Business Credit Cards and B2B Payments: More Credit, Please

- Date:November 13, 2017

- Author(s):

- Karen Augustine

- Research Topic(s):

- Small Business PaymentsInsights

- PAID CONTENT

Overview

In spring 2017, Mercator Advisory Group fielded a web-based survey of U.S. small businesses (between $500 thousand and $5 million annual sales) regarding payment acceptance, B2B payments and use of banking services and alternative lenders. Business Credit Cards and B2B Payments: More Credit, Please is the second of three reports summarizing the results of the 2017 Small Business Payments and Banking Survey.

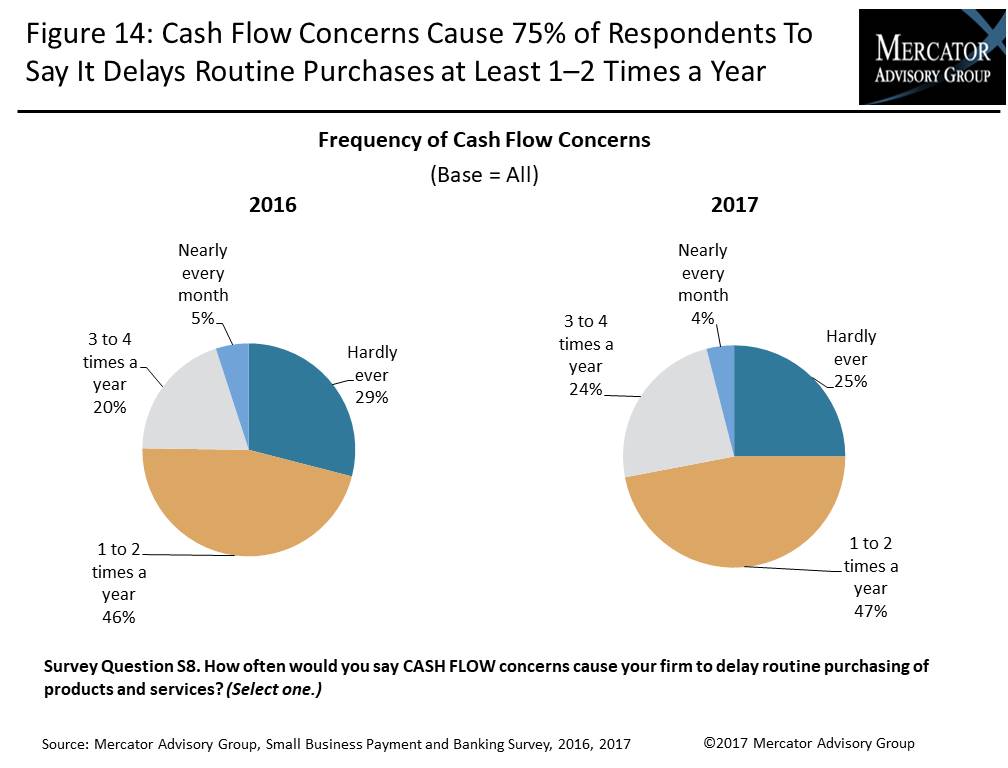

The survey finds that cash flow issues are an overriding concern for most small businesses in the United States. In fact, 3 in 4 small businesses have had to delay routine purchases at least once or twice a year because of cash flow management issues. This concern causes small businesses to use credit lines wherever they can, seeking more generous credit lines from business credit cards and loans from banks, nonbanks, and alternative lenders.

Nearly all of the respondents to the survey have some type of business account with a financial institution, including 8 in 10 who have a business credit or charge card. Less than half of them claim to pay their balance in full every month. Small businesses are less likely than consumers to pay their credit card bill in full every month.

Small businesses are hungry for credit and often supplement their business credit lines by using personal cards or funds. It’s not always easy for small businesses to obtain the credit they need, when they need it, particularly newer companies that seek business credit lines of less than $100,000. This is due to traditional banks’ often restrictive lending policies.

Nevertheless, small businesses are overwhelmingly optimistic about their growth and profitability over the next year. More than 4 in 5 small businesses surveyed in 2017 expect their firms’ sales and profitability to increase over the next year. The 28 million U.S. small businesses have been a growth engine for the U.S. economy over the past decade, and Mercator Advisory Group’s survey results suggest that this growth will continue.

“Managing cash flow is a top concern for small businesses. Access to credit by borrowing on business credit cards and being able to obtain business loans to supplement existing credit lines are essential to keep the businesses afloat and invest in new products and services to keep them growing and profitable,” notes Karen Augustine, Mercator Advisory Group’s Senior Manager of Primary Data Services, the author of this report.

In total, over 1,600 qualified responses were obtained from decision makers at revenue-qualified small businesses in the United States that accept credit and/or debit cards for payment. The sample included a geographically dispersed quota of 450 responses from businesses with annual sales of $2–5 million and the remainder from businesses with annual sales of $500,000–$1.99 million.

This report contains 41 pages and 21 exhibits.

Companies mentioned include: American Express, Mastercard, and PayPal.

One of the exhibits included in this report:

Highlights of this Insight Summary Report include:

- Most common methods of payment used for business-to-business (B2B) payments

- Number of employees in a firm that have a business credit or charge card

- Network brand of business credit or charge card used

- Most important features for business credit cards

- Business credit card payment behavior

- Use of credit lines on business credit cards

- Reasons for using personal credit or charge cards for B2B payments

- Frequency of purchase delays resulting from cash flow concerns

- Experience with online alternative marketplace lenders and reasons for using them

- Outlook on borrowing, revenues, profitability and employment growth

Learn More About This Report & Javelin

Related content

2024 Small Business PaymentsInsights: U.S.: Small Business Technology Attitudes

How a small business approaches its business and technology initiatives will set the tone for the types of vendors and solutions it must incorporate into its broader strategy. Smal...

2024 Small Business PaymentsInsights: U.S.: Exhibit

Small businesses make up the largest segment of businesses in the U.S. economy. Understanding the types of payments these businesses accept and the vendors that enable these servic...

2024 Small Business PaymentsInsights: U.S.: Payment Acceptance Services & Card Payment Processing

Small businesses make up the largest segment of businesses in the U.S. economy. Understanding the types of payments these businesses accept and the vendors that enable these servic...

Make informed decisions in a digital financial world