Overview

“At first glance, prepaid and debit appear so similar that one could conclude that the payments industry took two separate paths to end up with the same product. Initially prepaid product providers were developing solutions to offer users a bankcard-like product. Now financial institutions are seeing inspiration in GPR card attributes, comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and co-author of the report.

This research report has 16 pages and 8 exhibits.

Companies mentioned in this report include: Ace Cash Express, American Express, Bancorp Bank, Bank of America, Chase Bank, Citi Bank, Green Dot, InComm, Mastercard, Meta Bank, Netspend, PayPal, Square, U.S. Bank, Visa, Walmart, and Wells Fargo.

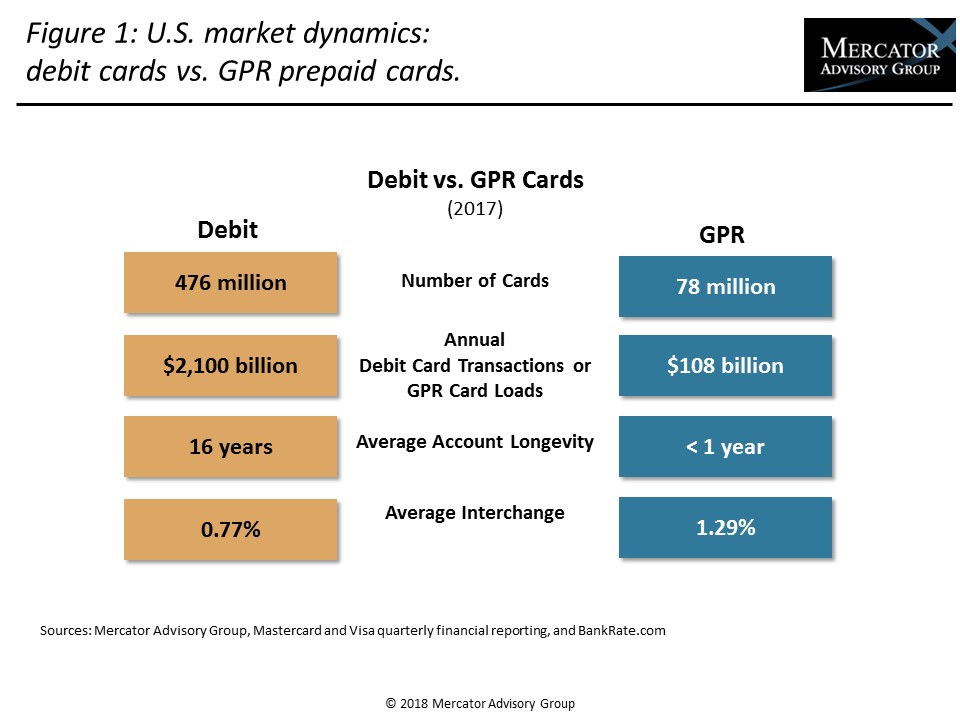

One of the exhibits included in this report:

- A comparison of some of the regulatory differences between debit and GPR cards.

- Market sizing for prepaid and debit, including a look at the decline in the unbanked population in the U.S.

- Review of the features and functionality of leading GPR cards and entry level checking accounts from five U.S. banks.

- The role that GPR cards have and continue to play in banking and payments innovation.

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world