Overview

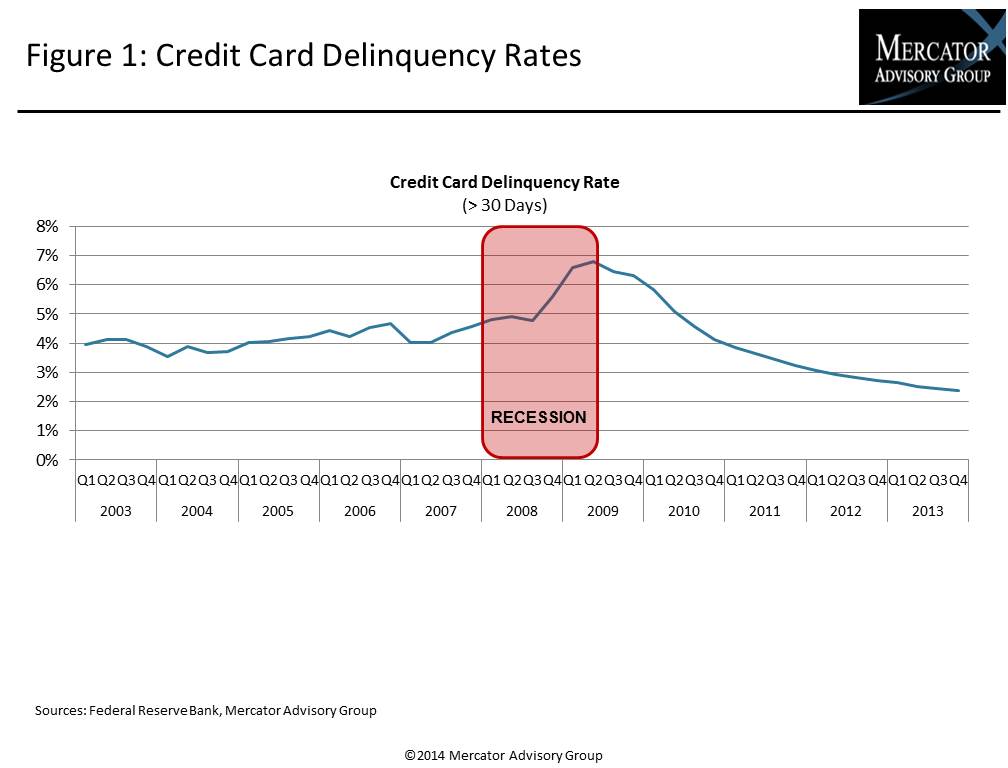

The U.S. economic environment has turned 180 degrees since the recession ended. In 2009, credit card issuers were awash with delinquent accounts and struggling to scale their collections operations to meet an exploding need. Today, the delinquency rates on credit card balances are at an all-time low and continue to trend lower. The regulatory environment has also changed considerably since the financial crisis. And recent guidance from multiple regulatory agencies regarding how financial institutions should manage vendor risk is also influencing creditors’ collection strategies.

“The context for credit card collections has changed considerably over the last five years, but it isn’t necessarily any closer to normal,” comments Michael Misasi, Senior Analyst, Credit Advisory Service at Mercator Advisory Group and the author of the Note. “The industry pendulum has swung from one extreme to the other. The only comparison we might make is that creditors and the technology providers that serve them are still waiting for a sustainable environment.”

This report contains 15 pages and 3 figures.

Companies mentioned in this report include: ACI, CMC, CGI, FICO, SAS

Members of Mercator Advisory Group’s Credit Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

One of the exhibits included in this report:

Highlights of the report include:

- A discussion of historical and ongoing compliance challenges facing first-party creditors

- An analysis of key competitive considerations such as self-service options, and customer service issues

- A review of 5 leading providers of credit card collection platforms and tools

- Mercator Advisory Group’s expectations for future shifts in banks’ collection strategies

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world