Asset-Backed Securities: A Primer for Credit Card Managers

- Date:February 25, 2019

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

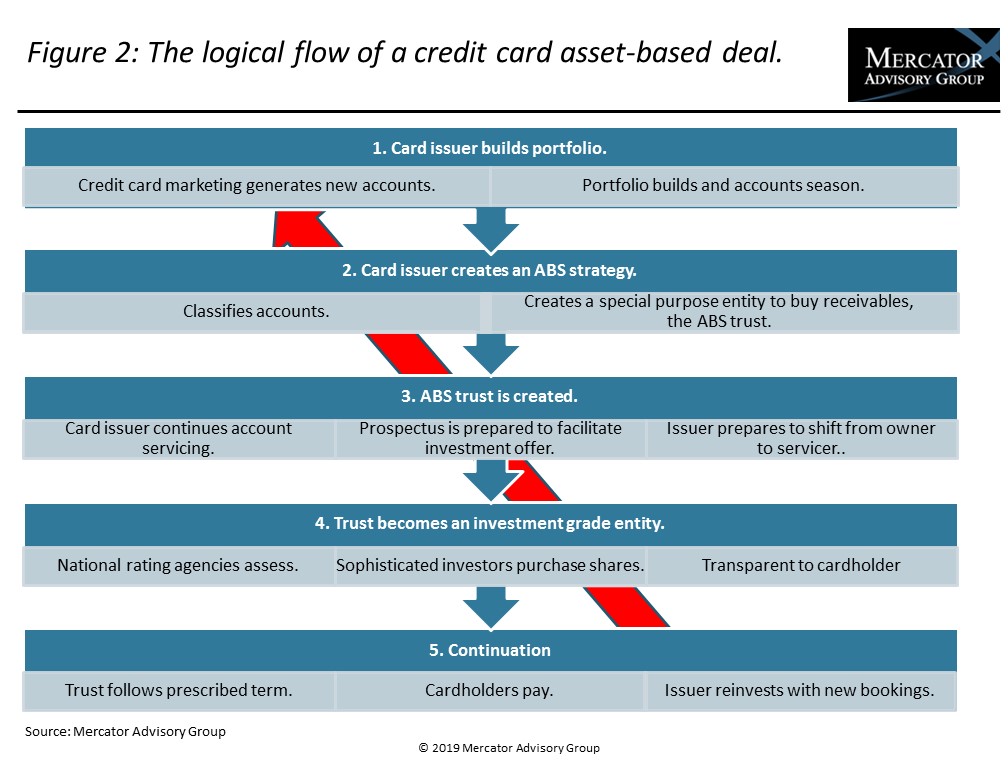

Readers will learn about the logical and legal flows of credit card asset-backed securities (ABS), an important financing tool used by many top issuers. Asset-backed securitization enables lenders to originate credit card accounts, season their portfolios, and then sell the receivables to bank-owned trusts that enable investors to buy future revenue streams. Credit card issuers can generate servicing fees and then use the funds to reinvest in new accounts. One top-tier bank has 50 percent of its portfolio securitized, which is a key component of its growth strategy.

“The report presents a case study of the asset-backed securitization of a credit card portfolio of a major global bank to illustrate the level of analytics covered in an ABS prospectus. One important facet that is apparent is the importance of the FICO® Score and the way it is used throughout the credit cycle from origination to credit cycle management and ultimately through securitization,” notes the author of the report, Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group. He adds: “Dodd-Frank brought discipline to the ABS process, and issuers have a requirement to effectively manage their portfolios, particularly as they place blocks of accounts into the capital markets.”

This document contains 29 pages and 17 exhibits.

Companies and other organizations mentioned in this research report include: Alliance Data Services, A.M. Best, American Express, Bank of America, Barclays Bank of Delaware, Barclays Capital, Capital One, Chase, Citi, DBRS, Discover, FICO, Fitch, KBRA, Mastercard, Moody’s, Morningstar, Scotiabank, Securities and Exchange Commission, Sperry Corporation, Standard & Poor’s, Synchrony, TD Securities, US Bank, and Wells Fargo Securities.

One of the exhibits included in this report:

- Asset-backed securitization volumes by issuing bank since the Great Recession

- Forecasted market projections through 2023

- A view of asset-backed security pricing strategies

- An explanation of how funds disperse based on revenue streams|

- A review of the credit rating process

- How credit managers play an important role in the success of ABS

- A case study drawn from a major global bank that illustrates the seven key elements of an ABS prospectus

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world