Overview

Authentication at the Edge

NFC, Smartphones, and a New Model for Payments Confidence

Boston, MA -- With NFC on the near-term horizon, the number of smartphones in the U.S. with this new security capability will number in the tens of millions within a year. This flood of highly capable devices will provide new security and fraud mitigation possibilities for payment accountholders, financial institutions, merchants, government, and other enterprises.

Growing in popularity with consumers, these devices offer the critical convenience features necessary for consumers to participate in security steps such as PIN entry to specific apps, fingerprint reading, etc.

Mercator Advisory Group's new report Authentication At the Edge: NFC, Smartphones, and a New Model for Payments Confidence examines the potential of the smartphone in security applications as it evolves to include hardware-based security via NFC, NFC's Secure Element card number storage, as well as potential biometric applications.

Findings of this report include:

Projections for the installed base of NFC-equipped smartphones in the North American Market by Q1/2012.

Context-specific, layered identity authentication provides a solid approach that does not break existing relationships among transaction participants.

As e-commerce merchandising and payment methodologies move into the physical point of sale environment, these clicks-at-bricks transactions will require strong payment credential authentication.

The availability of NFC facilities improves authentication services for m-banking, e-commerce, m-commerce, and POS payments.

Biometrics managed at the edge of the network by the device owner offer new layers for authentication surety without imposing the challenge of biometrics management on participants.

"Authentication is the heart of payments and online security. Smartphones with hardware-based security capability, especially via NFC and fingerprint readers, will give consumers, enterprise users, and the government unprecedented control over their payment and security interactions," stated George Peabody, Director of Mercator Advisory Group's Emerging Technologies Advisory Service. "The payments network has done an excellent job with network-based intelligence, but it is time to put intelligence into the devices accessing those networks from the very edge. Smartphones with hardware security features bring contextually appropriate authentication power to the problem of risk-based assessments.

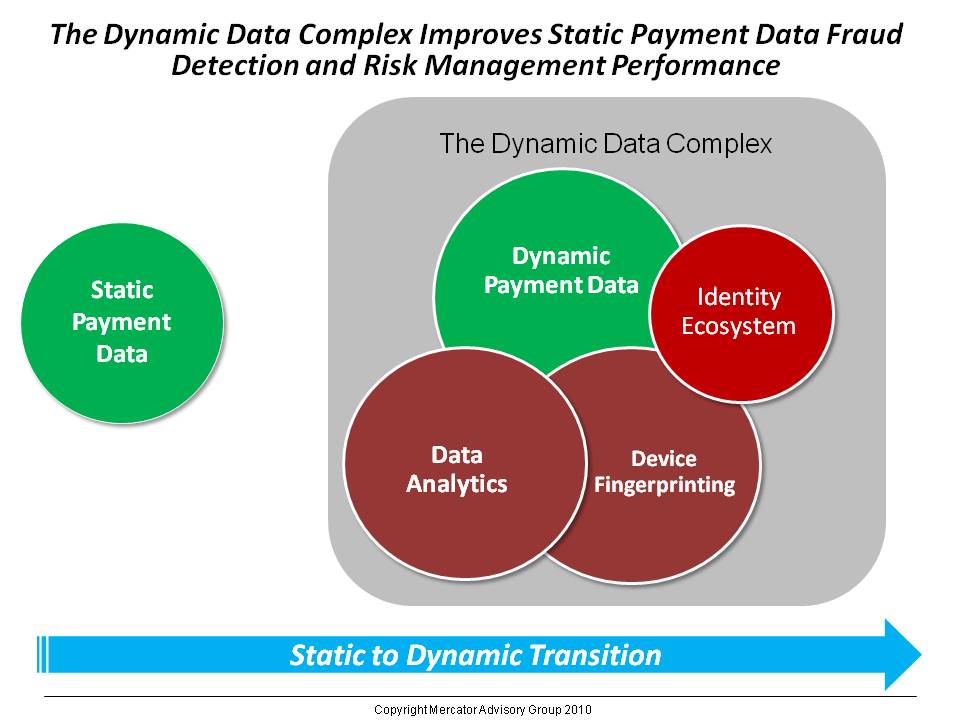

One of seven exhibits in this report:

This report is 29 pages long, with seven exhibits and three tables.

Companies mentioned in this report include: Broadcom, Apple, Isis, AT&T, Verizon Wireless, T-Mobile, Discover, Barclaycard, Gemalto, Giesecke & Devrient, AisleBuyer, Facebook, Amazon, Google, SK Telecom, First Data, CASSIS International, TSYS, Visa, MasterCard, Discover, Microsoft, Prime Sense, Omnicom, Barbarian Group, Cheil Worldwide), and Razorfish, Publicis, ID-U Biometrics, Disney, Blue Planet Apps, Bank of America, and INSIDE Secur.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world