The overall growth rate associated with the Network Branded Prepaid Market has slowed somewhat, but still grew by 44.5% from $26.8 Billion in 2006 to $38.7B in 2007. While this represents an enviable growth rate by almost any external standard, it will likely still disappoint an industry that has come to expect triple digit growth rates. This slowdown in growth rate should not be surprising since the increase in total market dollar value simply makes triple digit growth rates increasingly difficult to achieve. The $11.9B increase for the Open Loop load is a very healthy increase in market size. Some of the market segments that are most hard pressed to maintain triple digit (or higher) growth rates include State Unemployment and Court Ordered Payments. These segments were growing rapidly as each of the larges states adopted prepaid and rolled it out, but once that is achieved for the largest states, the addition of each smaller state represents a smaller percentage of the total."

One of the 10 Exhibits included in this report

This report contains 30 pages and 13 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to mailto:[email protected]

Learn More About This Report & Javelin

Related content

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

2025 Prepaid Card Data Book

Open-loop and closed-loop prepaid segments have stabilized, with a slight uptick in overall growth aided by positive consumer behaviors and the introduction and expansion of gaming...

Make informed decisions in a digital financial world