Overview

Boston, MA

March 2006

The Canadian Credit Card Industry

Taking Stock of Issuers and Processors

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

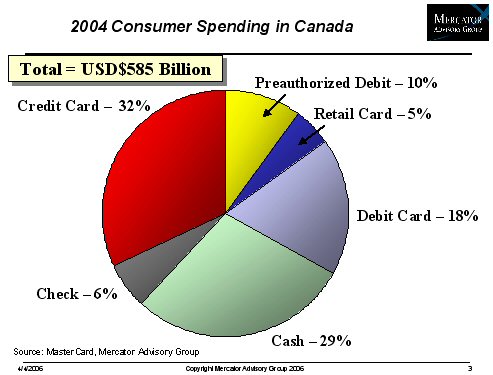

Canada represents one of the largest markets for electronic payments in the world. The economy is large and the people are both wealthy and extremely comfortable with the use of plastic payment cards. Add in political and economic stability, as well as robust telecom infrastructure and consumer credit data, and it is no surprise that Canadians are among the per capita leaders in the use of plastic payments cards. The size and maturity of the electronic payments market has drawn some intense competition from domestic banks, international banks (largely US based) and one very important domestic consortium.

There is a popular tendency to assume that the Canadian market is basically the same as the US market. This assumption, however, is wrong. "There are clearly some strong similarities between the US and Canadian markets," says Brian O'Keeffe, Director of Mercator's Credit Advisory Practice and the author of this report. "But the two markets have some large structural differences, and consumers some significant habitual differences that make them highly distinct. Any effort to simply replicate a US business model in Canada will likely prove futile."

The report discusses, among other subjects:

* How is the Canadian economy different from the US economy, and what does that mean about the market for credit cards?

* How does the national debit platform (Interac) effect the competitive dynamic for credit card issuers?

* How do Canadians use their credit cards, and how is that different from US consumers?

* What does the competitive environment for issuers look like?

* What do the current product offerings look like, and how substantially do they differ from US products?

This report also includes a discussion of the major Canadian card issuers, their products and strategies, and the impact of foreign competitors on the market. Finally, there is an analysis of the regulatory environment in Canada, and how that will affect the dynamics of the market going forward.

This report contains 29 pages and 8 exhibits. (Figure 2 is above)

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world