Credit Card Risk, Protracted Pandemic, and the Household Budget: Advice for Issuers

- Date:December 23, 2021

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Credit card issuers must prepare for another COVID wave.

Mercator Advisory Group released a report covering the credit card issuer risks in a world of COVID variants, titled Credit Card Risk, Protracted Pandemic, and the Household Budget: Advice for Issuers. The research explains current credit card risk and the impact on household budgets as inflation grows, interest rates increase, and the workplace continues to be disrupted.

The research explains why the latest COVID variation may affect consumers and their spending habits differently than it did in 2020.

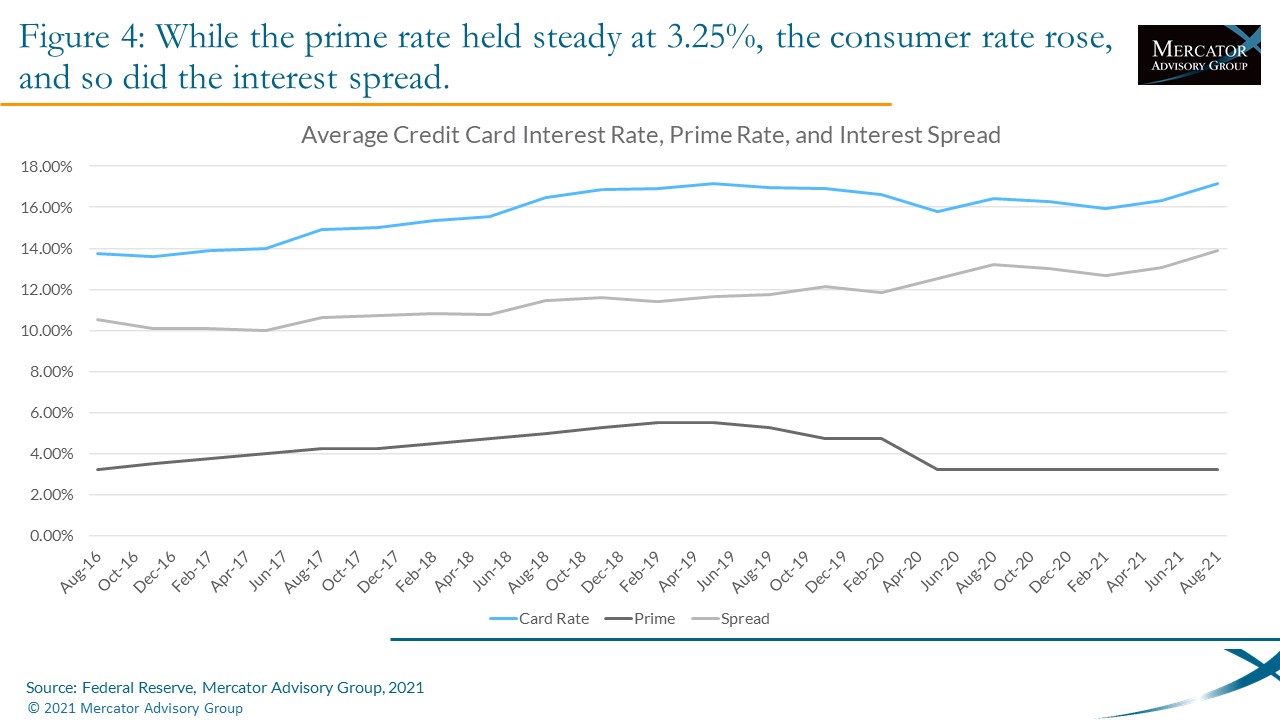

"The economic relief programs offered by the U.S. and many other countries might be impossible if the pandemic rebounds,” comments Brian Riley, Director, Credit Advisory, at Mercator Advisory Group, and the author of the research note. Riley continues: “Credit card issuers must keep a keen eye on the impact of inflation, rising interest rates, and employment. Issuers underwrite with higher spreads than ever, but the interest opportunity may not be sufficient if credit losses shift.”

This document contains 20 pages and 10 exhibits.

Companies mentioned in this research note include: American Express, Capital One, Chase, Citi, FICO, FIS, Fiserv, Mastercard, TSYS, Visa.

One of the exhibits included in this report:

- Explanation of current issues surrounding revolving debt

- Illustration of rising consumer interest rates while the prime rate sits at 2%

- Discussion of new credit card accounts and delinquency rates

- Review of the household budget and the capacity to repay as interest and inflation rise

- An action plan for credit managers

Learn More About This Report & Javelin

Related content

Capital One and Discover: A Big Deal, Not a Cakewalk

The newly approved Capital One-Discover merger, which comes with a combined $250 billion loan book, creates a behemoth in payments but will require firm and judicious leadership to...

Riffing on Tariffs: Now is the Time to Build Your Small Business Card Portfolio

Small businesses represent the backbone of the U.S. economy, but they also struggle with the cash flow necessary for long-term survival. Amid the U.S. imposition of tariffs, many s...

Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out

For credit card managers, assessing risk metrics and adjusting their strategies are the bedrock aspects of the job. Right now, those messages are mixed. Unemployment is steady, inf...

Make informed decisions in a digital financial world