Overview

Passwords are now totally unreliable. They were vulnerable before Yahoo lost 1 billion passwords to criminals but can’t be trusted today unless additional identification methods are incorporated. As identified in the companion report

- Evaluates four key issues that will most impact the adoption of biometrics: Consumer Attitudes, Availability, Practicality, and Application Support.

- Using the output of the evaluations of the four issues above, forecasts to 2025 the penetration of the U.S. market by mobile devices that have the hardware required to support biometrics, the market availability of persistent biometrics, and the percentage of the U.S. population that will utilize biometrics for authentication.

- Predicts when the availability of persistent identity utilizing behavioral biometrics will transition the industry away from hardware to a software- and cloud-based solution.

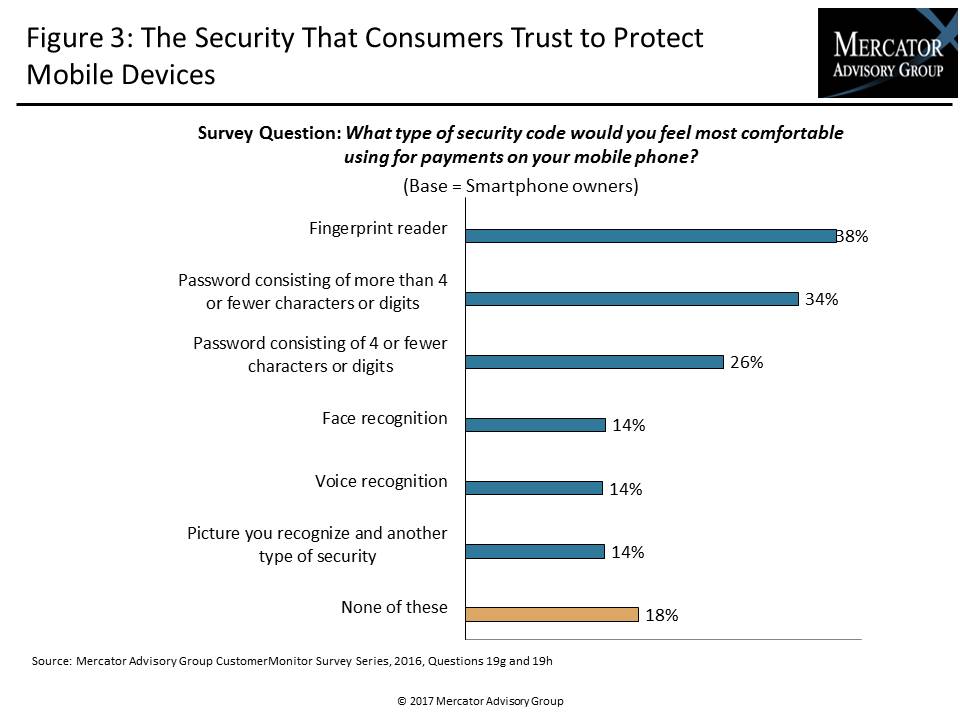

- Utilizes data from Mercator Advisory Group’s CustomerMonitor Survey Series (CMSS) research of 3,000 U.S. adults as the 2016 starting point for U.S. adoption of biometrics on mobile devices.

- Cites Mercator CustomerMonitor Survey Series (CMSS) research used here to quantify the current lack of consumer trust in biometrics.

- Presents evidence of several years of Mercator CustomerMonitor Survey Series (CMSS) research data on mobile banking, where consumers had equal concerns regarding safety and efficacy, to establish a consumer adoption model for biometrics.

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world