Overview

Boston, MA - June 11, 2013 - Alternative currencies typically evolve when threats or economic problems occur and stabilization efforts are perceived as necessary. Few, however, have staying power. A review of various alternative currencies (operating either only in the U.S. or globally) suggests traditional payments industry players should monitor the initiatives' progress but not necessarily shift their strategic direction in response.

Mercator Advisory Group's new report, Alternative Currencies: Is There Staying Power?, identifies four types of virtual currencies with the potential to circumvent traditional payment methods or complement them:

- Open, online currencies, such as Bitcoin

- Closed, proprietary virtual currencies, often tied to online games

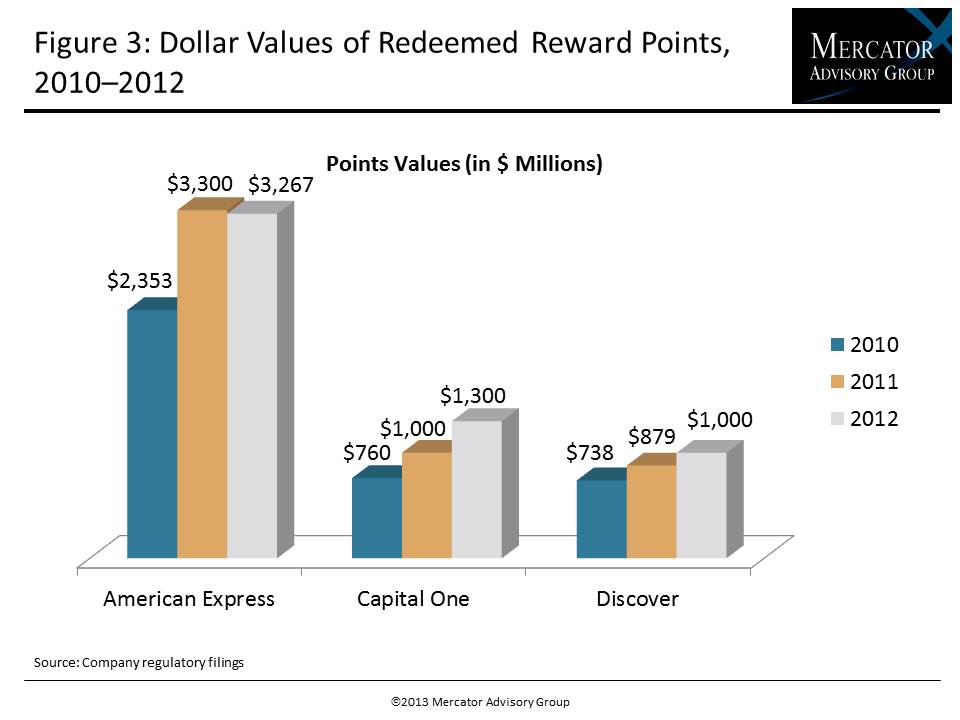

- Loyalty and reward points and miles tied to traditional payment cards

- Community-based paper currencies

One of the exhibits included in this report:

"Distrust of government-issued currencies, or competitive threats involving businesses, for years has prompted the occasional alternative currency to emerge, but few have had much staying power," says Jeffrey Green, director of Mercator Advisory Group's Emerging Technologies Advisory Service and author of the report. "Fears tend to subside once the situation stabilizes and conditions improve. But alternative currencies that complement and reward traditional payment card use have found a niche that will keep them prospering for years to come."

Highlights of the report include:

- An overview of Bitcoin and its potential to disrupt the global online marketplace

- A look at Amazon's new Coins virtual currency and whether it fits with market trends

- An analysis of the potential threat or opportunity of examined alternative currencies for traditional card issuers and networks

This report is 24 pages along with five exhibits

Companies mentioned in the report include: Amazon, American Airlines, American Express, Andreessen Horwitz, BerkShares Inc., Bitcoin 7, Bitcoin Foundation, Bitfloor, Bitmarket.eu, BitPay, Bitomat, Btcex.com, Btetree, Capital One, Carlson Companies, CNBC, Coinbase, CoinLab, Coinsetter, Delta, Discover, Dwolla, eBay, Expensify, Facebook, frequentflier.com, Gyft, JPMorgan Chase & Co., Microsoft, mileblaster.com, MoneyGram, Mt. Gox, Mutum Sigillum, OpenCoin, PayPal, PPCoin, Points.com, Redditt, Ripple, Robocoin, Royal Canadian Mint, Ruxum, Silk Road, Skype, Target, TradeHill, traxo.com, Twitter, Union Square Ventures, Vircurex, Webflyer.com, Wells Fargo, Western Union, WordPress, and World Bitcoin Exchange.

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world