Overview

Boston, MA

July 2008

Banks, Cognitive Dissonance and Underserved Consumers

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This newest report from Mercator Advisory Group's Retail Banking Practice explores the perils facing banks as they present: clashing marketing messages; confounding product pricing policies; and, innovative adverse credit offerings to the unbanked, underbanked, and even to their best and most profitable customers.

Banks profess their commitment to serving the unbanked and underserved populations but consistently undermine their own initiatives. In contrast to the successes chronicled in their CRA filings, too often banks' marketing to the underserved involve unwelcoming branches, slow deposited check clearing times and punitively expensive products. However, and fortunately for these consumers, underserved consumers have managed just fine, thank you.

And the populations, underserved by banks may be far more numerous than traditionally counted. In addition to immigrants, benefits recipients and blue-collar workers, banking's most profitable customers also find themselves shopping among nontraditional financial services providers looking for the most convenient technologies and the most rationally priced products and services.

Indeed, we posit that if nontraditional financial services providers have poured billions of dollars into growing and deepening their relationships with the 40 million underserved, it is only a matter of time until they tweak their products and marketing messages to disinter-mediate bankings most affluent and profitable customers.

While banks are eager to build relationships with the unbanked and profit from their ATM withdrawals, wire transfers and POS transactions, those efforts are undermined by the industry's need to maximize fee income from the populations least able to support it. For instance, while a bank may promote its inexpensive wire transfers and offer credit cards to customers without social security numbers, it will also try to maximize overdraft revenue gleaned from those customers. The populations banks are trying to woo are the very groups that would be hardest hit by those accruing fees and overdraft events.

- The typical debit card transaction incurring a $34 overdraft fee is a $20 purchase.

- More consumers are enrolled in the most expensive overdraft option, and low and to moderate income consumers pay the bulk of charges.

- Sixteen percent of overdraft loan users account for 71% of fee-based overdraft loan fees.

- Repeat overdrafters are most often low-income, single, non-white renters.

Branches closing at 5:00 p.m., slow check clearing times and icy platform personnel reinforce the underserved resistance to the marketing messages of banks. So while banks want to bring these groups into their branches, fee minimizing underserved but banked workers are using direct deposit to payroll cards to avoid bank branches NSFs and overdrafts.

Among marketers there is a growing sense that opportunistic users of financial services overlap that unbanked/underbanked and the banking industry's traditional customer base. That is, those who have a bank account may also be interested in using a wide-range of nontraditional financial services, like prepaid cards and ecommerce payment channels. These consumers move fluidly from bank lobbies to convenience store financial services kiosks to buying antiques on eBay and settling that transaction through their PayPal accounts. They may be banked, but their loyalty is to themselves - to their own schedules, to cheaper products and faster service.

They are a marketing challenge to traditional and nontraditional service providers alike because they require each player, product and service to stand on its own merit. They don't need brands - they require excellence. Among those nimble and affluent bank customers, many have a credit card through American Express and a four year auto loan through GMAC. They read blogs, newspapers and MSNBC so they know how rough the economy is, how many homeowners are losing their homes to foreclosure and at a personal level, they know that if their bank accounts are hacked, they will lose days and days talking to customer service reps in Manila and Mumbai trying to get their accounts made whole.

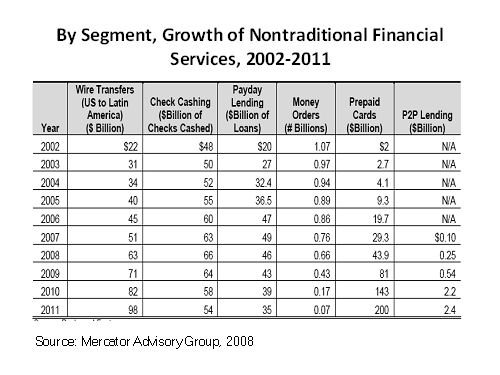

One of the 6 Exhibits included in this report.

Report Highlights:

- The market for nontraditional financial services is populated by 84 million consumers who collectively earn $1.1 trillion a year.

- We estimate that these consumers spend $12.6 billion on 1.2 billion alternative financial transactions and products each year, including check cashing, money orders, remittances, prepaid cards and bill payments.

- Nontraditional financial services providers, having spent billions of dollars growing and deepening their relationships with the 40 million underserved, will tweak their products and marketing messages to disinter-mediate banking's most affluent and profitable customers.

- Consumer credit offerings delivering superior experiences (like FirstAgain and Bill Me Later) are well positioned to snare zero-risk credit buyers who would otherwise have borrowed from their banks. Bankers must be alert not only these new competitors offering consumer credit, but also to the changing consumer expectation base-lines those firms create.

- Disintermediation is afoot, but the banking industry may yet recover if it embraces new technology partners, new marketing and pricing strategies and experiments with its risk models, delivery channels and new retail partners.

Elizabeth Rowe, Group Director of Mercator Advisory Group's Banking Advisory Services and author of this report, comments, "The subprime mortgage debacle, which quickly morphed into a national homeowner's crisis, has also led to widespread disillusionment with the financial services industry. Even as American consumers have scrambled to keep ahead of plummeting real estate values and soaring energy, food and health care costs, the Government Accounting Office found that in 2007, banks charged their retail customers $36 billion in fees.

While bankers had hoped for a stampede of unbanked into their branches, what they've actually witnessed has been a stampede out of those branches that is being led by their most desirable customers.

However, there are kilowatt-lit bright spots for banking industry. Bank customers may be dissatisfied with the bank branches, tellers and customer service representatives, but they are both energized and enthusiastic about mobile banking and their online banking experiences. The challenge for banks to benchmark and implement best practices both in the U.S. and abroad.

Even as bankers assess new products and go-to-market strategies, they find the emotional and transactional disintermediation of their most profitable customers a continuing and daunting challenge. As banks consider retooling their check-clearing and overdraft policies, the pricing of their products and mandate bank-wide standards of respectful customer service to compete against the self-sufficiency of the unbanked and underbanked, they must carefully craft products and strategies meaningful to fully-banked, wounded and wary American consumers. And yes, even as all these challenges are on their plates, bankers must monitor best-in-breed nonbank financial players targeting their best and most profitable customers."

The report is 25 pages long and contains 6 exhibits

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Make informed decisions in a digital financial world