The Credit Card Data Book: 12 Significant Indicators

- Date:December 13, 2017

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

More U.S. households are revolving credit card debt today than did before the recession, and contingent liability, the amount of open credit lines, will pass the previous high during 2018. Mercator Advisory Group cautions credit card issuers to be watchful of increases in account delinquency, which may further disrupt their profitability. Credit cards remain profitable for retail bankers, but reductions in non-interest revenue since the Credit Card Accountability Responsibility and Disclosure Act of 2009 (the CARD Act) have disrupted the business model. Credit loss protection must be a top consideration for card issuers.

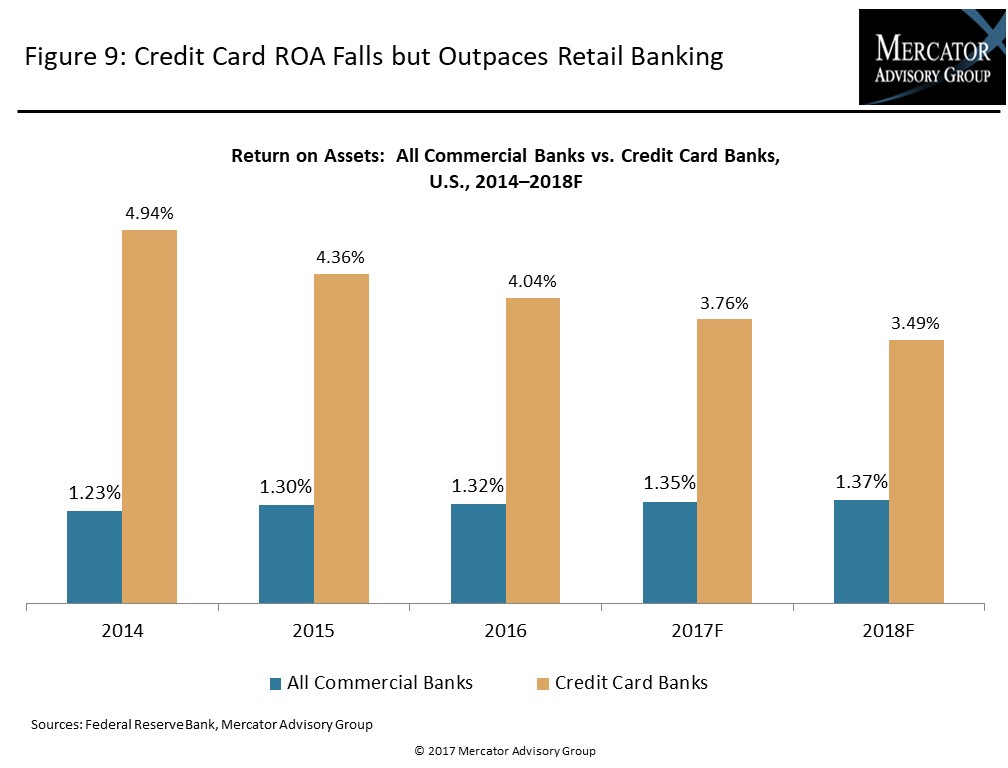

“The return on assets (ROA) indicator for credit cards slipped again during 2017 and is trending downward,” commented Brian Riley, Director, Credit Advisory Service, author of this report. “Increases in delinquency will drive up costs and negatively impact credit losses, a major industry expense. Growth has been solid, but the basics of credit management are what will bring in profits for issuers during 2018.”

This research report contains 23 pages and 14 exhibits.

Companies mentioned in this report include: Bank of American, Chase, Citi, FICO, HSBC, LexisNexis Risk Solutions, Mastercard, Visa

Members of Mercator Advisory Group’s Credit Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

For more information and media inquiries, please call Mercator Advisory Group's main line: 1-781-419-1700, send email to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

One of the exhibits included in this report:

- The credit card aging process

- Revolving debt

- Open credit card account volume

- Consumer credit delinquency

- Bank return on assets

- Projected interest rates

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world