Overview

Boston, MA

April 2004

Check 21:

Harnessing A Billion Points of Light

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

A large and complex industry has evolved to support the clearing of 40 billion checks annually, but Check 21 will change the entire ecosystem this October when an imaged check can be printed and presented as a legal substitute. From the checkwriter, to those that process and transport checksl to the bank that releases the funds and notifies the check writer -- every participant faces major change in technology, processes, volumes and risk.

Tim Sloane, Director of Debit Advisory Research for Mercator Advisory Group and author of the report identifies imaging technology as a critical weak link. The image technology used today is not a competent forensic tool for identifying and convicting fraudulent parties, yet this is what Check 21 demands if liability is to be avoided. Risk adverse merchant check processors may decide to return high value paper checks rather than build a paper archive or accept the liability. Current check imaging technology was always a backup to the archived or processed physical check, and was never intended to assist forensics.

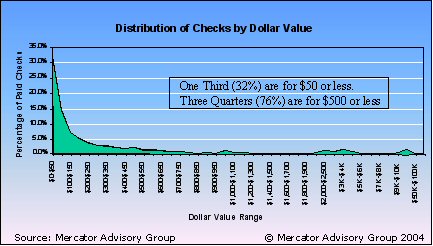

"With between 8 to 60 thousand defects for every million checks imaged, reconverting banks must carefully consider how much liability they can bear. Twenty four percent of all checks are valued at more than $500 and 2% are worth between $10,000 and $50,000. I predict a paying bank caught on the short end of this stick will challenge exactly what is considered by the regulation to be 'sufficient to determine whether or not the claim is valid sooner rather than later."

This report identifies the ongoing decline in check volumes that began in 1999 and continues with rapid acceptance of check conversion. This decline in volume will prevent some processors from making the infrastructure upgrades needed to be ready for Check 21, so financial institutions should evaluate current and future partners carefully.

This report also evaluates the role of check conversion solutions that provide far more benefits to a wider group of participants than Check 21. With check conversion the merchant avoids the costs associated with check handling because the paper check is eliminated when presented. The merchant also almost eliminates the risk of non-payment and gets access to the cash much sooner. The paying bank no longer needs to pay a check processing fee because the transaction is received as a debit transaction. Should the bank work to migrate these transactions to the EFT network, they may be able to create a payment revenue stream, although there are obstacles to this tempting future.

Despite these benefits, banks have ignored check conversion - yet merchant acceptance has spurred an 800% increase without bank participation. While paying banks find check conversions that clear over the ACH highly inefficient, the volume will simply continue to grow if banks don't take action to manage the situation.

This report contains 32 pages and 4 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world