Consumers and Credit: Rising Usage

- Date:December 25, 2018

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

The most recent Insight Summary Report from Mercator Advisory Group’s biannual CustomerMonitor Survey Series, titled U.S. Consumers and Credit: Rising Usage, reveals that 62% of U.S. households use credit cards in 2018, up from 60% of U.S. households in 2017. Rising use of online shopping appears to make credit cards more attractive, as the survey also finds that U.S. consumers are now more likely to prefer using credit cards rather than debit cards or any other payment type at online retailers, for online travel, digital content, and even online bill payments than since we started tracking usage preference in 2015.

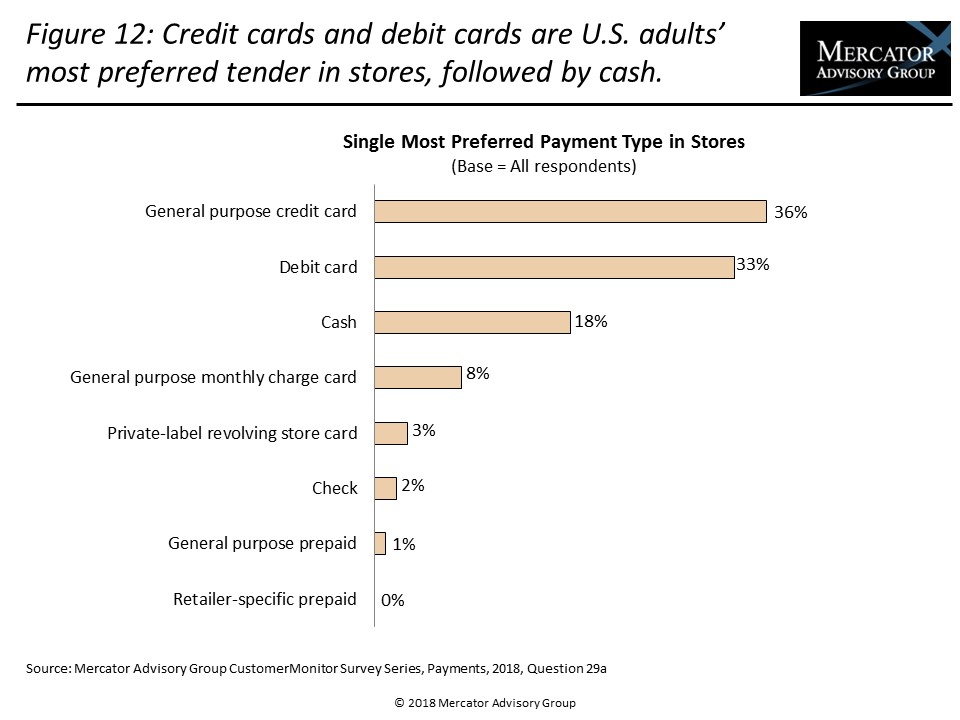

Debit cards, however, are often preferred for small purchases and everyday in-store spending such as groceries. But when consumers were asked to choose their single most preferred payment type in stores, 36% prefer credit cards and 33% prefer debit, the top two payment types, followed by 18% who prefer using cash. Surprisingly, the preference for cash remains strong, particularly among Gen Z young adults aged 18 to 24 who, since the CARD Act of 2009, are less likely than older adults to use credit cards. This study also finds that consumers using credit cards are more likely than ever to be paying their monthly balances in full, though young adults are less likely than average to do so.

The report presents the findings from Mercator Advisory Group’s CustomerMonitor Survey Series online panel of 3,002 U.S. adult consumers surveyed in June 2018. The study examines the demographic distribution of credit card use in the United States, use of co-branded credit or charge card programs by type, changing patterns of credit card use relative to other payment types, credit card payment habits, and self-assessed credit history, as well as notice of and reaction to merchant steering practices, usage of peer-to-peer lenders by brand and reasons for use, consumer experience of changing fees, APRs, motivators to increase credit card borrowing and credit card spending, methods used to shop for new credit cards, application channels used for general purpose credit cards and store credit cards, and consumers’ notice of and reaction to merchant rules for credit card use and interest in mobile-based account controls.

“In 2018, credit cards rewards and online shopping appear to be driving stronger use of general purpose network branded credit cards, especially since 3 in 10 credit cardholders say they use premium credit cards that have an annual fee. Consumers recognize the security that credit cards offer particularly online. When it comes to fraud and disputed charges, it’s easier to deal with when the money is borrowed from the issuer, and not their own,” stated Karen Augustine, manager of Primary Data Services, including CustomerMonitor Survey Series, at Mercator Advisory Group, the author of the report.

The report is 83 pages long and contains 38 exhibits.

Companies mentioned in this report include: Acima Credit, Affirm, Avant, Bread, Klarna, Lending Club, Prosper, SoFi, and Upstart.

One of the exhibits included in this report:

Highlights of this report include:

- Year-over-year trending of penetration of credit cards in the U.S. market, cardholder behavior, and changes to features, credit limits, APRs, applications, and turn-downs

- Number of credit cards used in the past year and those who pay an annual fee

- Usage of co-branded credit cards by type

- Most important features of credit cards and selection criteria

- Participation in credit cards rewards program, most valued rewards, and estimated value of credit card rewards

- Shifts in the channels that consumers used most recently to apply for general purpose and store credit cards

- General purpose reward card participation, type of rewards available, most valuable reward type

- Considered applying for new credit cards and most valuable methods of shopping

- Consumer perception and expected reaction to merchant policies and practices restricting credit card use or steering customers to other payment forms

- Interest in mobile-based account controls for use by cardholders to limit fraud on their accounts by card type, awareness and use of card controls for credit vs. debit

- Typical payment habits and use of automatic payments

- Usage of peer-to-peer lenders by brand and reasons for use

Learn More About This Report & Javelin

Related content

2024 North American PaymentsInsights: U.S.: Generational Consumer Payment Trends

The economic environment of 2024 was particularly challenging. Consumers grappled with inflationary pressures and high interest rates among an economically uncertain market with a ...

2024 North American PaymentsInsights: Canada: Exhibit

This year, we identified consistent patterns of payment behavior that align with the findings from last year's study of Canadian consumers. Younger generations predominantly drove ...

2024 North American PaymentsInsights: U.S.: Exhibit

The economic environment of 2024 was particularly challenging. Consumers grappled with inflationary pressures and high interest rates among an economically uncertain market with a ...

Make informed decisions in a digital financial world