Overview

For the last several years, credit card issuers in the United States have experienced a paradox—strong growth in purchase volumes despite declining accounts on file and declining outstanding balances. Mixed performance metrics are finally starting to converge though, and 2014 is shaping up to be a strong year for general purpose and private label portfolios. Innovation is occurring within several familiar credit products. Even seemingly forgotten ones such as charge cards and secured cards are performing well.

Mercator Advisory Group’s research note, Credit Card Market Update: The Future Brightens for U.S. Issuers, provides the Credit Advisory Service’s assessment of the credit issuing business in 2014, noting key product strategies for credit issuers and networks.

“Issuers should feel pretty good heading into 2015," comments Michael Misasi, Senior Analyst, Credit Advisory Service at Mercator Advisory Group and author of the research note. “Not only have industry performance metrics shown signs of acceleration, but a few concerning strategic issues have also abated in 2014.”

This research note contains 10 pages and 5 figures.

Companies mentioned in this note include: American Express, Bank of America, Capital One, Citibank, Discover, Fifth Third, JPMorgan Chase, MasterCard, PNC, US Bank, Visa, and Wells Fargo.

Members of Mercator Advisory Group’s Credit Advisory Service have access to this research note as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

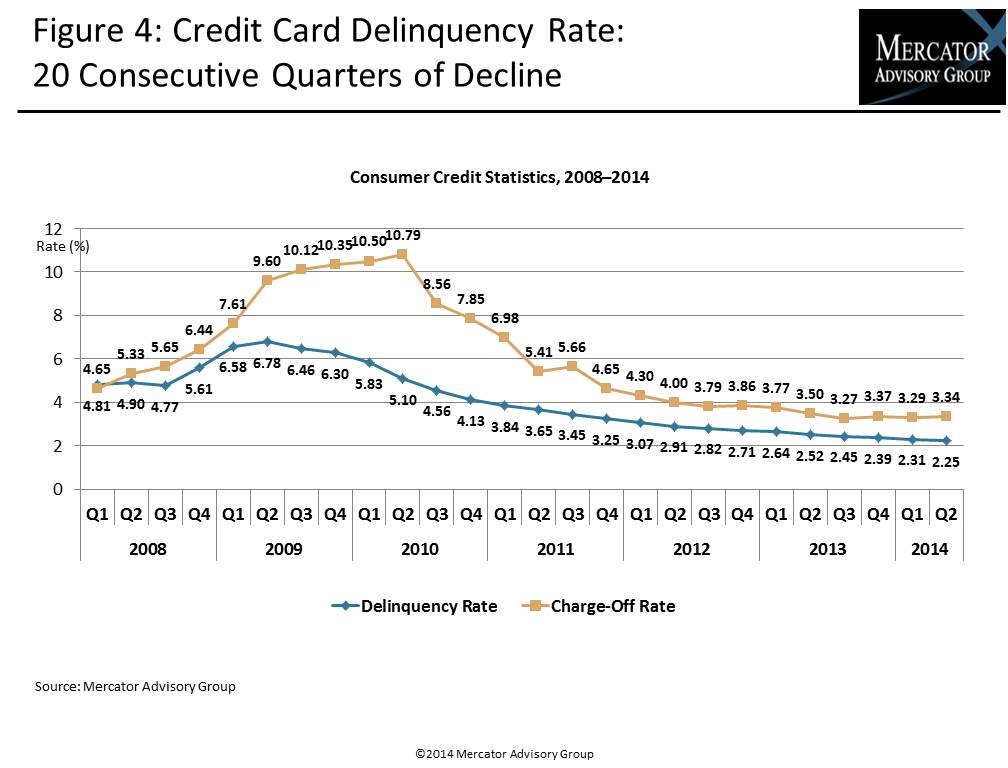

One of the exhibits included in this report:

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world