Overview

COVID-19 has created consumer interest and use of contact-free payment experiences as fear of infection from surfaces, including a point-of-sale (POS) device, drives new behaviors. While reports and surveys proclaim cardholders’ interest in contactless technology, the actual number of contactless debit transactions authorized on a contactless card or mobile app remains elusive. This report, COVID-19: The Power Behind Contactless, considers the available market data and Mercator Advisory Group research to better understand the level of contactless payment activity and the degree to which COVID-19 is affecting its growth.

“The onset of the coronavirus created the perfect storm of events that is driving awareness more quickly than all the promotional activities have to date. Cardholders’ wellbeing is the incentive to adopt a new payment method. More consumers are now aware of the contactless capabilities they have on their debit card, which is driving new users in addition to increased use by current users,” comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report.

This report has 13 pages and 3 exhibits.

Companies mentioned in this report include: Apple, Costco, CVS, Starbucks, Target, Visa, Walmart.

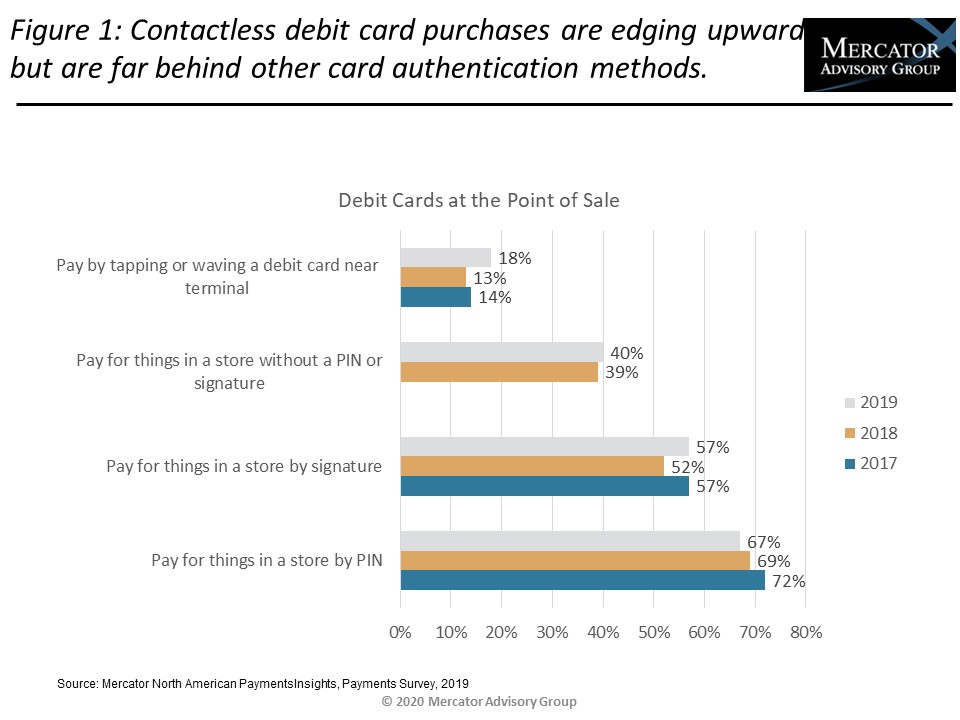

One of the exhibits included in this report:

Highlights of the report include:

- Prior to the onset of the coronavirus, debit card issuers had been actively issuing contactless debit cards for the improved user experience, and hoping to convert cash transactions to interchange earning payments as experienced in similar economies like Australia, Canada and the United Kingdom.

- While adoption of contactless by merchants has also been growing, it will likely create higher card processing fees. Contactless transactions are often routed through the global networks, which may be more expensive than an EFT debit network transaction. Also, if the experience of other countries is repeated in the U.S, cash purchases will now incur more visible interchange expense and processing costs.

- Cardholder interest in contact-free transactions, including recent Mercator Advisory Group survey data collected in June 2020, measures the increased use of contactless by current users and new users.

Learn More About This Report & Javelin

Related content

An Executive Order: What’s the Impact of Eliminating Government Check Payments?

An order by President Donald J. Trump to eliminate the issuance and acceptance of paper checks by the government isn’t the first time an effort has been made to limit the use of th...

2025 Digital Issuance Provider Scorecard

Galileo ranks as the Best in Class winner in Javelin Strategy & Research’s inaugural Digital Issuance Provider Scorecard. Galileo’s flexible, secure, scalable and fully integrated ...

Tumultuous Times: Uncertainty at the CFPB and Financial Services Regulations

The Consumer Financial Protection Bureau’s future is in question amid scrutiny by the Trump administration and Elon Musk’s Department of Government Efficiency. An order to stop wor...

Make informed decisions in a digital financial world