Overview

Card-Not-Present Risk Management Across the Value Chain

Research Examines Collaboration in Card Fraud Countermeasures

Boston, MA -- Mercator Advisory Group's new report, Card-Not-Present Risk Management Across the Value Chain, examines strategies with which payment industry stakeholders might manage fraud risk in a more collaborative fashion across the value chain. To define the context for the report, the analysis begins with a look at the current dynamics in global e-commerce markets that are making adoption of collaborative strategies more imperative. Next, the discussion proceeds into current implementations of risk management practices within payment acquiring, online and multi-channel retail, and card issuing, as well as strategic concepts that may propel these practices into the next generation.

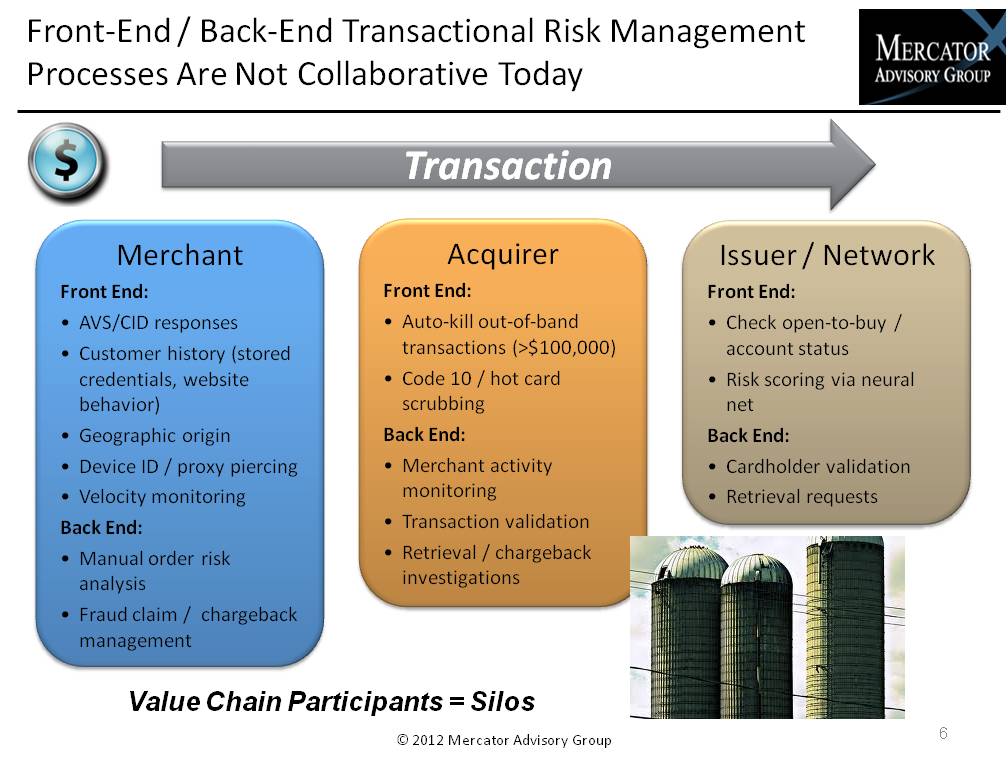

"Payment card risk management today exists in silos that correspond to each link in the transaction flow -- generally, the merchant, the acquirer, and the issuer (and its network partner). The various systems and processes that enable card transactions only talk to each other in limited ways; to a large degree, each party utilizes them only to manage its own risk. In other words, issuers, merchants, and acquirers concern themselves mostly with managing their own risk out of self-interest without much regard to risks posed to other members of the value chain," David Fish, senior analyst at Mercator Advisory Group and author of the report comments. "Mercator postulates that more collaborative use of risk management systems in payments would be of greater benefit to all involved, and thus the self-interest paradigm is actually a paradox."

Highlights of this report include:

An in depth analysis of the global growth of e-commerce and its implications for card risk management practices

Explanation of current risk procedures and duties associated with the various card payment value chain stakeholders

Coverage of instances where collaboration exists between stakeholder entities (both of the same type and of different types) in risk processes and practices

New criteria with which the payments industry should evaluate or build fraud prevention and risk management tools

Strategic considerations and action steps for risk managers in the payments industry and at CNP merchants

One of seven exhibits in this report:

This report is 22 pages long and has seven exhibits and two tables.

Companies mentioned in this report include: 41st Parameter; Acculynk; Amazon; American Express; ChargeAnywhere; CyberSource; Ethoca; FICO; iovation; Kount; NICE Actimize; Retail Decisions; RoamPay; SecureKey; Square; ThreatMetrix; Visa.

Members of Mercator Advisory Group's Credit, Emerging Technologies, and Fraud, Risk & Analytics Advisory Services have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world