Overview

During the last several years, there has been a steady exodus of electronic bill-payment (bill-pay) transactions from financial institutions in favor of paying the billers directly through digital channels. Mercator Advisory Group’s latest research report, Bill Pay: Fast and Simple Wins, discusses why and how banks and credit unions could staunch this outflow.

Most financial institutions do not charge fees for electronic bill payment despite the expense of maintaining a bill-pay system. That is because consumers expect the service to be included in their monthly checking account fee or in the balances they need to carry. But bill pay is a product that keeps consumers coming back to the financial institutions’ web and mobile sites, which leads to frequent interactions and opportunities for a bank or credit union to communicate information to its customers or members and offer financial advice.

Mercator Advisory Group’s new report provides an understanding of current U.S. bill-pay market, characteristics of bill-pay customers, and tactics being deployed by financial institutions that are interested in keeping and attracting bill-pay transactions in order to retain this critical consumer interaction.

“Billers have done a great job of making paying bills through digital channels as frictionless an activity as possible. Financial institutions need to determine if this trend matters. Bill pay doesn’t have much to offer FIs in terms of revenue, so assessing its value is difficult, but it is a very sticky product,” comments Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group, and author of the report.

This report has 13 pages and 5 exhibits.

Companies mentioned in this report include: Fiserv, PayGo, PayPal, Square Cash, and TIO.

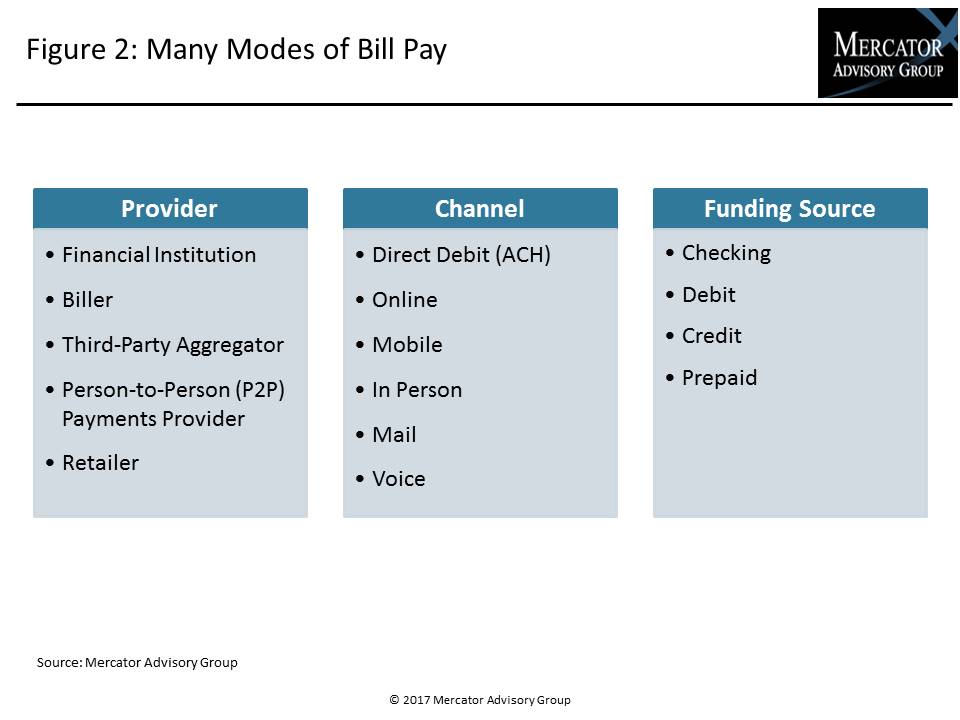

One of the exhibits included in this report:

Highlights of the report include:

- Overview of the current bill-pay market

- Bill pay’s role in banking relationships

- Mercator Advisory Group proprietary survey data showing U.S. consumers’ bill-pay channel preferences

- Growth of online and mobile channels for bill pay

- Tactics that financial institutions are deploying to retain bill pay customers

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world