Overview

Boston, MA

July 2004

Account Origination Vendor Review

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

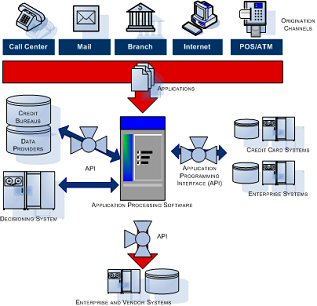

The increasingly intense competition in the US credit card market puts more pressure on the issuers to increase their efficiency and and effectiveness across the entire account lifecycle and origination process is no exception. Account origination is where the marketing efforts materialize and where critical lend / do not lend decisions are made. In order to stay ahead of the curve, credit card issuers need to make these decisions faster, more accurately and profitably, and do so in a cost effective manner. The latest generation of origination software products aim to accomplish this complex set of goals.

Evren Bayri, Director of Mercator Advisory Group's Credit Advisory Service comments, "Account Origination is an area where technology is widely used. Today's origination systems leverage advanced software, analytics, and modeling technologies to provide solutions to originations challenges such as processing bottlenecks and application fraud. These systems streamline operations, reduce costs, improve efficiency, and enable cross-selling and better customer service."

Account Origination Vendor Review provides an overview of the account origination process and typical origination system, and a discussion on the industry challenges regarding originations. It covers leading vendors including American Management Systems, Baker Hill, and Fair Isaac Corporation looking at important factors to consider when choosing a solution.

This report contains 17 pages and 6 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world