Credit Card Acquisitions: Maximizing Results amid Change

- Date:January 30, 2018

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

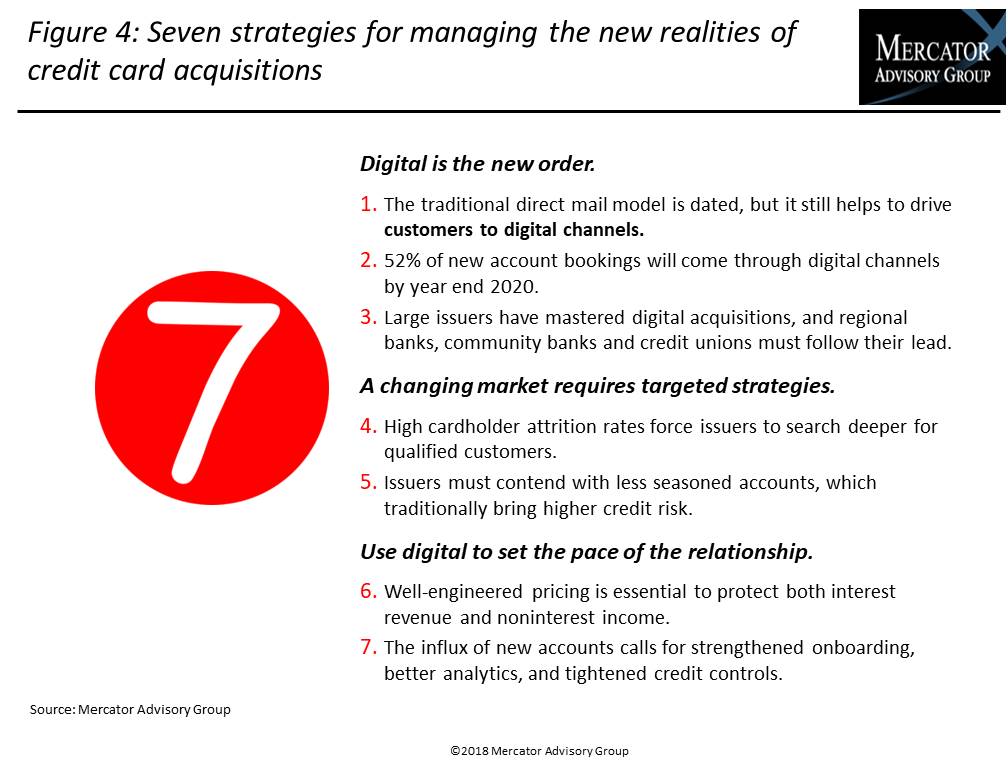

Credit card issuers in the U.S. market booked 66.6 million new accounts in 2017, but the total volume of accounts grew by only 2.3 million because of account attrition. Mercator Advisory Group’s latest research report, Credit Card Acquisitions: Maximizing Results amid Change, discusses the high volume of account attrition and the industry trend toward digital acquisitions, projects how the credit card acquisition model will shift through 2022, and recommends practical strategies for credit card issuers to adapt to a changing market.

“Issuers in the U.S. credit card industry should be urgently concerned,” commented Brian Riley, Director, Credit Advisory, at Mercator Advisory Group and author of the research note. “Issuers continue to open large volumes of new accounts. Since 2015, we have seen more than 60 million new accounts annually in the U.S. market, but total account growth occurs at a snail’s pace. This means cardholders are leaving their issuers almost as quickly as issuers book new accounts. As can be observed from many issuers’ loss numbers, accounts in the portfolios have not seasoned, so risk and delinquency are high. Also, these results show that the rewards model is flawed. Could it be that consumers have outfoxed the rewards incentive model? Have they outfoxed the issuers by shifting their loyalty to the best introductory offer? In a 2017 report, Mercator Advisory Group identified how the return on asset (ROA) metric for credit cards in the U.S. plummeted from 7.65% in 2006 to a projected 3.74% in 2017. One of the driving factors is net revenue per account, and attrition is an obvious component.”

This research report contains 14 pages and 6 exhibits.

Companies mentioned in this research report include: Bank of America, BB&T, Capital One, Chase, Citi, Discover, FICO, First Data, FIS, Fiserv, Mastercard, PNC, SunTrust, TSYS, and Visa.

One of the exhibits included in this report:

- U.S. cardholder attrition rates

- Total numbers of new accounts

- New account bookings by year

- Sources of U.S. card acquisitions

- Projected card acquisition volumes by channel through 2022

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world