Overview

Financial institutions first started deploying mobile card controls in 2012. Since then, a couple hundred or so of financial institutions have rolled out the service to their cardholders. Success has so far gone unrecognized, partly because the early adopters have been relatively small community banks and credit unions. The future for this technology is promising though, as it can ride the waves of two of the strongest trends in banking; self-service technology and improved account security. Recent data breaches have also served as a catalyst for adoption, raising consumers’ awareness of the need for improved payment card security.

The company’s research note, Are Mobile Controls the Next Essential Product Feature for Credit Card Accounts? reviews emerging vendor solutions and explains the business opportunity for implementation.

“Implementations of card controls have so far been concentrated among debit portfolios, and a simple On/Off authorization switch has been the most utilized feature,” comments Michael Misasi, Senior Analyst, Credit Advisory Service at Mercator Advisory Group and the primary author of the research note. “There is potentially a very significant opportunity for credit issuers to use a more comprehensive feature set to capture spend from other payment types and decrease some customer service and fraud resolution expenses.”

This note contains 13 pages and 8 figures.

Companies mentioned in this report include: Co-Op Financial Services, Diebold, First Performance, Malauzai Software, Ondot Systems, PSCU, Vantiv, and World Pass Key

Members of Mercator Advisory Group’s Credit Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

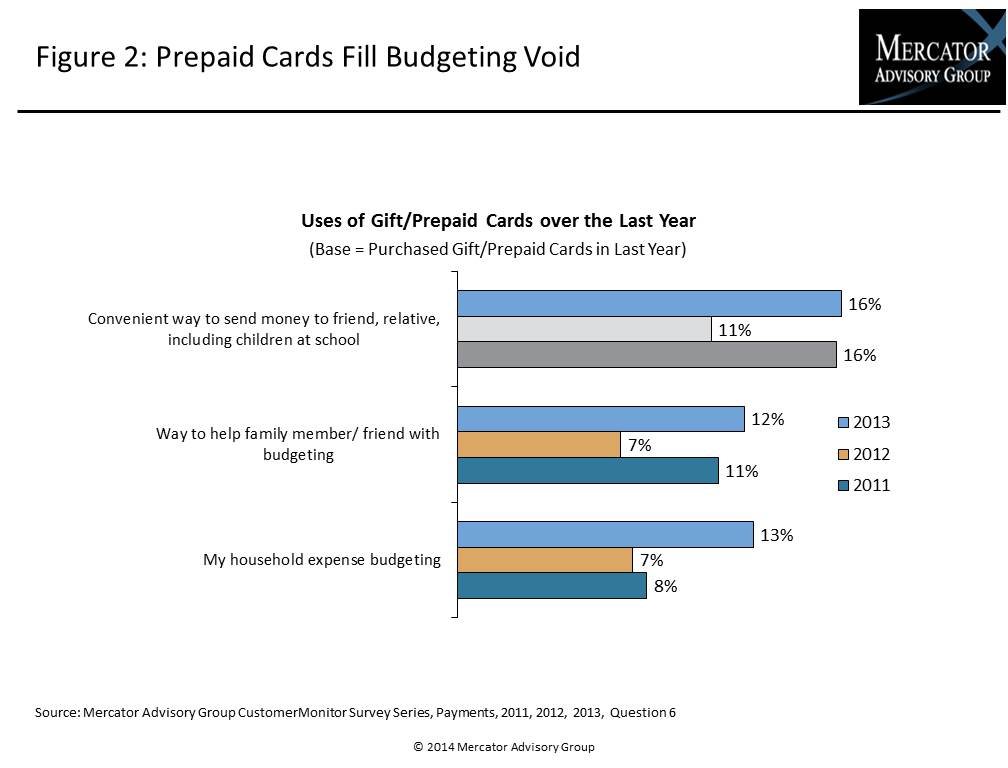

One of the exhibits included in this report:

Highlights of the note include:

- An overview of card control functionality

- Data from Mercator Advisory Group’s 2014 CustomerMonitor Survey Series showing consumer interest in payment card controls

- Analysis of key uses cases for credit card portfolios such as reducing customer service contacts, preventing fraud, and capturing more spending

- A review of 4 important solution providers

- Mercator Advisory Group’s outlook for mobile credit card controls, including possible implementation challenges

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world