Overview

Decelerating growth curves, emerging regulatory guidance, and intensifying concerns from investors are fueling doubts about the long-term potential of marketplace lending—an industry that some market observers have estimated to be worth $1 trillion globally by 2025.

Mercator Advisory Group's research note, Bad News Comes In Threes: Assessing the Future of Marketplace Lending, delves into the myriad of negative developments that have converged recently around the largest U.S. marketplace lenders— OnDeck Capital, Lending Club, and Prosper Marketplace—and provides an outlook on how those developments may reshape the marketplace lending industry (and its intersection with traditional consumer and small business lending) over the next 12 to 18 months.

“Venture capitalists’ expectations for the marketplace lending industry have long outstripped the performance of even the most successful marketplace lenders,” comments Alex Johnson, Director of Mercator Advisory Group’s Credit Advisory Service and author of the note. “The recent struggles of OnDeck, Lending Club, and Prosper, while painful, represent a healthy course correction for an important area of financial technology innovation.”

This note contains 14 pages and 3 exhibits.

Companies mentioned in this note include: Avant, DriverUp, JPMorgan Chase, Lending Club, OnDeck Capital, Prosper Marketplace (Prosper), Radius Bank, Social Finance (SoFi), WebBank, and Wells Fargo

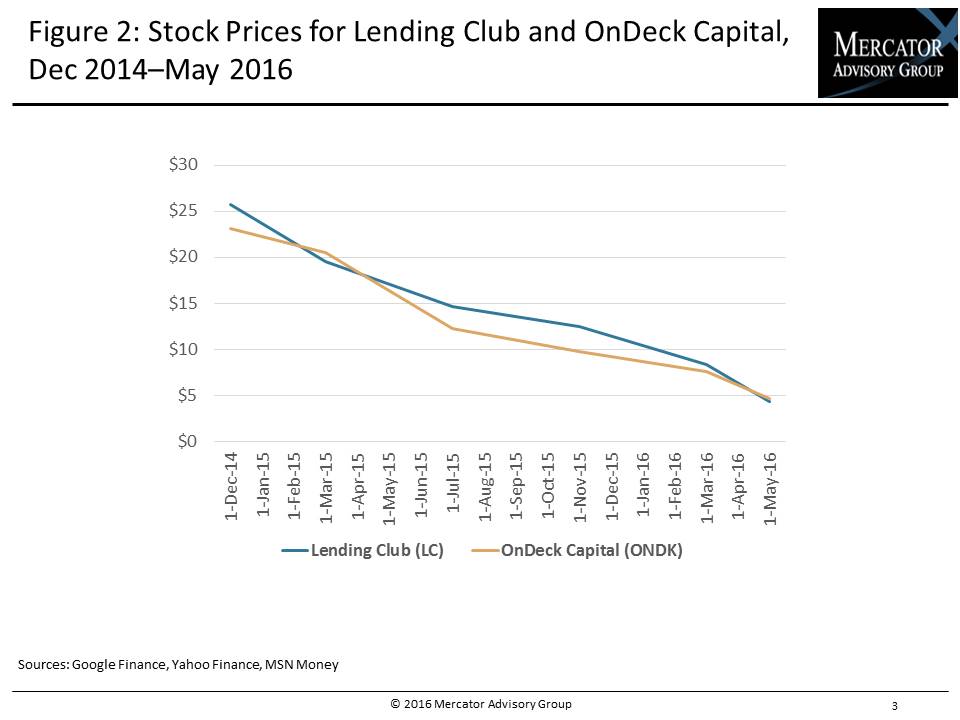

One of the exhibits included in this report:

Highlights of the research note include:

- An overview of the valuations and market expectations, from both venture capitalists and public stockholders, for leading marketplace lenders

- A review of the performance of OnDeck capital, Lending Club, and Prosper Marketplace over the past 18 months

- Commentary on the evolving sentiments of retail and institutional investors in online marketplace loans

- A summary of recently released regulatory guidance on the marketplace lending industry, at both a federal and state level

- A list of strategic questions about the future of the marketplace lending industry

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world