Overview

Consumer Prepaid Distribution Strategies,

And The "Malling" Of Prepaid

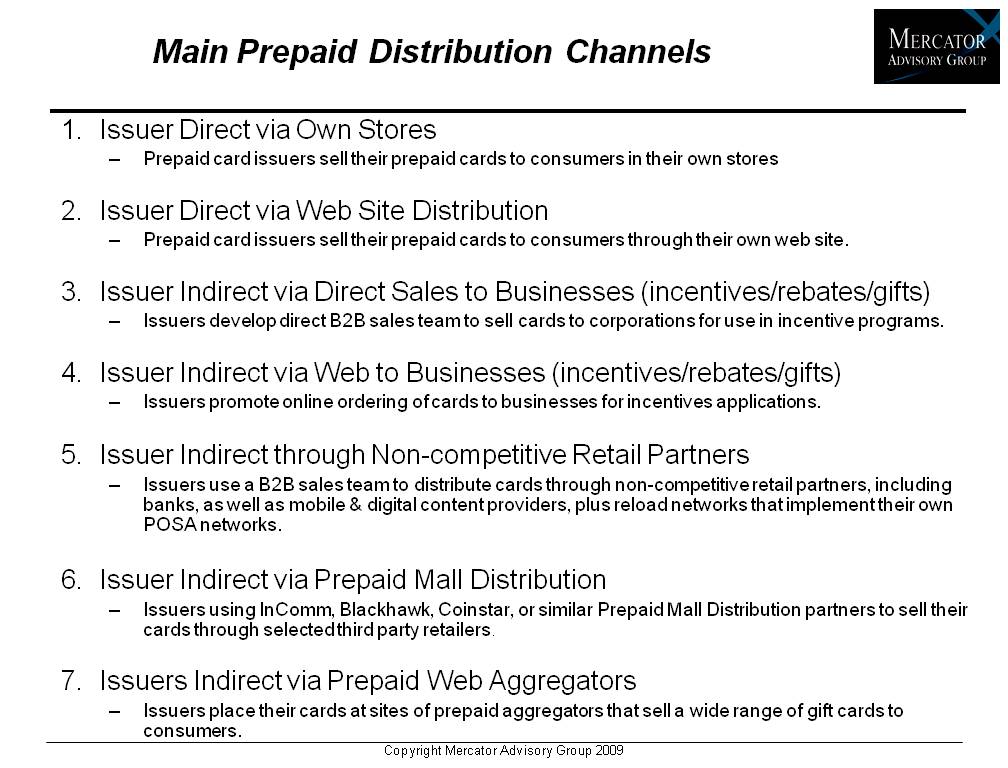

Boston, MA -Prepaid in-store card distribution has in many ways become the public face of consumer prepaid open and closed gift cards for many buyers (and indirectly to the recipients of cards as gifts). But why should card distribution be this simple? In fact, it is not and Mercator Advisory Group has identified seven major distribution channels used by issuers today to sell their cards directly and indirectly to consumers.

One of the most successful distribution channels having a major impact on consumer prepaid card sales is the prepaid mall, where dozens of cards hang on the large displays. This distribution channel has become significant in its own right, with a handful of major distributors deploying their own point of sale activation (POSA) networks and in-store display expertise to support these implementations. By our estimates, prepaid malls are responsible for nearly one third of total load volume within the thirteen prepaid segments using mall distribution today, although the proportion varies markedly by segment.

The Consumer Prepaid Distribution Strategies, And The "Malling" Of Prepaid report reviews the nature and types of card distribution strategies with a specific drill down on the prepaid mall channel, where discussed are the card segments using the mall channel, as well as how consumers use the channel. From retailer feedback, it is apparent that prepaid mall management is becoming a science, just as other in-store marketing tasks. We identify, at a high level, best in-store marketing practices of major retailer and their mall partners.

In this research report Mercator Advisory Group introduces a new analysis of data from Mercator's 2009 Primary Data Series, which collected survey data from 1,012 adults on a variety of payment topics, including prepaid as well as credit, loyalty, mobile payments, and payment security topics. Our analysis identifies four broad segments of prepaid card shoppers, and their propensity to use in-store prepaid malls versus other modalities.

Also presented in this report is our first-time estimate of the magnitude of prepaid load volume originated through prepaid malls, and how that is distributed across the 13 segments of cards using malls today.

"While marketing traditionally has only four 'P's or levers than can be adjusted to optimize the mix, prepaid distribution has evolved seven complimentary distribution channels that might be employed. A major prepaid card issuer and/or retail sponsor has the opportunity to adjust the mix of channels used, and resources devoted to each one," Ken Paterson, VP for Research Operations at Mercator Advisory Group comments.

Highlights of the report include the following:

Consumer prepaid card issuers and their retail partners use seven main distribution channels to support card sales.

Mercator's survey data from May/June 2009 documents a wide range of consumer behaviors in using prepaid distribution channels, and four distinct prepaid shopper segments based on reported shopping behavior and preferences.

In-store "prepaid malls" have become a major distribution channel in their own right, with an estimated $16.4 billion in prepaid card load in 2008.

Mercator has developed first-time estimates of the 2008 load volumes of the 13 prepaid segments currently distributed through prepaid malls.

Prepaid mall volumes are likely to grow thanks to the presence of fast-growing categories like open money and open gift cards.

One of the 11 Exhibits included in this report

The report is 28 pages long and contains 11 exhibits

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information about the Mercator Consumer Payments Survey Research Series, call Mercator Advisory Groups main line: 781-419-1700 or send email to [email protected]<">Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs.

About Mercator Advisory Group

Learn More About This Report & Javelin

Related content

Proceed With Caution: Instability in Government Programs Shakes Up the Prepaid Sector

The rapid action of the so-named Department of Government Efficiency, combined with budgetary priorities that could sap aid programs, highlights a potentially tumultuous time for p...

2025 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market should present divergent opportunities for growth, given the positive growth in business-to-business relationships and stagnant or shrinking governmen...

2025 Prepaid Card Data Book

Open-loop and closed-loop prepaid segments have stabilized, with a slight uptick in overall growth aided by positive consumer behaviors and the introduction and expansion of gaming...

Make informed decisions in a digital financial world