Overview

Alternate Payments: Disruptive Technology or Just an Online Ally for Traditional Payment Providers?

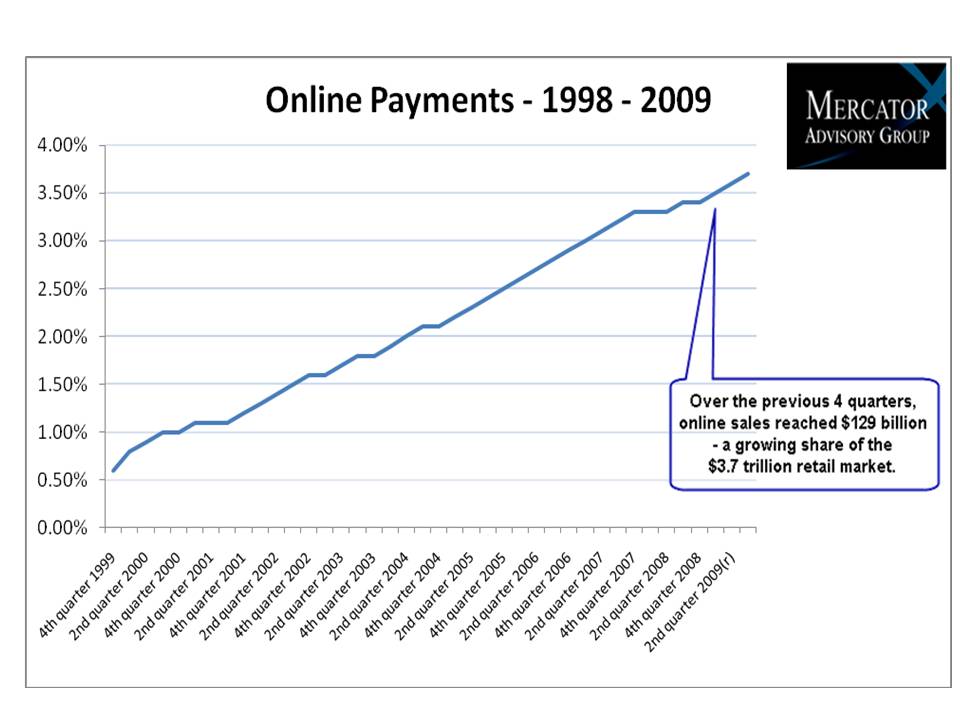

Boston, MA -- Jan. 06, 2010 -The growth of retail sales online - from just 0.60% of retail sales 10 years ago to nearly 4% of total retail sales today - has created new opportunities for payment providers to take some share of market from the incumbent players in the payments market.

In a new report, Alternate Payments: Disruptive Technology or Just an Online Ally for Traditional Payment Providers?, Mercator Advisory Group examines the key players in the rapidly growing market for alternative payments, their approach to the payments process and the outlook for their evolution. The report analyzes each product, including a nuts-and-bolts dissection of each, with details on the fee structures, product positioning and value proposition of each.

Consumers have numerous traditional payment options for making online purchases - generally credit and debit cards. But the growth of alternative online payment systems, including PayPal, Amazon Payments, Google Checkout and others - continues to take a growing share of the merchant acquiring side of the business.

There are two key drivers behind the growth of these emerging payment platforms:

The promise of lower costs for merchants - interchange is a significant expense for merchants, and lower-cost alternatives allow merchants to potentially increase margins;

"Portability" of online payments - a single user name and password allows customers to quickly and securely checkout. Users never have to share credit card information with a merchant when using these methods of payment.

"The incumbent credit card brands have a dominant role in both the online and offline payments arena," said George Peabody, Director of Mercator Advisory Group's Emerging Technologies Advisory Service and principal analyst on the report. "Alternative payment schemes still rely heavily on card-based payments. Until the knotty problem of lower cost funding sources gets solved, card-backed payments will predominate, despite the attractive value proposition alternative platforms provide to consumers and merchants alike."

Highlights of the report include:

Profiles of five key alternative payment schemes:

o PayPal

o Google Checkout

o Amazon Payments

o Revolution Money

o Mazooma

Alternative payment providers including PayPal, Google and Amazon are competing for consumer-driven usage of their online "wallet" approaches that largely front existing card-based payment mechanisms

PayPal is by far the leader among alternate payment providers in terms of consumer brand recognition, with awareness exceeding 90%. Bill Me Later - which is owned by PayPal - is the second-most recognized brand, but all of the others have awareness of less than 30%.

In order to be competitive, merchants are offering as many payment methods as they can to attract and retain customers.

"Captive" sales from eBay and Amazon were key to the growth and development of PayPal and Amazon Payments, while Google Checkout tapped Adwords sales for some of its early revenues.

The low-cost funding challenge still attracts small players hoping to breach what is a very high wall and survive within a specific niche.

One of 10 exhibits in this report:

This report contains 32 pages, 10 exhibits and 3 tables.

Companies and programs mentioned in this report include: PayPal, Visa, MasterCard, eBay, American Express, Revolution Money, Chase Paymentech, Google, Amazon, Apple, eBillMe, Mazooma.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: 781-419-1700 or send E-mail to info@mercatoradvisorygroup.com.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

2025 Emerging Payments Trends

In 2025, Payments will continue to feel the impact of three key trends that have been at work for the last decade and more. 2025 is the time when the nature of these impact will be...

What Mobile Wallets Are Doing to Defend Against Competitive Threats

OS-based mobile wallets, particularly Apple’s, maintain the dominant share of the market. But challengers are coming in various alternative payment forms (such as account-to-accoun...

Have You Been on a Digital-Only Magic Carpet Ride?

The digital-only payer—one who has left behind the physical wallet and its tangible payment forms—is a popular creature in the media, one who fronts declarations that all-digital p...

Make informed decisions in a digital financial world