Overview

Boston, MA – August 2, 2012 – In new research, Banking Profitability Drivers, Mercator Advisory Group reviews how retail financial institutions (FIs) are driven to improve their efficiency, productivity, and overall financial performance, and are poised to make their organizations stronger and more profitable.

“After a half-decade of macroeconomic and microeconomic malaise, the financial performance of banks and other financial institutions (FIs) is largely improving and is poised for further improvements. For many of these FIs, however, customer profitability remains tepid, particularly when compared to pre-financial-crisis levels,” comments Ed O’Brien, director of Mercator Advisory Group’s Banking Channels Advisory Service and author of the report.

Organizations mentioned in this report include: Bank Industry Architecture Network (BIAN), FIS, Fiserv, Harte-Hanks Trillium, IBM, Jack Henry & Associates, JPMorgan Chase, SAP, SAS, U.S. Small Business Administration, and Temenos.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

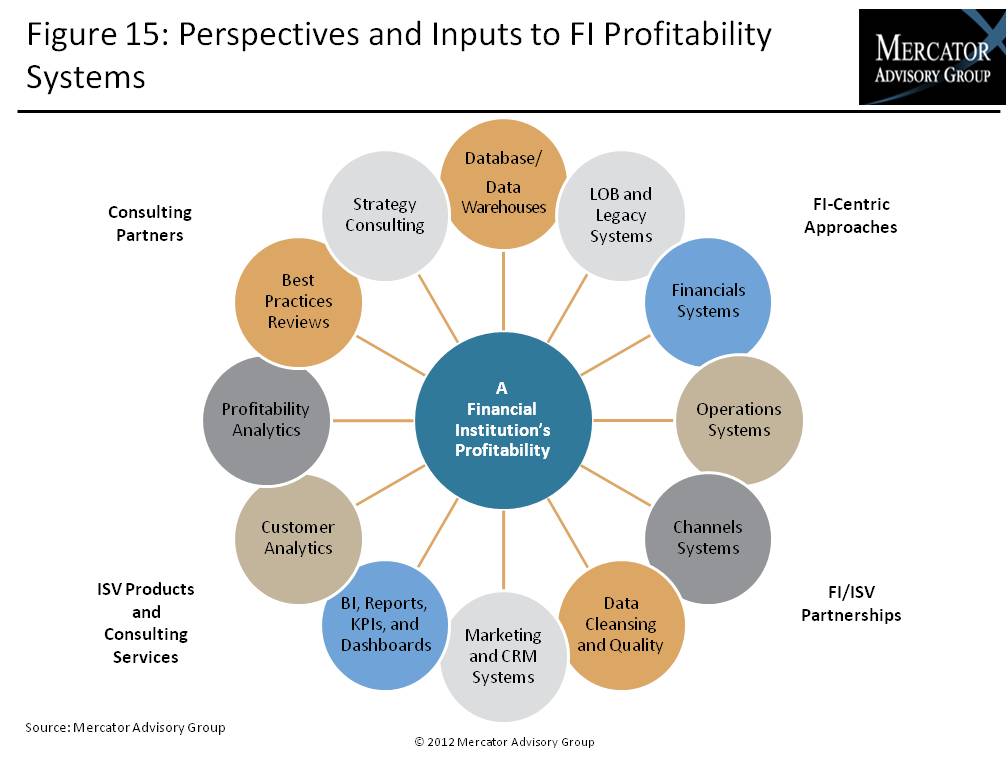

One of the exhibits included in this report:

Highlights of this report include:

- Discussion of the need for financial institutions to improve their performance in the wake of the Durbin Amendment to compensate for reduction in revenues formerly provided by fees

- Evidence that customers value strong, well-managed institutions with sufficient resources to deliver superior products and services

- Description of different approaches, including the use of software products and consulting services to help FIs improve profitability

- Review of leading tools and techniques that provide comprehensive and relevant views into profitability potential at the customer, household, and branch levels

Learn More About This Report & Javelin

Make informed decisions in a digital financial world