Overview

Boston, MA

May 2005

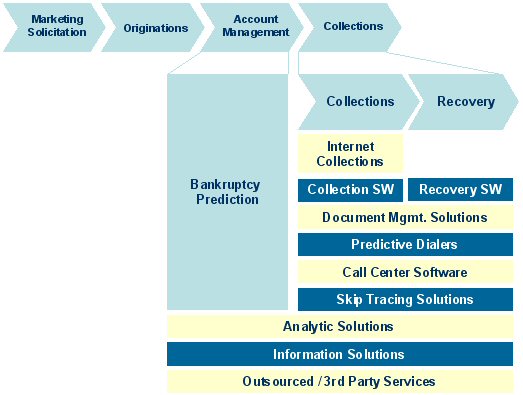

Account Life Cycle Solutions:

Scoring Solutions in Collections and Recovery

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

The collections stage is the least automated stage in the customer life cycle. The operations are labor intensive and require skilled collectors. In this type of operational environment, technologies that improve strategy design as well as the efficiency and effectiveness of the collections personnel can add significant value.

Process Flow Diagram

One of Five Exhibits in this Report

"Becoming a leader in today's competitive credit card markets often requires superior performance at every stage of the account life cycle and the collections stage is no exception, " comments Evren Bayri, a Director in Mercator Advisory Group's Credit Advisory Service. "The use of analytic technologies at the collections stage can improve the effectiveness of collection and recovery efforts by adding more insight into the process."

This report looks at scoring vendors and their solutions. It provides an overview of the collections process, a discussion on collections as a source of competitive advantage, an overview of collections solutions, and a discussion on analytic solutions available from selected vendors including: Fair Isaac, Experian, Intelligent Results, Predictive Metrics and Trans Union.

The report contains 27 pages and 5 Exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world