Commercial Card as an Integrated Payables Solution

- Date:December 17, 2014

- Author(s):

- Richard Hall

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

Corporations are seeking to simplify and consolidate accounts payable operations and lower their payment overhead costs. For banks with corporate clients, continuing development to improve efficiencies through technology and deploy new commercial payment solutions is necessary to stay competitive—or even to remain in the game. Mercator Advisory Group believes that along with the advancements in corporate payment solutions, a real opportunity exists to improve the way commercial payments products are sold.

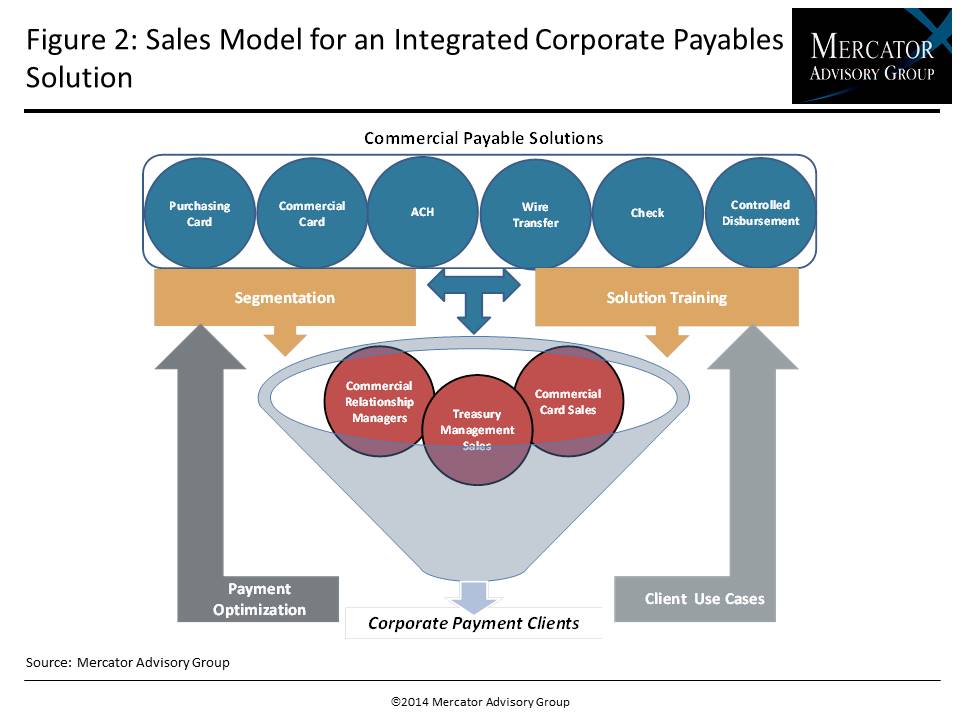

Mercator Advisory Group's research note, Commercial Card as an Integrated Payables Solution, looks at traditional sales models for commercial payable solutions, including cards, and suggests a new model in which integration is just as important for sales channels as it is for products themselves. Greater use of tools like segmentation and enhanced solution training for a more client-centric sales model can provide a genuine point of differentiation and result in successful client relationships.

"As commercial cards continue to grow, an integrated sales process can maximize the opportunity that comes from a comprehensive program,” comments Richard Hall, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “With increasing ubiquity of commercial payables solutions, a key factor in differentiation and client value lies as much in the way these solutions are sold as in what is sold.”

The research note is 7 pages long and contains 2 exhibits.

Members of Mercator Advisory Group's Commercial and Enterprise Payments Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

One of the exhibits included in this report:

Highlights of the research note include:

- Current commercial card program efficiency levels

- Traditional sales models for commercial cards

- Integration of more tools to reengineer the sales process

- Developing a more client-centric sales model

Learn More About This Report & Javelin

Related content

Tech Meets Tariffs: Cross-Border Payments in 2025

In 2025, businesses in cross-border payments are being transformed by global trade shifts, evolving tariff policies, and technological innovations. This Javelin Strategy & Research...

Catching Up With Faster Payments

The push for real-time payments is gaining momentum in the United States, but the share that’s shifting to such payments remains minimal. By taking cues from the success of real-ti...

Cross-Border Payments and the Impact of Tariffs: An Opportunity for Fintechs

Fintechs are bringing diverse options to the world of cross-border payments, which were once solely marked by opaque and costly movement through correspondent banking channels. Now...

Make informed decisions in a digital financial world