Overview

As they review their own operations, much of which revolves around a commoditized merchant-acquiring market, the transaction incumbents - merchant processors, card networks and issuers - should take note of such companies as they consider ways to diversify to generate revenue (either through building their own competing products or by partnering with or acquiring existing firms to gain a piece of the action).

Mercator Advisory Group's new report, Business at the Periphery: Opportunities Around the Transaction, identifies various markets where before, during and after the transaction companies finding ways to make money from payments without actually are becoming involved in transaction settlement.

"The 'payments business' has evolved well beyond just simple commerce," says Jeffrey Green, director of Mercator Advisory Group's Emerging Technologies Advisory Service and author of the report. "Entrepreneurs have identified a plethora of niche areas around the transaction to earn a living, primarily through products and serves that enhance the experience merchants and shoppers have when they interact."

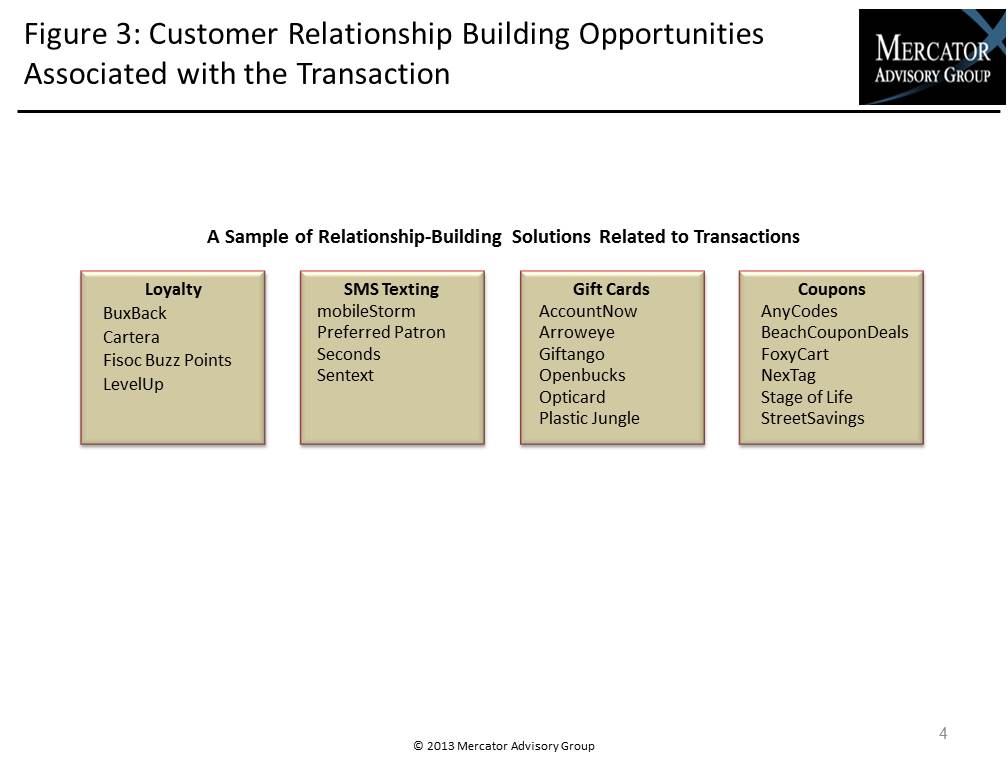

One of the exhibits included in this report:

Highlights of the report include:

- An overview of business categories not directly involved in the payment settlement but whose livelihood is dependent on the payment experience

- A sampling of specific companies operating in those business categories

- An analysis on whether these companies or business areas pose a threat, or an opportunity, for core players in the transaction-settlement process

This report is 20 pages long with five exhibits.

Companies mentioned in the report include: 1Password, 2nd Source Funding, 403Labs, Accertify, Access Rewards, AccountNow, Adyen, Aeris Secure, Alaska Air Group, American Airlines, American Express Co., American Microloan, AmeriMerchant, AnyCodes.com, Arroweye, BC Funding, BeachCouponDeals, Braintree Payment Solutions, Buck, Capital One Financial, Cardfree, Cartera Commerce, Cash Back, CEO Global Enterprises, Chargeback Guardian, Chase Paymentech Solutions, Citigroup, Clear2Pay, ClickFox, Clk Clk, Coalfire, CoffeeTable, comScore, ControlScan, Coretex MCP, CrowdTilt, Dashlane, Delta Air Lines, Deutsche Bank, Elavon, eScrip, Euclid, Euronet, FatWallet, Fexco, First Data, First Trade Union Bank, Fiserv, Fisoc Buzz Points, FiveStars Merchant Toolkit, Foursquare, FoxyCart, Frontier Airlines, Giftango, Global Payments, Google Catalogs, GroupM, Groupon, Heartland Payment Systems, Hukkster, IDology, iDine, IDology, inStream, Intuit, InvoiceASAP, Invoices Made Easy, Janrain, Kantar Shopcom, LastPass, LevelUp, LinkConnector, LivingSocial, Loylogic, MasterCard, mCatalog, MerchantPost, MerchantWarehouse.com, mobileStorm, Monex, Mozido, MPO International, Mr. Rebates, Network Merchants, Neustar, NexTag, OneID, OneLogin, OnTrack Software, Openbucks, Opticard, Oracle, Parago, PayLeap, PayPal, PerksPoints, Placecast, Planet Group, Planet Payment, Plastic Jungle, Plastiq, PointShop, Preferred Patron, PriceGrabber, Privy, PunchTab, RealWinWin, RewardsNOW, RoboForm, Rocketgate, Saepio MarketPort, Salt Technology, SAP, SAS, ScanMyID.net, Seconds, SecureKey Technologies, SecurityMetrics, Sentext, Shopping.com, Shopzilla, Sionic, SmartReceipt, Soldsie, Source Technologies, Sparkfly, Spently, SplashID, Stage of Life, Storeplacer, StreetSavings, Stripe, Sweetgreen, Swift Exchange, Switchfly, Synapse Group, Thanks Again LLC, TheFind, TrialPay, TSYS Accounting, US Airways, USAepay, Veratad Technologies, Visa, W.A. Fisher, World Pay, Wrapp, YCD Multimedia, Young America, Your Chargeback Support, Your Choice Rebates

Members of Mercator Advisory Group's Emerging Technology Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Learn More About This Report & Javelin

Related content

‘Disappearing’ Accounts and the Future of Payments

The legacy view of accounts—rigid holdings and lines of credit in financial silos—is yielding to the reality of open banking and interoperability, by which the walls around those a...

Generative AI Isn’t Happening Like We’ve Been Told

Although the AI future isn’t coming as quickly as we were told, it will arrive. Bringing that future to life will require new plumbing (read: technological standards and infrastruc...

Fintech Investing: 3 Trends to Watch in 2025

Venture capital investment in fintech is being gobbled up by AI startups, but the implications for players in the payments space is much more expansive. In the year ahead, look for...

Make informed decisions in a digital financial world