Overview

September 2008

Credit Card Rewards Programs 2008: Trends, Challenges, and the Demand of Innovation

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

United States credit card issuers are facing many challenges today. The weak economy and turmoil in the financial industry are making it harder for issuers to deal with the soaring costs of their reward programs. Rewards have become a key driver of card acquisition, usage, and retention. The pressure from the uncertainty surrounding the disputation and pending bill about interchange fees, which is the main funding source of card rewards, also pose a significant threat to the survival of today's credit card rewards programs. At the same time, consumers' needs and expectations are also changing, calling for credit card issuers to offer more attractive and relevant products and services. Merchants, while pushing for more regulation on interchange fees, also face their own problems to attract and retain customers and encourage spending. All these factors represent challenges as well as opportunities to the credit card industry.

Terry Xie, Director of Mercator Advisory Group's International Advisory Service and principal analyst on the report, comments, "The credit card industry needs to think about rewards programs in a new way. No longer can they take the old funding mechanisms for granted and hope to survive and prosper by just doing what everyone else is doing. There is an urgent need for taking a new look at the relationships between merchants, consumers, and issuers to rethink the value proposition for each party involved. With insights into customers' needs, innovative thinking, and the help of new technology solutions, some players will gain a significant competitive advantage over others that fail to adapt."

The most recent report from Mercator's International Advisory Service provides an update of some new developments in credit card rewards programs in the United States since February 2007. The focus is on major and potentially fundamental challenges for the credit card rewards market. With limited upsides (and potentially a deep dive) on the revenue side on the horizon, credit card issuers need to rethink how they design and structure rewards offerings. It is possible that this mandate will drive innovations that revolutionize credit card reward programs, perhaps more so than we have seen in a long time.

Highlights from this report include:

- The card industry is seeking solutions to reinvigorate credit card rewards programs in response to the soft economy, regulation, fuel prices, and consumer behavior.

- Gas cards and miles cards both have their challenges in today's economy.

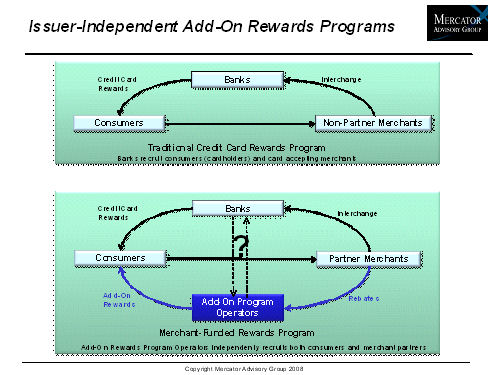

- Merchant-funded rewards programs have a tremendous amount of potential to revolutionize credit card rewards programs due to new value propositions to different parties.

- Premium merchants might become a scarce resource as they are heavily sought after by card networks, issuers, processors, and independent merchant discount networks.

- Data analytics offer a new level of targeted marketing and promotions but their full potential will not be realized until combined with merchants' involvement, likely in the format of a merchant-funded discount network.

- New innovative rewards programs such as non-transactional rewards and programs combined with non-traditional rewards components are emerging.

One of the 7 Figures included in this report

This report contains 32 pages and 7 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at http://www.mercatoradvisorygroup.com/.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world