Overview

The Canadian Credit Card Market: Tough Sledding

Research Describes Challenges in the Canadian Credit Card Issuing Market

Boston, MA -- The credit card market in Canada has long been the focus of intense competition among the leading Canadian banks, with the plethora of reward programs providing evidence of their non-stop battle to motivate usage. In the harsher current economic climate, have they perhaps overdone it?

Mercator Advisory Group's new report The Canadian Credit Card Market: Tough Sledding examines the relative positioning in Canada of the major card networks, and takes a closer look at the activities of the top 15-20 card issuers. We examine the strategies intended to increase card account numbers, as well as those intended to increase utilization rates on cards outstanding.

"The events of the past year have significantly unsettled the credit card market in Canada. The level of competition for customer accounts has been increased by both new entrants and the legalization of dual network-branded issuing. At the same time, the economic recession is driving up household debt levels as well as card delinquencies and write-offs. Factoring in the cost of rewards programs, some card issuers will struggle to preserve profitability in the near term," states Patricia McGinnis, Director in Mercator Advisory Group's Banking Group.

Highlights of this report include:

The "Big Five" Canadian banks hold leadership positions in this market, but they continue to be challenged by second tier domestic financial firms, by the Canadian subsidiaries of major foreign banks, and by card market entrants from the retail sector, including most recently the new Walmart Bank Canada.

To preserve profitability and avoid excessive losses in the current macro-economic environment, lenders must recalibrate most existing credit models and develop new strategies to respond to credit deterioration.

Dual-issuing is now allowed, and some issuers are already taking the bait. In a market already so saturated, we do not believe that simply issuing a new card of the "other" network will significantly change market positioning.

Among the leading Canadian banks, CIBC has built a volume of business significantly more than proportional to the bank's asset size in its market.

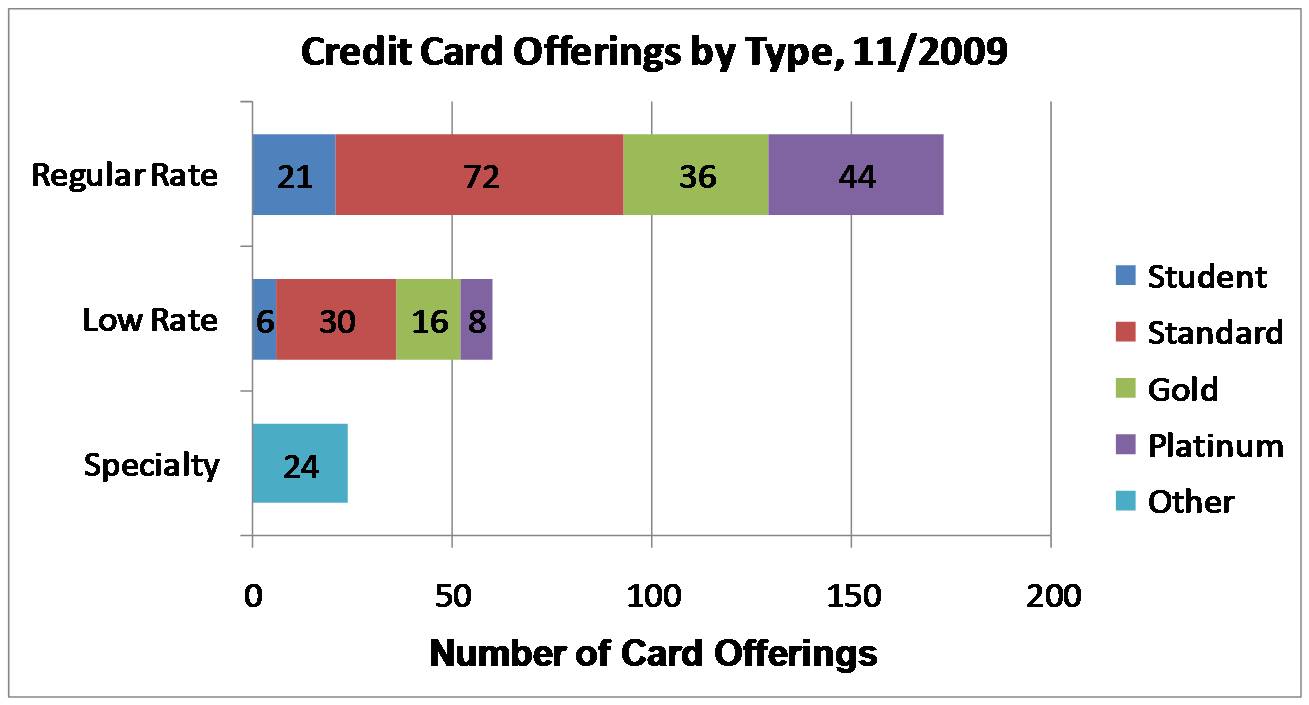

One of 12 exhibits in this report:

This report is 27 pages long and has 12 exhibits.

Companies mentioned in this report include: Bank of Montreal, Bank of Nova Scotia, Canadian Imperial Bank of Commerce, Citibank, Royal Bank of Canada, TD Canada Trust, Davis & Henderson, Ernex Marketing Technologies, Groupe Aeroplan, Loyalty One, Total Systems.

Members of Mercator Advisory Group have access to this report as well as research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700 or send E-mail to [email protected]

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world