Overview

Boston, MA

December 2008

Call Centers and the On-shoring Challenge: Building Customer Satisfaction Across Bank Contact Channels and Not Oceans

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This newest report from Mercator Advisory Group's Retail Banking Advisory Service delivers concrete strategies importable by financial services firms considering the power and efficacy of two types of customer contact experience: the traditional inbound call center and inbound, Internet, click-to-chat. The experience of the two, by both bank customers and prospective bank customers/product purchasers is wildly divergent with strikingly different satisfaction outcomes and sales results.

It is estimated that by 2017, 3.3 million U.S. service sector jobs will be off-shored, taking with them $136 billion in U.S. wages. Information technology and call centers are prime targets for these relocations and by their overwhelming embracing of this trend, U.S. commercial banks render themselves highly vulnerable to a stinging backlash by the customers and regulators actively supporting the industry not only with their fiduciary assets but their equity participation in our new economy's new age.

It is not only Detroit's blue-collar jobs that are threatened, but the white and pink collar jobs of the banking industry are particularly vulnerable to this continuing trend and it is time that while the prioritization of economic resources across multiple industries is being considered, the banking industry should commit to its long-term profitability and the success of the economy on which it is dependent by taking a leadership position in building a domestic call center industry that is both high performing and cost efficient.

For years, U.S. bankers have started at two competing mandates; develop holistic structures driving customer satisfaction levels that give their banks a competitive advantage in the marketplace and diametrically opposed, slash variable costs by lowering dollar outlays per customer interaction and transaction.

There is a conventional wisdom in the analyst community that since web Live Chat is so efficient and user friendly and cost $5.00 less per transaction than inbound call center interactions, that this migration both delights customers, satisfies the bank's mandate to lower variable (human) costs and saves call center interactions for more challenging or sales-oriented customer contacts.

However, it is the handoff of these calls from the Internet to the call center that remains a worrisome challenge for banks aspiring to build a human and technological infrastructure succeeding at both high-tech, high-touch.

The challenge for the banking industry is to bring in line the success of new Live Chat technology with its call centers. Live chats deals immediately (or at least with posted wait-times updated in real-times) with in-coming product/account questions or problem resolution requests. Web denizens logging on to live-chat have actively sought out the bank. They have followed a web ad, jotted down a URL displayed on a TV ad or billboard, or in the case of a current customer, taken the proactive step of coming to the bank's web site with an issue.

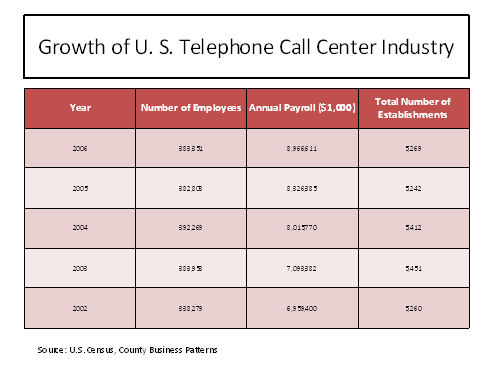

One of the 3 Exhibits included in this report.

Report Highlights:

- A July 2008 survey found that year over year, bank call centers had the largest drop in customer satisfaction among eight surveyed industries.

- IVR is the backbone of bank customer contact. There are 1.6 calls made to an IVR or a call center per checking account per month. That is double the total number of Internet banking log-ins reported. Of those calls, 80% are to the IVR.

- A Live Chat investment, including all start up costs, software support, web site integration and employee training, is accretive after only six months because it produces a new product/customer conversation rate 12% higher than previous bank systems.

- Since web Live Chat is so efficient, delights customers and costs $5.00 less per transaction than inbound call center interactions, this customer contact channel both satisfies the bank's mandate to lower variable (human) costs and reserve call center interactions for more challenging or sales-oriented customer contacts.

- While 75% of consumers said their lenders web site offered the ability to speak with someone by phone, only 26% responded that the web site offered an online chat feature.

Elizabeth Rowe, Group Director of Mercator Advisory Group's Banking Advisory Services and author of this report, comments, "With labor representing 70 percent of the total operating budget of a bank call center, banks have always strived to staff as tightly as possible, push performance metrics to reward a quick on/quick off operator model of customer interaction and often times rationalize a move to low cost offshore call centers. A consistent source of consumer frustration with outsourced call center operations is that the customer service representatives on the other end of the phone are unfamiliar with the products and institutions being discussed.

While customer dissatisfaction with off-shored customer contact centers has always been communicated back to banks (and vociferously around Internet), as that dissatisfaction has dovetailed with the growing power (and financial assets) of younger bank customers who are far more willing to attrite based on customer service experiences than older customers, there is a new push to onshore the call center and even promoted its American work force.

As off-shore labor costs have risen as qualified personnel is increasing short supply (remember that in India, for instance, only 3 to 5% of population speak English) and employee turnover rates have plagued staffing stability of those facilities, those challenges are increasingly justifying a positive response to U.S. customers demanding greater employment stateside.

Although bank retail customers have always owned significant share of their own institutions through their 401-(ks)s, IRAs, KEOGHs and individually traded equity shares, the TARP investment of $750 - $800 billion in U.S. commercial banks has made the you-are-working-for-me awareness of stakeholders and customers very top of mind.

With this keen awareness, customers are flummoxed when they learn that their federal bailout is pouring billions into banks that are off shoring technology and customer contact jobs to emerging economies and are not employing U.S. residents. This frustration is happening against a backdrop of rising unemployment which will grow even grimmer as Mercator Advisory Group is projecting unemployment will reach 10% by Q2 2009.

To paraphrase a bumper sticker, think globally, but hire locally. With community banks and credit unions claiming a moral high road with their 24/7 call centers and well-paid, well-trained American staff; the current economy will only heighten the public relations advantage of that public face of the smaller financial institution.

The report is 22 pages long and contains 3 exhibits

Other recent research from the Retail Banking Advisory Service:

| Electronic Bill Pay: Niche Opportunities Still Abound | |||||||||

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send an email to mailto:[email protected]

Learn More About This Report & Javelin

Make informed decisions in a digital financial world