Overview

The Cost of Payment Acquiring vs. the Cost of Card Acceptance: Acquirer Pricing Strategies Post-Durbin

New Report Examines Merchant and Acquirer Costs

in a Regulated Payments Market

Boston, MA -- With the July 2010 passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act, the financial services sector has faced extensive changes in conducting business under an increasingly complex regulatory framework. The payments industry was included within the scope of the massive legislation, which gave the Federal Reserve regulatory power to cap payment network interchange rates for debit card transactions and to govern the rules that guide merchant, processor, and bank routing of debit card transactions.

While all parties in debit card transactions have or will soon feel the impact of the new regulations, Mercator's new research report, The Cost of Payment Acquiring vs. the Cost of Card Acceptance: Acquirer Pricing Strategies Post-Durbin, centers on the payment acquirer and how Durbin rules fit in with, and might change, the traditional market paradigms governing the cost of payments.

"The markup methodology for acquirer interchange cost has experienced a period of significant revision more recently, though, with many more players in the market adopting (and many more merchants demanding) an "interchange plus" structure that more clearly demonstrates the acquirer's expense on each card transaction. A laudable development!" David Fish, senior analyst at Mercator Advisory Group and author of the report comments. "It's also important to note that "tiered" is not necessarily synonymous with "opaque" - acquirers have been known to go to market with a tiered pricing system for sake of simplicity but then disclose interchange qualifications on merchant activity statements and through online merchant reporting systems."

Highlights of this report include:

The biggest issue facing the payments industry, and the affect of the Durbin Amendment on the division of value in the value chain.

The sides of card transaction where risk exists and is alleviated.

The competing preferences that may split acquiring industry market strategy.

The impact of Durbin on card payment acceptance costs to merchants.

The opportunity for acquirers to invest in technology and innovation, and the parties that stand to reap the benefits.

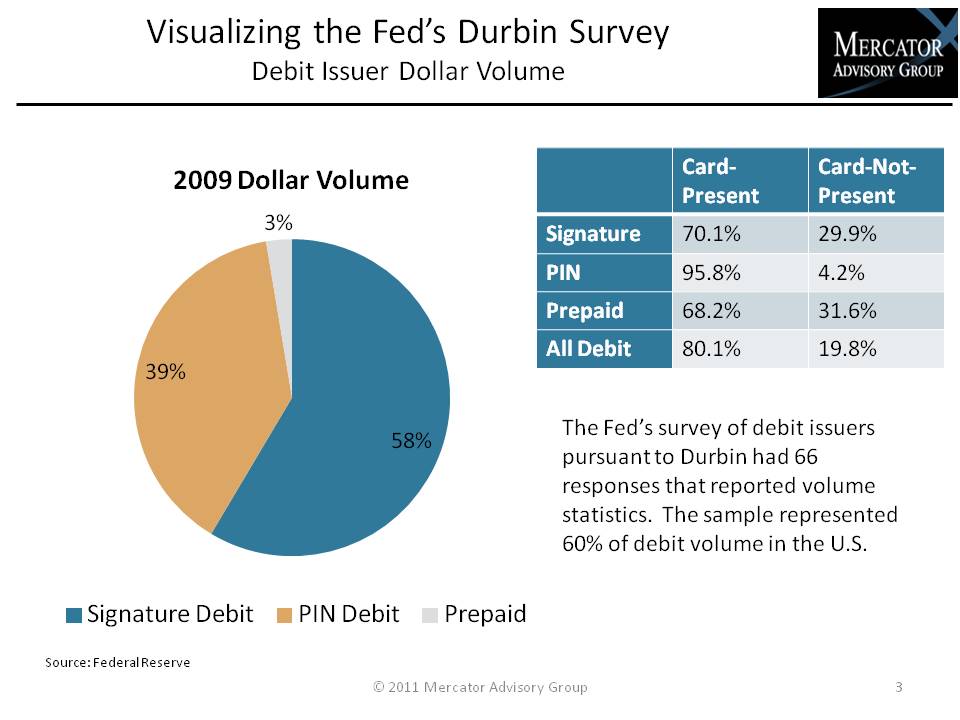

One of 10 exhibits in this report:

This report is 22 pages long and has 10 exhibits.

Companies mentioned in this report include: Braintree Payments, Chase Paymentech, Elavon, First Data / Star, First Hawaiian Merchant Services, Global Payments Inc., Heartland Payment Systems, Intuit, Litle & Co., MasterCard, Merchantservice.com, Mercury Payments, North American Bancard, NYCE, PNC Merchant Services, Pulse, Sage, Square, TSYS Merchant Solutions, United Bank Card, Vantage Card, Vantiv, Visa Inc. / Interlink, Wells Fargo Merchant Services, and WorldPay.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world