Buy Now, Pay Later: Gaining Scale and the Disrupting Status Quo in Lending

- Date:May 07, 2021

- Author(s):

- Brian Riley

- PAID CONTENT

Overview

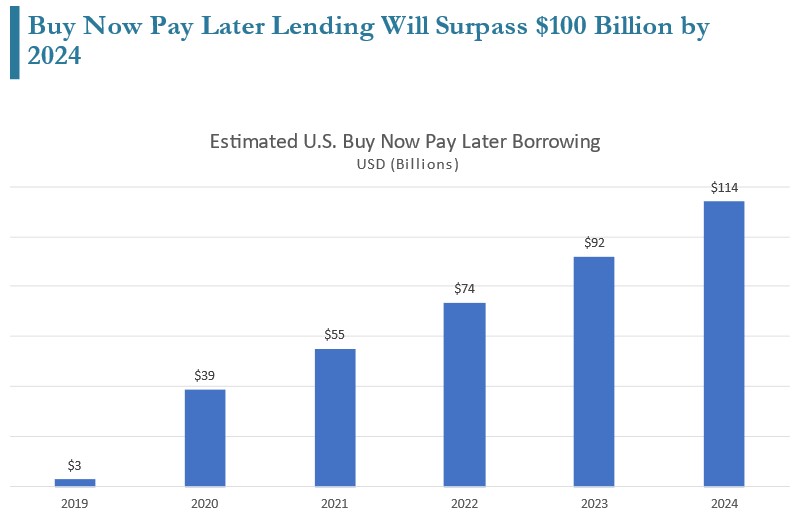

Buy Now Pay Later: U.S. volumes will surpass $100 billion annually by 2024.

Mercator Advisory Group released a report covering the Buy Now, Pay Later (BNPL) lending model, titled Buy Now, Pay Later: Gaining Scale and Disrupting the Status Quo in Lending. The research explains the current market, discusses the strengths, weaknesses, opportunities, and threats to fintech, and explains the business and cashflow of this emerging credit option.

The research compares both consumer and merchant costs in comparison to credit cards. It dispels the claims that the product is a cheaper option for buyers and sellers. Research also covers the liberal credit policies used to gain scale, and suggests that fintechs consider tightening credit policies so that losses do not cannibalize profits.

"BNPL is not the “new thing” in lending; it is a modernized version of retail finance. There is certainly a high appeal, but with limited credit policies, consumers need to self-govern their retail purchasing so that they do not overextend themselves financially,” comments Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group, and the author of the research note. Riley continues, “Financial institutions and other players in the credit cycle need to pay attention to the way fintechs aggressively book accounts. Fintechs should not compromise their credit standards, but the rapid take-up indicates that credit card issuers must provide access to thin credit files, and watch customers mature. Fintechs also need to think beyond the single transaction and look at the way banks manage a customer’s lifecycle.

This document contains 22 pages and 11 exhibits.

Companies mentioned in this research note include: Afterpay, American Express, Avant, Bluevine, Capital One, Chase, Citi, Credit Intelligence, Discover, Dough Limited, Fatfish Group, FICO, General Electric Credit, GreenSky, Household Finance, Humm Group, IouPay, Kabbage, Klarna, Laybuy, Lending Point, LendingClub, Margeta, Mastercard, OnDeck, Openpay, OpyPay, PayPal, Payright, Petal Card, Prosper, QVC, Sezzle, SoFi, Splitit, Square, Synchrony, TD Bank, TSYS, Visa, Zebit, Zip, Zoot Solutions.

One of the exhibits included in this report:

Highlights of the research note include:

- Forecasted U.S. volumes through 2024, when they will exceed $100 billion

- Placing the merchant at the center of the relationship, not the consumer

- What will happen to the BNPL interest-free model when the prime rate rises

- A discussion on interchange versus merchant discount and why credit cards can be cheaper

- Market capitalization and why fintechs continue to lose money on BNPL

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world